Beginner stock investing guide 2026

Investing can seem overwhelming if you're just starting out. With terms like stocks, bonds, and compound interest thrown around, it's easy to feel lost in a sea of financial jargon. But here's the good news: you don't need to be a Wall Street expert to begin building wealth. Investing is simply putting your money to work in assets that have the potential to grow over time, rather than letting it sit idle in a bank account earning minimal interest.

In 2026, with economic shifts like rising interest rates, AI-driven market changes, and more accessible online tools, starting to invest has never been easier — or more important. Inflation continues to erode purchasing power, and traditional savings accounts often can't keep up. Whether you're a young professional in your early 20s saving for a house, or someone later in life planning for retirement, understanding the basics of investing can help your money grow and secure your financial future.

This beginner’s guide to investing will break it all down in simple terms. We'll cover what investing means, the types of investments available, how to start investing with little money, key strategies, risks to watch for, and much more. By the end, you'll have a clear, step-by-step plan to get started. No prior knowledge required — just an open mind and a willingness to learn. We'll use real-world examples, tables, and tips to make it practical. If you're wondering "how to invest money" or "what are the best investments for beginners," you're in the right place. Let's dive in and turn your financial goals into reality.

Table of Contents

- What is Investing?

- Types of Investments

- How to Start Investing: Step-by-Step Guide

- Investment Strategies for Beginners

- Understanding Risk and Return in Investing

- The Power of Compound Interest and Investing

- Long-Term vs Short-Term Investing

- Safe Investments for Beginners

- FAQ

What is Investing?

Investing means committing your money to assets or ventures with the expectation of generating a profit or income over time. Unlike saving, where your money earns a fixed, low interest in a bank, investing involves buying things like shares in companies or funds that can appreciate in value or pay dividends. The goal is to make your money work for you, potentially outpacing inflation and building wealth.

At its core, investing is about future financial security. For beginners, it's important to know that anyone can start — you don't need a lot of money or expertise. In 2026, digital platforms make it accessible, with options to invest as little as $5 in fractional shares.

Why Invest?

- Beat inflation: Money in a savings account might lose value over time due to rising costs.

- Achieve goals: Fund retirement, a home, or education.

- Build wealth: Through growth and income from assets.

For example, if you invest in a company's stock and it performs well, you could sell it later for more than you paid or receive regular dividend payments.

Types of Investments

There are many ways to invest, each with different levels of complexity, risk, and potential return. As a beginner, focus on diversified options to spread out risk. Here's a breakdown:

| Type |

Description |

Risk Level |

Potential Return |

Best For Beginners? |

| Stocks |

Shares of ownership in a company. Earn through price increases or dividends. |

High |

High (e.g., 7-10% average annually for broad market) |

Yes, via funds; avoid single stocks initially. |

| Bonds |

Loans to governments or companies that pay interest. |

Low to Medium |

Low to Medium (3-5%) |

Yes, for stability. |

| Mutual Funds |

Pooled money invested in a mix of stocks/bonds by professionals. |

Medium |

Medium (5-8%) |

Yes, for easy diversification. |

| ETFs (Exchange-Traded Funds) |

Like mutual funds but trade like stocks; often track indices like S&P 500. |

Medium |

Medium to High (7-10%) |

Highly recommended; low-cost and simple. |

| Real Estate/REITs |

Property investments or funds that own real estate. |

Medium |

Medium (5-8% plus appreciation) |

Yes, via REITs for hands-off approach. |

| High-Yield Savings/CDs |

Bank products with higher interest. |

Low |

Low (4-5% in 2026) |

Yes, as a starting point for safety. |

| Cryptocurrencies |

Digital assets like Bitcoin. |

Very High |

Variable (high potential but volatile) |

Limited; only 5-10% of portfolio if at all. |

This table shows a mix for building a balanced portfolio. For stock market beginners, ETFs are a great entry point because they provide exposure to hundreds of companies without picking winners yourself.

