How Much Money Beginners Actually Lose Investing (Realistic Numbers) in 2026

Investing can seem like a golden ticket to financial freedom, but for many beginners, it's a harsh lesson in reality. The question on everyone's mind is: how much money beginners actually lose investing? Realistic numbers show that new investors often face significant setbacks, with studies indicating that up to 97% of day traders lose money net of fees. This isn't just hype—it's backed by data from markets worldwide, where emotional decisions and lack of knowledge lead to beginner investing losses averaging thousands of dollars annually. In this comprehensive guide, we'll dive into how much do beginners lose investing, explore beginner stock market losses through real examples, and provide actionable advice on realistic investing losses. Whether you're pondering how much money do new investors lose or seeking investing losses for beginners to set proper expectations, we'll cover it all. By understanding these patterns, you can shift from first time investing losses to smarter strategies that align with long-term success. Expect honest insights, no sugarcoating—just the tools to navigate the market with eyes wide open.

Table of Contents

- Why Beginners Experience Losses

- How Much Can You Lose Investing $100

- How Much Can You Lose Investing $500

- How Much Can You Lose Investing $1,000

- How Long Does It Take to Recover Losses

- How to Minimize Losses as a Beginner Investor

- FAQ

Why Beginners Experience Losses

Beginners often dive into investing with high hopes, but the reality is stark: most new investors face substantial losses. How much money beginners actually lose investing isn't just a theoretical question—it's grounded in data showing that 80% to 97% of active traders, especially day traders, end up in the red. This section explores the root causes, from psychological pitfalls to common mistakes, providing a deep dive into why these losses occur and how they manifest in realistic investing losses.

Common Beginner Investing Mistakes That Lead to Losses

One of the primary reasons beginners lose money is through avoidable errors. For instance, emotional decision-making tops the list of beginner investing mistakes. New investors often buy high during market euphoria and sell low in panic, locking in losses that could have been avoided with patience. Studies show that traders sell winners at a 50% higher rate than losers, exacerbating the problem. This disposition effect means holding onto losing stocks too long, hoping for a rebound that may never come.

Another critical mistake is lack of diversification. Putting all eggs in one basket, like investing heavily in a single stock or sector, amplifies risks. During market corrections, undiversified portfolios can drop 20% or more, turning a $1,000 investment into $800 overnight. Real-world data from the 2020 COVID-19 crash illustrates this: the S&P 500 fell nearly 34% in a month, but diversified portfolios with bonds mitigated losses to around 15-20%.

Overtrading is equally damaging. Active traders underperform the market by 6.5% annually, largely due to high fees and commissions that eat into returns. Beginners, enticed by apps like Robinhood, often trade frequently, leading to aggregate losses equivalent to 2% of GDP in markets like Taiwan. For example, a beginner making 50 trades a year might incur $500 in fees alone, wiping out modest gains.

Neglecting research is another pitfall. Investing without understanding fundamentals leads to poor choices, like chasing meme stocks or IPOs that plummet post-hype. A study of Brazilian day traders found 97% lost money over extended periods, with beginners particularly vulnerable due to inexperience.

Finally, using leverage or margin amplifies losses. A 20% market drop on a leveraged position can erase the entire investment, as seen in stories where traders lost $100,000 by risking too much per trade. To avoid these, beginners should prioritize education and simple strategies like index funds.

The Psychology Behind Investing Emotions and Panic Selling Losses

Investing isn't just about numbers—it's deeply psychological. Fear and greed drive many decisions, leading to why investors lose money. Behavioral keys like loss aversion make beginners hold losers longer, fearing realization of losses, while selling winners too soon to lock in gains. This "fear selling stocks" phenomenon results in portfolios underperforming by 1.5% to 6.5% annually.

Panic selling losses are rampant during volatility. In the 2008 financial crisis, many sold at the bottom, missing the subsequent recovery that saw the S&P 500 triple in value over five years. Overconfidence, especially among young males, leads to more trading and higher losses—men trade 45% more than women, reducing net returns by 2.65%.

