Long-Term vs Short-Term Investing: Why Beginners Usually Choose Wrong in 2026

Introduction

Investing can feel overwhelming for newcomers, especially when deciding between long-term vs short-term investing strategies. Many beginners jump into short-term investing, lured by the promise of quick gains, but this often leads to costly mistakes. Short-term investing vs long-term investing returns show a stark contrast: while short-term approaches might offer fast profits in ideal conditions, they come with high risks and volatility that can wipe out savings. On the other hand, long-term investing builds wealth steadily over time, benefiting from compound returns and market growth.

In this comprehensive guide, we'll explore why beginners usually choose the wrong investing strategy, often favoring short-term tactics that hurt their financial future. We'll break down the differences between long and short-term investing, including investment time horizon explained, volatility in investing, and real-world examples. By the end, you'll understand short vs long term investment strategy choices and how to avoid beginner investment mistakes. Whether you're starting with a small amount or planning for retirement, this article provides actionable insights based on historical data and expert advice to help you make informed decisions in 2026.

Table of Contents

- What Short-Term Investing Looks Like

- What Long-Term Investing Entails

- Differences Between Long and Short-Term Investing

- Investment Time Horizon Explained

- Why Beginners Pick Short-Term

- Beginner Investment Mistakes

- Volatility Comparison (Short vs Long)

- Short Term vs Long Term Investment Returns

- How Long-Term Returns Compare Historically

- Which is Better: Long Term or Short Term Investing

- Risks of Short-Term Investing for Beginners

- Long Term Investing Benefits for Beginners

- How to Choose Investment Horizon as Beginner

- Short Term Investing Example with Real Numbers

- Best Long-Term Investment Ideas

- Low Risk Long Term Investments

- Short Term Trading vs Long Term Investing

- How to Build a Long Term Investment Portfolio

- Tools for Beginner Investors

- FAQ

- Conclusion

What Short-Term Investing Looks Like

Short-term investing typically involves holding assets for less than a year, often just days, weeks, or months. It's all about capitalizing on quick market movements to generate profits. For beginners, what short-term investing looks like often includes day trading stocks, flipping cryptocurrencies, or betting on forex fluctuations. You might buy a stock at $50, hoping it jumps to $60 in a week due to earnings reports or news events.

This approach requires constant monitoring of market trends, economic indicators, and company news. Tools like trading apps allow real-time trades, but it demands discipline to avoid emotional decisions. A common short-term investing example with real numbers: In 2025, Tesla stock swung from $200 to $250 in a month amid EV market hype. A short-term investor could have bought at the low and sold at the peak for a 25% gain, but timing it wrong might mean a 10% loss if the price dipped instead.

However, short-term investing comes with high transaction costs, taxes on gains (treated as ordinary income), and stress from daily volatility. Beginners often underestimate the time commitment—it's like a full-time job. Unlike long-term strategies, there's little room for error; one bad trade can erase multiple wins. Historical data shows that most short-term traders underperform the market due to fees and poor timing.

Pros of short-term investing:

- Potential for quick profits

- Flexibility to react to market changes

- Opportunity to learn market dynamics hands-on

Cons:

- High risk of losses from volatility

- Increased tax burden

- Time-intensive and stressful

To succeed, beginners should start small, use stop-loss orders, and educate themselves on technical analysis. But for most, it's wiser to view short-term plays as a supplement to a core long-term portfolio rather than the main strategy.

What Long-Term Investing Entails

Long-term investing means holding assets for years or decades, focusing on growth rather than immediate returns. It entails a "buy and hold" approach, where you invest in quality assets like stocks, bonds, or index funds and let them compound over time. For beginners, this strategy aligns with goals like retirement or buying a home, emphasizing patience over constant action.

What long-term investing entails includes selecting diversified portfolios that weather market downturns. For instance, investing in an S&P 500 index fund allows exposure to top U.S. companies without picking individual stocks. The key is compound returns: Reinvesting dividends and gains snowball your wealth. A $10,000 investment at 7% annual return grows to about $76,000 in 30 years.

This method reduces the impact of short-term market volatility. You don't react to daily news; instead, you review annually and rebalance as needed. Long-term investing average returns historically hover around 7-10% annually for stocks, adjusted for inflation. Benefits include lower taxes (long-term capital gains rates are favorable) and less emotional stress.

Steps to start:

- Define your goals and risk tolerance.

- Choose low-cost index funds or ETFs.

- Automate contributions via dollar-cost averaging.

- Ignore short-term dips and stay invested.

Challenges include opportunity costs if money is tied up, but the rewards far outweigh for patient investors. It's ideal for beginners building wealth steadily without expertise in timing markets.

Differences Between Long and Short-Term Investing

The differences between long and short-term investing are fundamental, affecting risk, returns, and strategy. Short-term focuses on quick flips, while long-term prioritizes sustained growth.

Time Horizon: Short-term is under a year; long-term is 5+ years.

Risk Level: Short-term faces higher volatility from daily market swings, leading to potential big losses. Long-term smooths out fluctuations through compounding.

Returns: Short-term can yield high but inconsistent gains; long-term offers steadier, historically higher average returns.

Taxes: Short-term gains are taxed as ordinary income (up to 37%); long-term at 0-20%.

