Step-by-Step Guide to Building an Investment Portfolio in 2026

Building an investment portfolio can feel overwhelming, especially for beginners. With market volatility, economic shifts, and endless options like stocks, bonds, and ETFs, it's easy to wonder where to start. But a well-planned portfolio is key to achieving financial security and growth over time. This comprehensive guide breaks down how to create an investment portfolio step by step, covering everything from setting goals to monitoring performance.

Whether you're a novice looking for a beginner investment portfolio guide or someone refining your strategy, this article provides practical advice based on proven principles. We'll explore investment portfolio planning, asset allocation strategies, and how to diversify an investment portfolio effectively. By following these steps, you'll learn how to build an investment portfolio that aligns with your risk tolerance investing needs and financial goals. Let's dive in and turn your savings into a powerful tool for the future.

Table of Contents

- What is an Investment Portfolio?

- The Basics of Investment Portfolio Planning

- Step-by-Step Investment Portfolio for Beginners

- Step 1: How to Define Investment Goals

- Step 2: Risk Tolerance Quiz for Investors

- Step 3: What is Asset Allocation and Why It Matters

- Step 4: Best Investments for Long-Term Growth

- Step 5: How to Diversify Your Investment Portfolio

- Step 6: Portfolio Performance Tracking Tools

- Step 7: Portfolio Rebalancing Steps

- Beginner Investment Portfolio Asset Allocation

- Simple Investment Portfolio Guide with Examples

- Investment Platforms for Beginners

- Low-Cost Index Funds for Portfolio

- Robo-Advisor Investment Portfolio

- Investment Portfolio Calculator

- FAQ

- Conclusion

What is an Investment Portfolio?

An investment portfolio is a collection of assets like stocks, bonds, ETFs, and other investments that you own to meet your financial goals. It's not just about picking random investments; it's a strategic mix designed to grow your wealth while managing risk. Think of it as a basket where you place different items to balance potential gains and losses.

Portfolios come in various types based on your needs. A growth portfolio focuses on high-return assets like stocks for long-term appreciation, ideal if you have a high risk tolerance. A balanced portfolio mixes stocks and bonds for moderate growth with stability, suitable for those with medium risk levels. A conservative portfolio emphasizes bonds and cash for capital preservation, perfect for low-risk investors nearing retirement.

Why build one? A portfolio helps you achieve financial goals investing, such as saving for a home or retirement. It spreads risk through diversification, so if one asset drops, others might rise. According to studies, asset allocation drives about 90% of a portfolio's return variability over time. Without a portfolio, your money might sit idle in a savings account, losing value to inflation.

Key elements include asset classes (stocks for growth, bonds for income), investment horizon (how long you plan to invest), and portfolio construction strategy. Starting simple with index funds can make it accessible for beginners. Remember, all investing involves risk, including potential loss of principal, but a thoughtful portfolio minimizes that while pursuing returns.

In 2026, with rising interest rates and tech-driven markets, portfolios should adapt to include sustainable investments or emerging assets like renewable energy funds. This ensures relevance in a changing economy.

The Basics of Investment Portfolio Planning

Investment portfolio planning is the foundation of successful investing. It involves assessing your current financial situation, understanding key concepts, and creating a roadmap for your money. Start by reviewing your income, expenses, debts, and savings. Ensure you have an emergency fund covering 3-6 months of living expenses before investing, as this protects against unexpected needs without selling assets at a loss.

Core principles include diversification, which spreads investments to reduce risk; asset allocation, the mix of asset classes like stocks, bonds, and cash; and rebalancing, adjusting the mix over time. These help manage risk tolerance levels and align with your investment strategy.

Common mistakes to avoid: Chasing hot trends without research, ignoring fees that erode returns, or failing to diversify, leading to big losses if one sector tanks. For example, during the 2008 financial crisis, undiversified portfolios heavy in stocks suffered more than balanced ones.

Tools for planning include online calculators to project growth and robo-advisors for automated suggestions. Internal link: Learn more about starting with stocks in our guide on how to start investing in stocks.

Planning also considers taxes—use accounts like Roth IRAs for tax-free growth. In 2026, with potential tax changes, focus on tax-efficient strategies like municipal bonds.

Benefits of solid planning: It provides clarity, reduces emotional decisions, and boosts long-term performance. Studies show disciplined planners achieve better returns than reactive investors. Take time to map this out; it's the difference between random saving and strategic wealth building.

Here's a quick checklist for basics:

- Review finances and build emergency fund.