Recency bias fools beginners into extrapolating recent trends, like buying during bubbles only to face corrections. During the 2022 bear market, retail investors increased risk exposure by 15%, setting up for deeper losses. To combat this, develop a plan that ignores short-term noise and focuses on long-term compound growth.

Stock Market Volatility for Beginners and Average Market Drop Per Year

Stock market volatility beginners often underestimate can lead to shocking losses. The S&P 500 experiences an average intra-year drop of about 14%, with corrections (10%+ drops) occurring roughly every 1.5 years. How often stock market goes down? About 25% of years see negative returns, but over 10 years, the risk drops to near zero.

Market correction losses average 10-20%, while bear markets (20%+ drops) happen every 6 years, lasting about 370 days. For beginners, this means a $5,000 portfolio could lose $1,000 in a correction. Stock market crash losses are more severe: the 1929 crash saw 89% losses, taking 25 years to recover.

Bear market beginner losses are amplified by inexperience. In 2020, the market dropped 34% in 33 days, but recovered in 6 months. Understanding market cycles—expansions followed by contractions—helps set realistic expectations.

Do Beginners Usually Lose Money Investing? Statistics and Trends

Yes, do beginners usually lose money investing? Data screams yes: 80% quit day trading within two years, with only 1% profiting consistently. How common are losses for beginner investors? Extremely—90% of retail traders lose in the first year.

Is it normal to lose money when investing? Absolutely, as markets fluctuate. But can beginners lose all their money investing? Yes, especially with leverage or options, where 100% losses are possible. In 2024 NFCS, 8% of investors were new, with many under 35 engaging in risky behaviors like options (43%), heightening loss risks.

Trends show pandemic-era beginners took 15% more risk, leading to amplified losses in 2022. How much money did investors lose in 2022? Trillions globally, with S&P 500 down 19%, translating to $19,000 average loss on a $100,000 portfolio.

Beginner Investor Loss Examples from Real Stories

Real stories highlight the pain. One trader lost $100,000 over 18 months by leveraging too much and ignoring fundamentals, blowing three accounts. Another, addicted to Robinhood, nearly ended his life after massive day trading losses.

In options, retail investors lose 5-9% per earnings announcement due to overpaying and holding too long. A beginner lost $10,000 in 90 seconds from a bad trade, learning the dangers of volatility.

These beginner investor loss examples underscore the need for education and caution.