How to Start Investing as a Teenager (and Why It's a Great idea)

How to Start Investing: Step-by-Step Guide

Ready to begin? Here's a simple, step-by-step investing guide for beginners:

- Set Your Goals: Decide what you're investing for — retirement, a house, or emergency fund. Assess your time horizon (e.g., 5+ years for stocks) and risk tolerance.

- Build an Emergency Fund: Save 3-6 months of expenses in a high-yield savings account before investing.

- Choose an Account: Open a brokerage account (for flexibility), IRA (for retirement tax benefits), or 401(k) if offered by your employer. Many have no minimums in 2026.

- Fund Your Account: Start small — many platforms allow $10-100 initial deposits. Use apps for easy transfers.

- Pick Investments: Begin with low-cost ETFs or index funds. Diversify across stocks and bonds.

- Invest Regularly: Set up automatic contributions (e.g., $50/month) to benefit from dollar-cost averaging — buying more when prices are low.

- Monitor and Adjust: Review annually, but avoid frequent changes.

Investing tips for first-time investors: Use robo-advisors like Vanguard or Betterment for automated help. If you have little money, look for fractional shares.

Investment Strategies for Beginners

As a newbie, keep it simple with these strategies:

- Passive Investing: Buy and hold index funds like those tracking the S&P 500. Low effort, historically averages 9-10% returns.

- Diversification: Spread money across asset types to reduce risk. Example: 60% stocks, 30% bonds, 10% cash.

- Dollar-Cost Averaging: Invest fixed amounts regularly, regardless of market highs/lows.

- Value vs. Growth: Value seeks undervalued assets; growth targets high-potential companies. Start with a mix via funds.

Avoid day trading or timing the market — it's risky for beginners. In 2026, consider ESG funds for ethical investing.

Understanding Risk and Return in Investing

Is investing risky for beginners? Yes, but manageable. Risk is the chance of losing money, while return is the gain.

- High Risk/High Return: Stocks, crypto — potential for big gains but volatility.

- Low Risk/Low Return: Bonds, CDs — stable but modest growth.

Key: Higher returns come with more risk. Diversify to balance. In 2026, watch for inflation and rate changes affecting bonds.

✅ Do: Assess your tolerance with quizzes. ❌ Don't: Invest money you need soon.