- Define risk and goals.

- Choose asset mix.

- Select low-cost investments.

- Plan for regular reviews.

Step-by-Step Investment Portfolio for Beginners

This section provides a detailed how to build an investment portfolio step by step, tailored for newcomers. Drawing from expert sources, it covers the essential phases of portfolio construction strategy. Each step builds on the last, ensuring a cohesive approach.

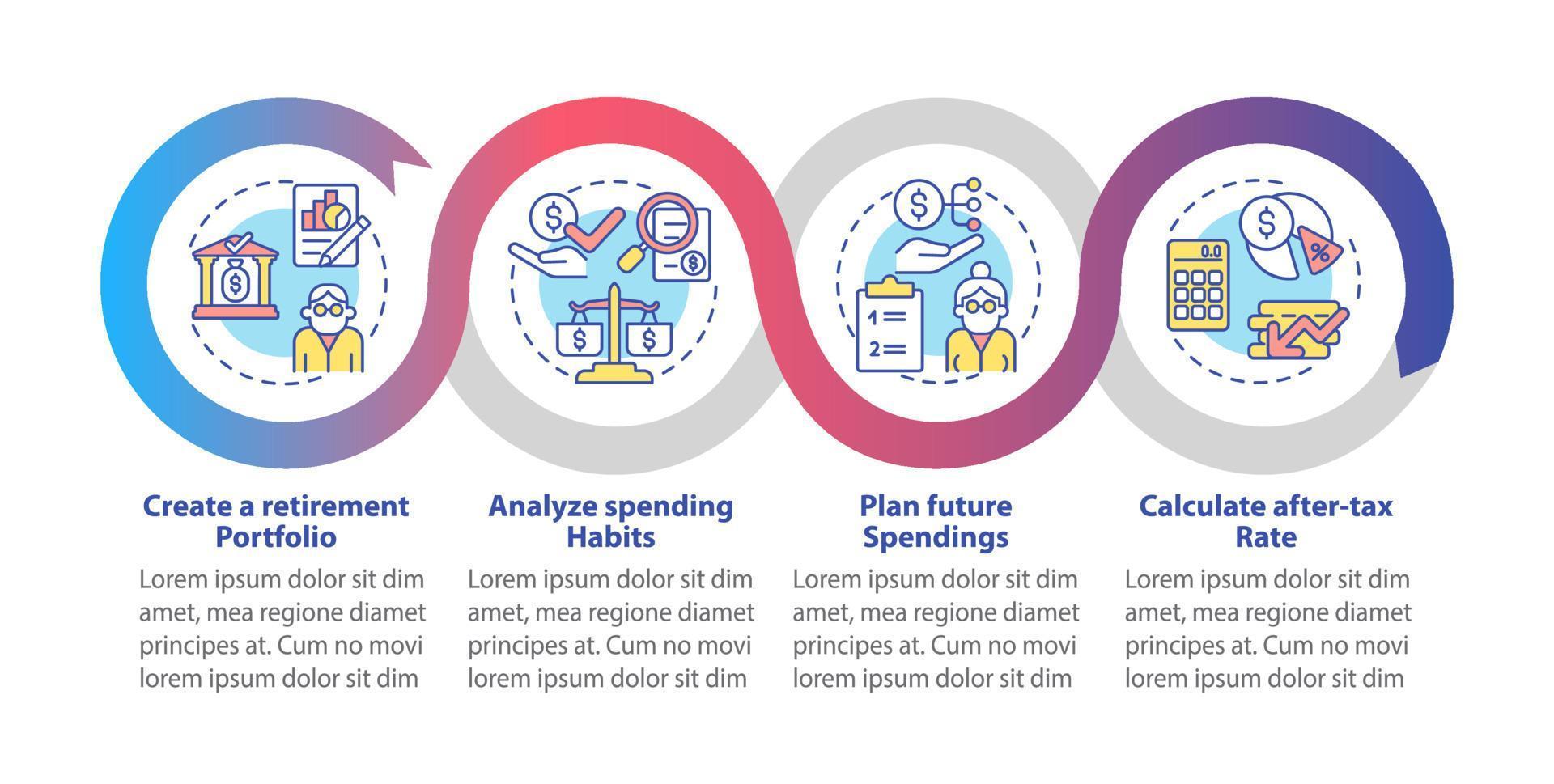

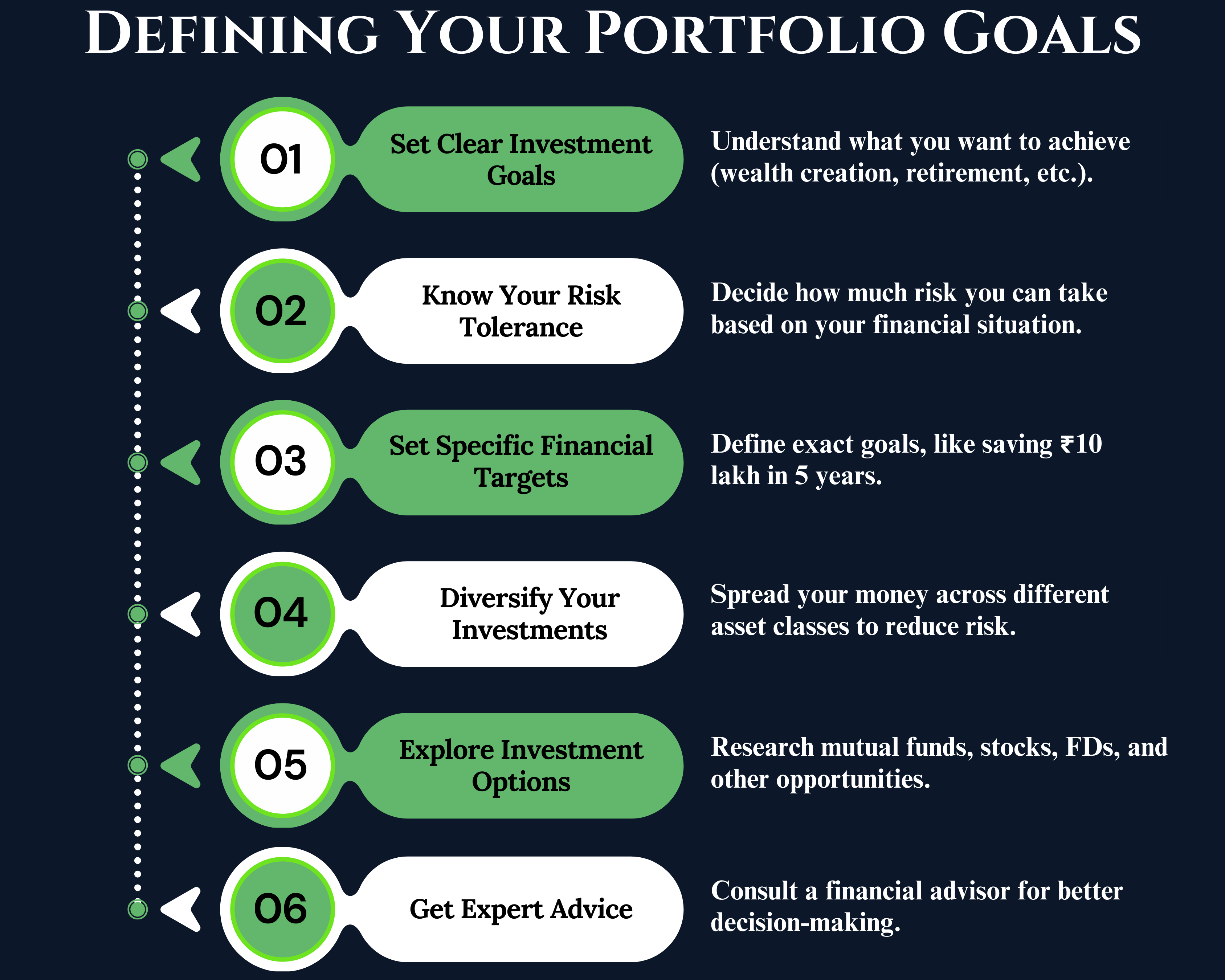

Step 1: How to Define Investment Goals

The first step in building an investment portfolio is setting clear financial goals. What is the first step in building an investment portfolio? It's asking why you're investing. Goals give direction and help measure progress.

How to set investment goals: Use the SMART framework—Specific, Measurable, Achievable, Relevant, Time-bound. For example, "Save $50,000 for a home down payment in 5 years" is better than "Save money." Consider short-term (1-3 years, like a vacation), medium-term (3-10 years, like education), and long-term (10+ years, like retirement) goals.

Investment goal planning tips: Factor in inflation—$50,000 today might need $60,000 in 5 years at 4% inflation. Prioritize goals; retirement often comes first. Assess current savings and needed contributions. For instance, if aiming for $1 million in retirement, calculate monthly investments using a compound interest calculator.