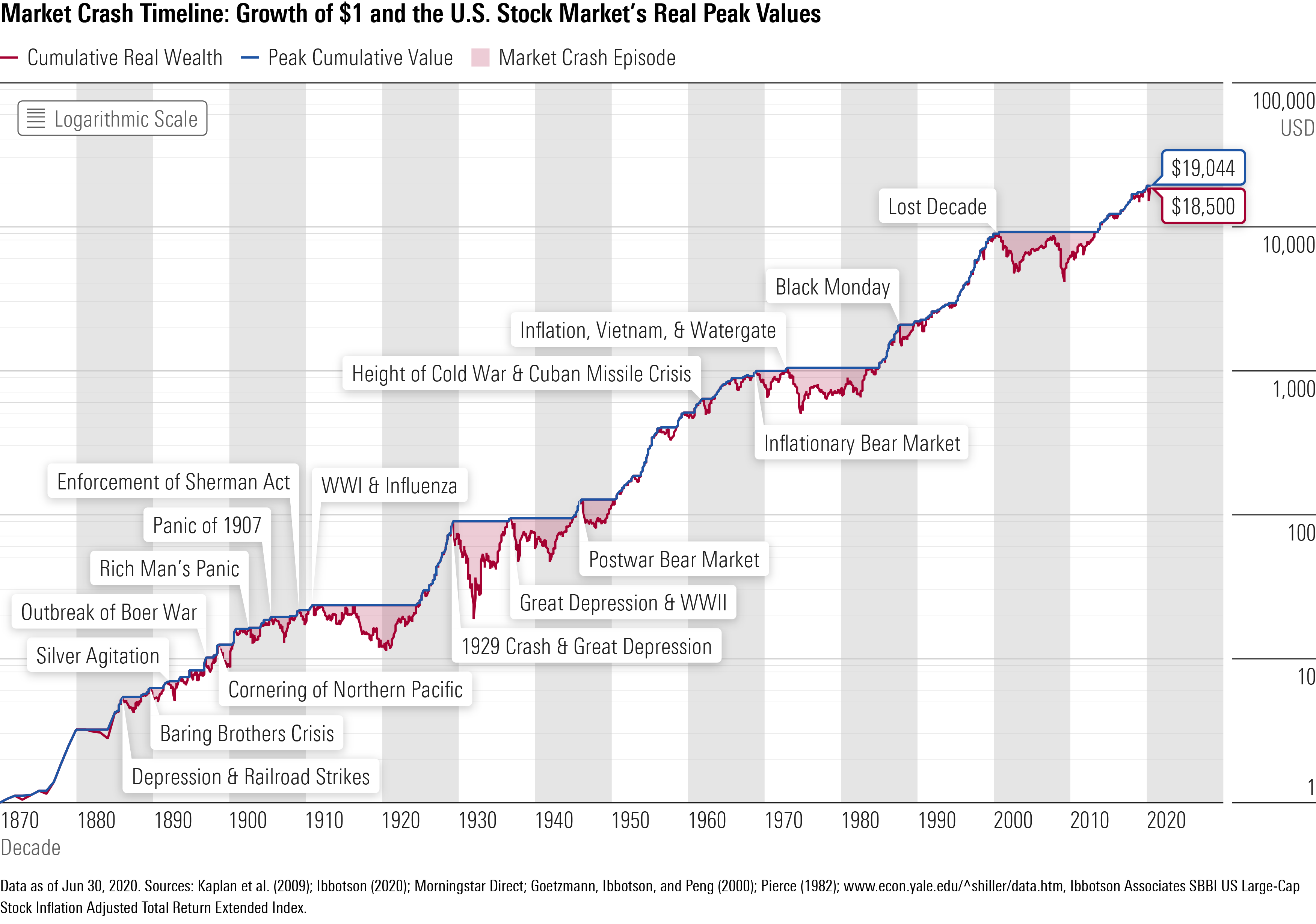

What Prior Market Crashes Taught Us in 2020 | Morningstar

How Much Can You Lose Investing $100

How much can you lose investing $100? As a beginner, it's easy to think small amounts are safe, but realistic losses can be significant. Let's break down investing $100 loss example scenarios, incorporating stock market loss percentage beginners often face.

Realistic Scenarios for $100 Investments

In a volatile market, a $100 stock investment could drop 20% in a correction, leaving you with $80—a $20 loss. But with fees, it could be more. For day traders, 97% lose money, so that $100 might evaporate through trades and commissions.

During a bear market, losses deepen. In 2020, a $100 index fund investment might have lost $34 temporarily before recovering. Beginner stock market losses like this are common without diversification.

How Much Can You Lose as a Beginner Investor with $100

How much can you lose as a beginner investor? Up to 100% if leveraging or in options. Realistic losses for beginner investors: 10-50% in drops. An investing $100 loss example: Buying a penny stock that tanks 50%, losing $50 plus fees.

Risk Factors and Volatility

Stock market volatility beginners encounter means average market drop per year of 14%. Your $100 could lose $14 on average, but in crashes, more. Diversify to minimize.

| Scenario |

Potential Loss |

Reason |

| Market Correction |

$10-20 |

10% drop |

| Bear Market |

$20-50 |

20-50% decline |

| Options Trading |

$100 |

Full expiration |

How Much Can You Lose Investing $500

Scaling up, how much can you lose investing $500? This amount opens more options but heightens risks. Realistic investing losses for $500 can range from $50 in minor dips to full wipeouts.

Examples of $500 Losses

An investing $500 market crash example: During 2008, a $500 stock position could lose $225 (45% drop). Beginner investing losses amplify with no stop-loss.

How much money can you lose investing stocks with $500? In volatile sectors, 30-60%. A diversified fund might limit to 15%.