The Power of Compound Interest and Investing

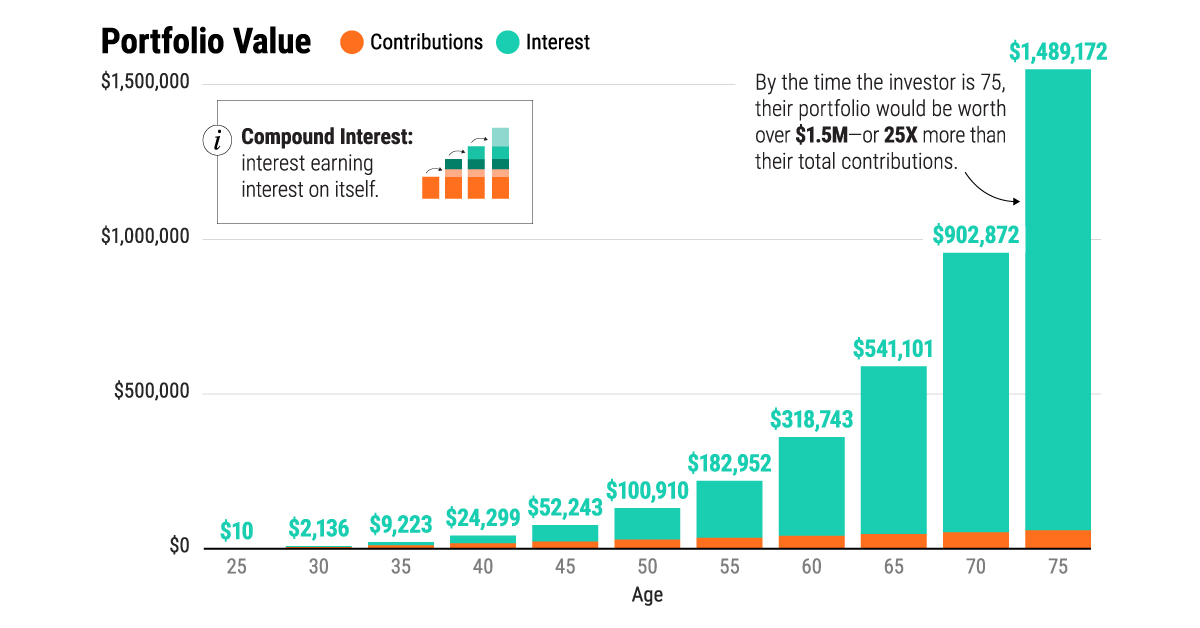

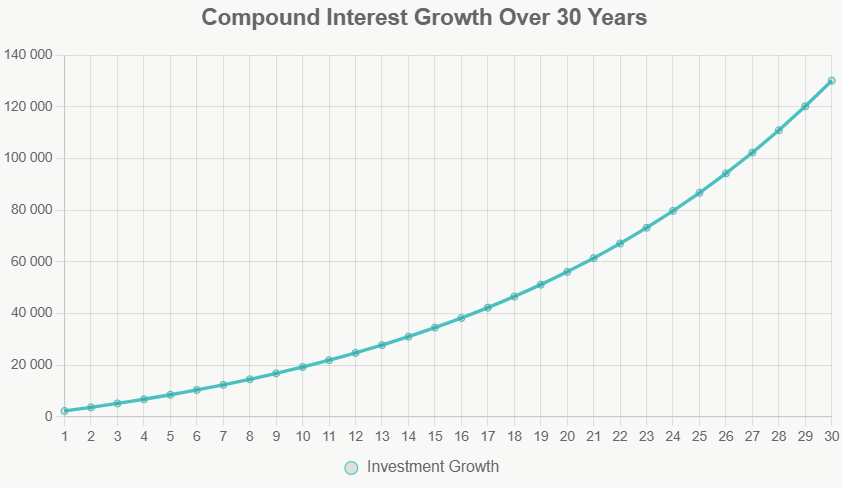

Compound interest is magic for investors — earnings generate more earnings. Start early for exponential growth.

Example: Invest $1,000 initially plus $100/month at 7% return. After 30 years, it could grow to over $130,000, with contributions totaling just $37,000.

How can I make my money grow? Reinvest dividends and add regularly. Use retirement accounts for tax advantages.

Grok может ошибаться. Всегда проверяй оригинальные источники.

Long-Term vs Short-Term Investing

Long-term (5+ years): Focus on growth via stocks/ETFs. Benefits from compounding and market recovery.

Short-term (<5 years): Safer options like bonds or CDs to preserve capital.

For beginners, prioritize long-term for higher returns. Example: S&P 500 has averaged 10% over decades, despite short dips.

Safe Investments for Beginners

Easy investment ideas:

- High-yield savings: Up to 5% in 2026.

- CDs: Locked rates for predictability.

- Bond funds: Stable income.

- Index funds: Broad market exposure.

Beginner’s guide to investing in stocks and bonds: Start with ETFs for both.

FAQ

What does investing mean?

Investing is allocating money to assets to generate returns over time.

How do beginners invest money?

Follow the steps: Set goals, open an account, start small with diversified funds.

What are the best investments for beginners?

ETFs, index funds, and high-yield savings for low risk and ease.

How much money do I need to start investing?

As little as $10-100 with fractional shares and no-minimum accounts.

Is investing risky for beginners?

Yes, but diversification and long-term focus minimize it.

How can I make my money grow?

Through compound interest, regular contributions, and smart asset choices.

For more on building credit to support investing, check our guide on How to Improve Credit Score.

Conclusion

Investing in 2026 is your path to financial independence. We've covered the basics — from what investing is to strategies, risks, and how to start with little money. Remember: Start small, diversify, and stay patient for compound growth.

Now, take action: Open a brokerage account today or explore our top picks for beginner funds. Subscribe to our newsletter for updates, or read our related article on Financial Literacy for Beginners to deepen your knowledge. Your future self will thank you.

This article is for educational purposes only. See our Financial Disclaimer.

About author person.