Examples: A 30-year-old might aim for retirement at 65 with a growth-focused portfolio. A parent could target college funds with a balanced mix.

Common pitfalls: Vague goals lead to inconsistent investing. Adjust for life changes, like marriage or job loss.

Internal link: For more on goal-setting, see setting financial goals for investment portfolio.

This step ensures your portfolio serves your life, not vice versa. Sources emphasize goals as the "why" behind asset choices.

Step 2: Risk Tolerance Quiz for Investors

After goals, assess your risk tolerance—your comfort with potential losses for higher returns. How to assess risk tolerance? It's a mix of emotional and financial factors.

Take a risk tolerance quiz for investors: Many online tools ask about reactions to market drops, like "If your portfolio fell 20%, would you sell, hold, or buy more?" Financial capacity includes age (younger = higher tolerance), income stability, and liquidity needs.

Risk tolerance levels: Conservative (prefer stability, low volatility), moderate (balance growth and safety), aggressive (accept high swings for potential gains). For beginners, start conservative to build confidence.

Examples: A 25-year-old with stable job might tolerate 80% stocks; a 60-year-old retiree prefers 40% stocks.

Tips: Reassess annually or after events like market crashes. Avoid overestimating—many panic in real downturns.

Pitfalls: Mismatching tolerance leads to selling low. Use questionnaires from sites like Vanguard or Fidelity.

This step shapes your asset mix, ensuring you sleep at night while pursuing goals.

Step 3: What is Asset Allocation and Why It Matters

Asset allocation is dividing your portfolio among asset classes like stocks, bonds, and cash to balance risk and return. Why it matters: It drives most of your portfolio's performance, reducing volatility through diversification.

How to allocate assets in a portfolio: Base on goals, tolerance, and horizon. Longer horizons favor stocks for growth; shorter ones bonds for stability.

Asset allocation strategies:

- Strategic: Long-term fixed mix, e.g., 60/40 stocks/bonds.

- Tactical: Adjust for market conditions.

- Dynamic: Shift based on age, like target-date funds.

Table: Sample Allocations

| Risk Level |

Stocks |

Bonds |

Cash |

| Conservative |

30% |

60% |

10% |

| Moderate |

60% |

35% |

5% |

| Aggressive |

80% |

15% |

5% |

Examples: For a beginner, a 50/50 mix provides balance.

Why matters: Poor allocation can lead to underperformance or excessive risk. In 2022, diversified portfolios weathered stock drops better.

Tips: Use ETFs for easy allocation. Revisit as life changes.

Step 4: Best Investments for Long-Term Growth

Choosing investments is key. How to choose investments for a portfolio? Match to allocation, focusing on long-term growth.

Best investments: Stocks (growth via company shares), bonds (income and stability), ETFs (diversified, low-cost).

Choosing stocks vs bonds vs ETFs: Stocks for high returns but volatility; bonds for fixed income; ETFs for broad exposure, e.g., S&P 500 trackers.

Low-cost index funds for portfolio: Vanguard S&P 500 ETF (VOO) offers market returns at 0.03% fees.

Examples: For growth, 70% in stock ETFs, 30% bonds.

Tips: Research fees, performance, and fit. Avoid timing; use dollar-cost averaging.

Pitfalls: Overpaying fees or picking based on past performance.

Step 5: How to Diversify Your Investment Portfolio

Diversification spreads risk across assets. How to diversify an investment portfolio? Mix classes, sectors, and geographies.

Strategies: Within stocks, include large-cap, small-cap, international. Add bonds, REITs.

Benefits: Reduces unsystematic risk; e.g., if tech drops, healthcare might rise.

What investments should be in a diversified portfolio: Stocks (40-60%), bonds (20-40%), ETFs (20%), alternatives like gold (5-10%).

Examples: A $10,000 portfolio: $5,000 US stocks ETF, $3,000 bonds, $1,000 international stocks, $1,000 REITs.

Tips: Use funds for instant diversification. Avoid over-diversification, which dilutes returns.

Step 6: Portfolio Performance Tracking Tools

Monitoring ensures alignment. How to monitor your investments? Use apps like Personal Capital or Mint for real-time tracking.

Best portfolio management tools: Vanguard app (free analytics), Fidelity (goal tracking), Bloomberg (advanced, paid).

Examples: Track returns, fees, allocation drifts.

Tips: Review quarterly; set alerts for rebalancing needs.

Internal link: See how to monitor your investments.