Beginner Expectations

Investing for beginners realistic expectations: Expect volatility. How much money should beginners expect to lose? 10-20% initially as learning curve.

Table of Losses:

| Investment Type |

Max Loss |

Avg Loss |

| Individual Stock |

$500 |

$150 |

| Index Fund |

$250 |

$75 |

| Options |

$500 |

$300 |

How Much Can You Lose Investing $1,000

How much can you lose investing $1,000? This is a common starting point, but losses can be eye-opening. Investing $1,000 market crash scenarios show potential for $300-600 drops.

Detailed Loss Examples

In 1987's Black Monday, a $1,000 investment lost $204 in one day. Stock market loss percentage beginners: Often 20-30% in corrections.

How much money can you lose investing stocks? Up to all if not careful. Realistic: $200-500.

Strategies to Limit

Use asset allocation: 60% stocks, 40% bonds to cap losses at 15%.

| Crash Event |

Loss on $1,000 |

Recovery Time |

| 2008 GFC |

$450 |

5 years |

| 2020 COVID |

$340 |

6 months |

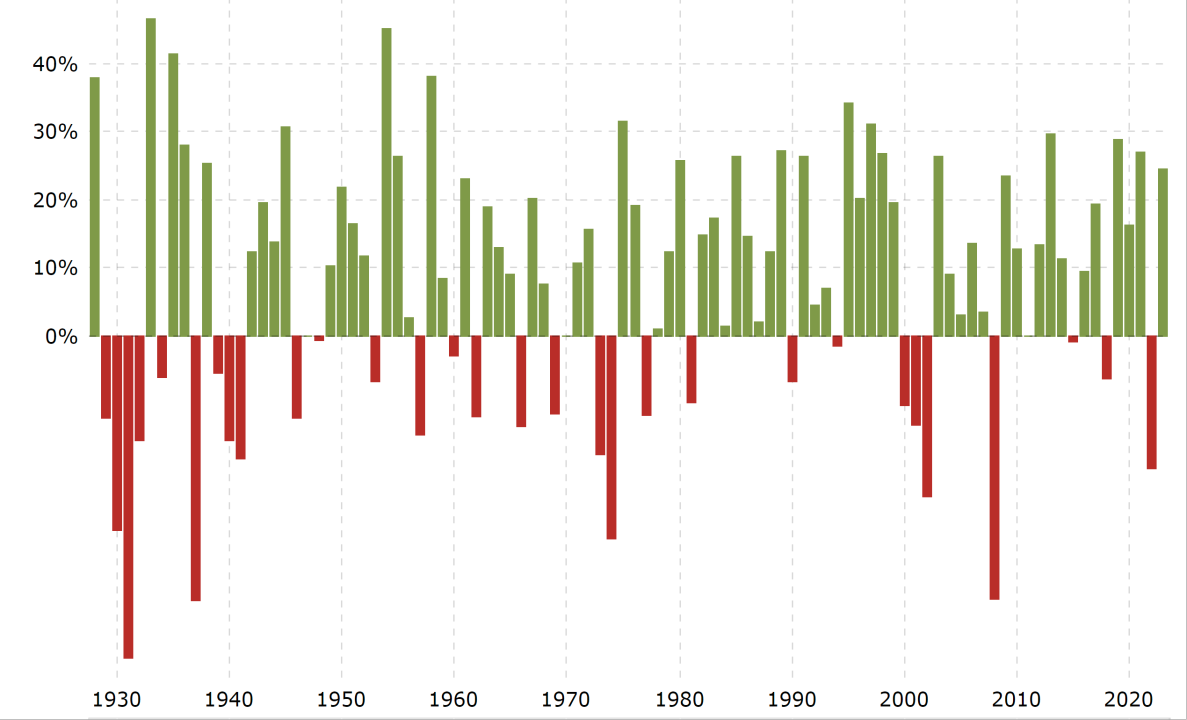

S&P 500 Historical Annual Returns (1927-2026)

How Long Does It Take to Recover Losses

How long does it take to recover investment losses? It varies, but historical data provides clues. Market downturns are temporary, but recovery can take months to years.

Historical Recoveries

Post-1987 crash, recovery took 23 months. 2008 took 5 years. Average for 20% drops: 370 days.

Should beginners invest during a market downturn? Yes, as buying low accelerates recovery.

Recovery Math

To recover a 20% loss, you need 25% gain. For 50% loss, 100% gain. Long-term investing in S&P 500 (10% avg return) aids recovery.

List of Recoveries:

- Black Monday: 264 days

- COVID-19: 19-57 days

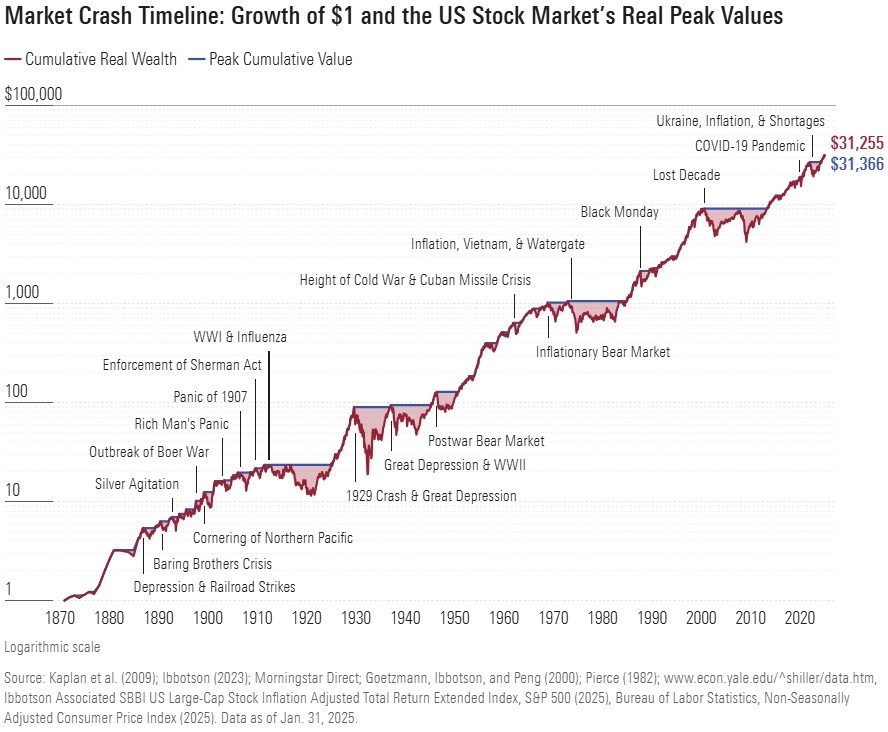

What we've learned from 150 years of stock market crashes

What we've learned from 150 years of stock market crashes

How to Minimize Losses as a Beginner Investor

How to minimize losses as a beginner investor? Focus on proven strategies like diversification and long-term holding.

Key Strategies

Diversification: Spread across stocks, bonds, index funds. Reduces risk by 50%+.

Long-term investing: Buy and hold index funds for 10% annual returns.