Step 7: Portfolio Rebalancing Steps

Rebalancing restores allocation. How to rebalance an investment portfolio? Sell overperformers, buy underperformers.

When to rebalance your investment portfolio: Annually or if drift >5%.

How often should you rebalance your portfolio? 6-12 months.

Steps:

- Review current mix.

- Calculate targets.

- Adjust via trades or contributions.

- Consider taxes.

Examples: If stocks rise to 70% from 60%, sell 10% stocks, buy bonds.

Tips: Automate with robo-advisors.

Beginner Investment Portfolio Asset Allocation

For beginners, asset allocation is crucial in a beginner investment portfolio guide. It involves splitting funds to match risk and goals.

Beginner investment portfolio asset allocation: Start with 50-70% stocks for growth, 30-50% bonds for stability.

Table: Beginner Examples

| Age Group |

Stocks |

Bonds |

Cash/Alternatives |

| 20-30 |

80% |

15% |

5% |

| 30-50 |

60% |

35% |

5% |

| 50+ |

40% |

50% |

10% |

Factors: Horizon, tolerance. Young beginners can afford more stocks.

Tips: Use ETFs like VTI (total stock market).

Examples: $20,000 portfolio for 35-year-old: $12,000 stock ETFs, $7,000 bond funds, $1,000 cash.

Pitfalls: Ignoring fees; aim for <0.2%.

This setup provides a simple start.

Simple Investment Portfolio Guide with Examples

A simple investment portfolio guide with examples keeps things straightforward. Focus on 3-5 funds for ease.

Example 1: Three-fund portfolio - US stocks (50%), international stocks (20%), bonds (30%). Use ETFs like VT (world stock), BND (bonds).

Example 2: For $5,000 starter: $2,500 S&P 500 ETF, $1,500 bond ETF, $1,000 international ETF.

Benefits: Low maintenance, diversification.

Steps: Open brokerage, buy funds, set auto-invest.

Internal link: Explore how to start investing and build a portfolio.

Investment Platforms for Beginners

Investment platforms for beginners make starting easy. Top picks: Vanguard (low fees, education), Fidelity (tools, no minimums), Robinhood (commission-free, user-friendly).

Features: Mobile apps, auto-invest, educational resources.

How to choose: Consider fees, tools, account types.

Examples: Use Vanguard for ETFs.

Tips: Start with demo accounts.

Low-Cost Index Funds for Portfolio

Low-cost index funds for portfolio track markets cheaply. Benefits: Outperform active funds long-term, fees <0.1%.

Top funds: VOO (S&P 500, 0.03% fee), VXUS (international, 0.07%).

How to use: Allocate 60% to stock indexes, 40% bond indexes.

Examples: Build with $10,000: $6,000 VOO, $4,000 BND.

Robo-Advisor Investment Portfolio

Robo-advisor investment portfolio uses algorithms for automated management. Best for beginners: Betterment (tax harvesting), Wealthfront (low fees).

How it works: Answer quiz, get allocation, auto-rebalance.

Pros: Hands-off, low cost (0.25% fees).

Examples: Input goals, get 70/30 mix.

Do beginners need a financial advisor? Not always; robo-advisors suffice for simple needs.

Investment Portfolio Calculator

Investment portfolio calculators project growth. Tools: Vanguard's (free), Bankrate (simple).

How to use: Input amount, allocation, time, expected returns (7% stocks).

Examples: $10,000 at 6% return over 20 years = ~$32,000.

Tips: Adjust for inflation, fees.

FAQ

What is the First Step in Building an Investment Portfolio?

Define your goals, like retirement or home buying.

How Often Should You Rebalance Your Portfolio?

Every 6-12 months or at 5% drift.

What is Asset Allocation and Why It Matters?

Mix of assets to balance risk/return; drives performance.

How to Set Investment Goals?

Use SMART; consider time, amount.

What Investments Should Be in a Diversified Portfolio?

Stocks, bonds, ETFs, alternatives.

Do Beginners Need a Financial Advisor for Portfolio Building?

Not necessarily; robo-advisors or self-education work for basics.

Conclusion

You've now got a complete step-by-step guide to building an investment portfolio. From defining goals to rebalancing, these strategies set you up for success in 2026. Remember, consistency and patience are key—start small, diversify, and monitor regularly.

Ready to act? Open an account on a platform like Vanguard today or use a robo-advisor for guidance. For more, check our related article on portfolio construction strategy. Invest wisely and watch your wealth grow.

This article is for educational purposes only. See our Financial Disclaimer.

About author person.