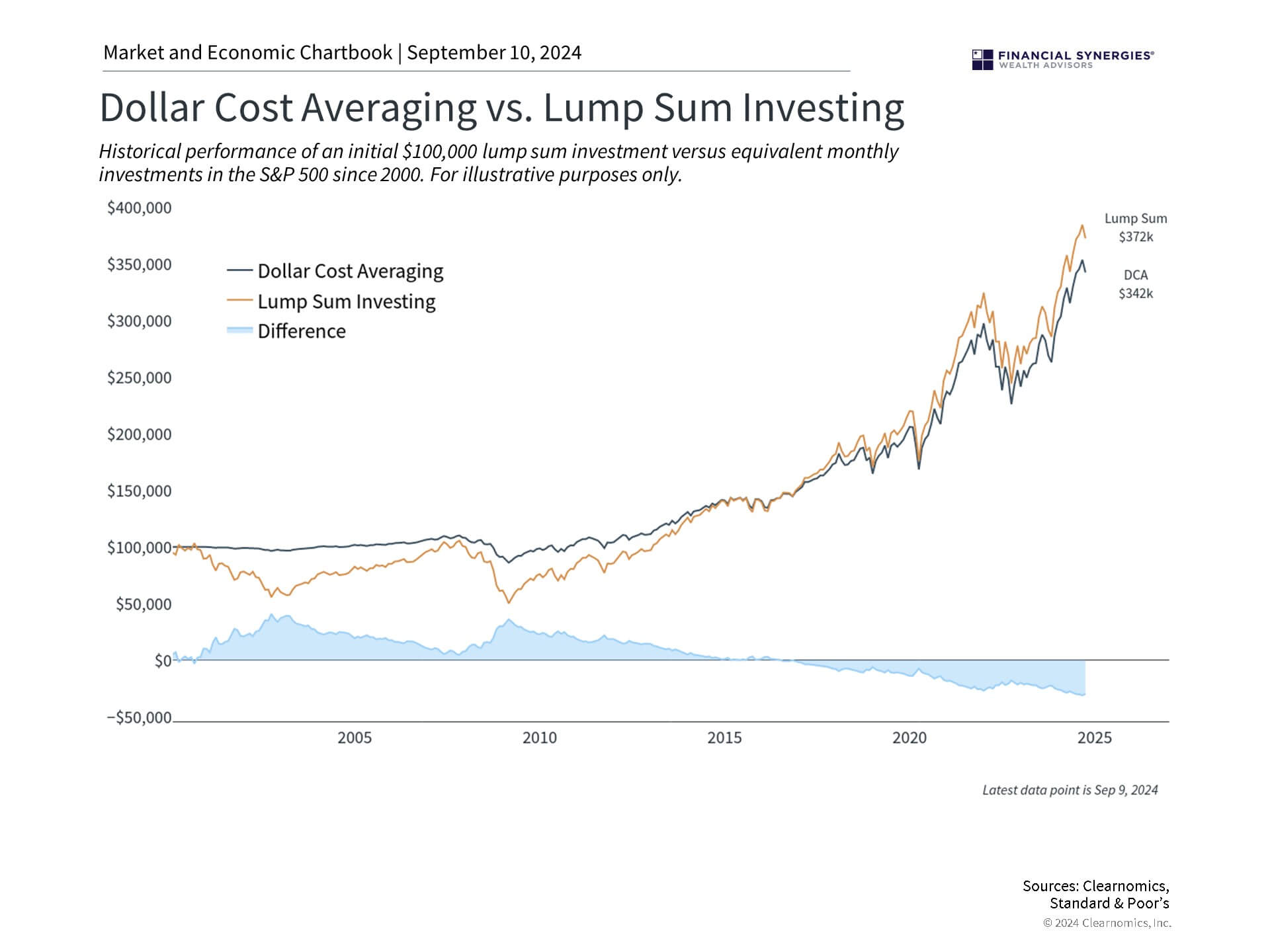

Dollar-cost averaging: Invest regularly to average costs.

Asset allocation: Match risk tolerance—e.g., bonds vs stocks.

For more on asset allocation, see our Guide to Asset Allocation.

LSI Concepts

Incorporate long-term investing, compound growth, S&P 500, risk tolerance.

FAQ

Do Beginners Usually Lose Money Investing?

Yes, 80-90% do due to mistakes.

How Common Are Losses for Beginner Investors?

Very common, with 97% of day traders losing.

Is It Normal to Lose Money When Investing?

Yes, volatility is normal.

Can Beginners Lose All Their Money Investing?

Possible with high-risk strategies.

How Long Does It Take to Recover Investment Losses?

Months to years, depending on drop.

Should Beginners Invest During a Market Downturn?

Yes, for lower prices.

Conclusion

In summary, how much money beginners actually lose investing varies, but with realistic expectations and strategies, you can minimize it. Start small, diversify, and stay long-term. For more, subscribe to our newsletter or check our top picks at Top Index Funds Guide.

This article is for educational purposes only. See our Financial Disclaimer.

About author person.