Effort: Short-term requires active monitoring; long-term is passive.

| Aspect |

Short-Term Investing |

Long-Term Investing |

| Time Frame |

<1 year |

5+ years |

| Risk |

High volatility |

Lower, diversified |

| Returns |

Variable, potentially high |

Steady, compound growth |

| Taxes |

Higher rates |

Lower capital gains |

| Suitability for Beginners |

Risky, skill-intensive |

Safer, easier entry |

Beginners often overlook these differences, leading to mismatches with their goals. Understanding them helps align strategies with personal finances.

Investment Time Horizon Explained

Investment time horizon explained simply: It's the period you plan to hold investments before needing the money. This determines your strategy, risk tolerance, and asset choices.

Short horizons (1-3 years) suit immediate needs like emergencies, favoring low-risk options like savings accounts to avoid losses from volatility.

Medium horizons (3-10 years) balance growth and safety, perhaps with bonds or balanced funds.

Long horizons (10+ years) allow aggressive investments like stocks, as time recovers from dips.

Factors influencing horizon: Age, goals (e.g., retirement at 65), and life events. A 25-year-old has a longer horizon than a 55-year-old.

To determine yours:

- List goals and timelines.

- Assess risk comfort.

- Adjust for changes like job loss.

Matching horizon prevents forced sales during downturns, maximizing returns.

Why Beginners Pick Short-Term

Why beginners usually choose short-term investing stems from excitement and misconceptions. New investors see stories of quick riches from meme stocks or crypto booms, thinking it's easy money. Media hype amplifies this, ignoring the 90% who lose.

Lack of education plays a role; beginners underestimate volatility and overestimate their timing skills. They chase "hot tips" without research, leading to why beginners choose wrong investing strategy.

Psychological factors: Fear of missing out (FOMO) pushes impulsive trades. Short-term seems less committing than long-term waits.

Consequences: Higher losses, taxes, and burnout. Shifting to long-term requires mindset change—focus on fundamentals over trends.

Beginner Investment Mistakes

Beginner investment mistakes often involve rushing into short-term strategies without planning. Common pitfalls include not diversifying, timing the market, and ignoring fees.

- Emotional trading: Selling in panic during dips locks in losses.

- Chasing trends: Buying hyped assets like NFTs without understanding.

- Overconcentration: Putting all in one stock.

- Neglecting goals: Investing without a horizon.

- High fees: Frequent trades erode returns.

To avoid: Educate via books like "The Intelligent Investor," start with index funds, and seek advice. Patience prevents costly errors.

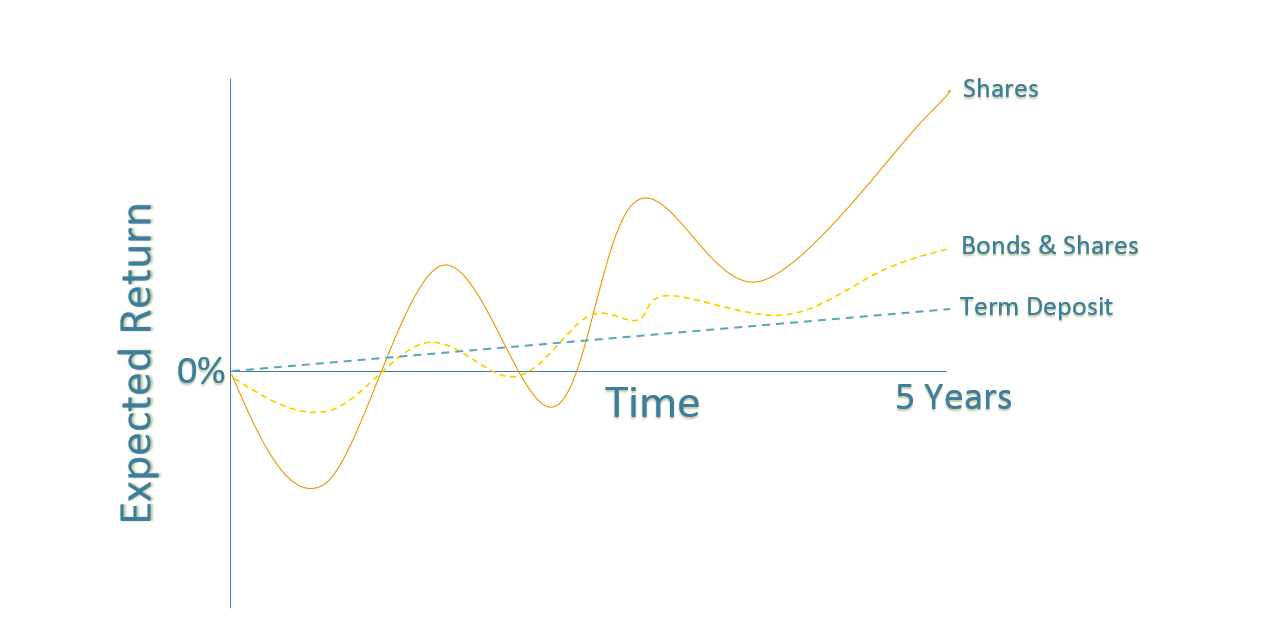

Volatility Comparison (Short vs Long)

Volatility comparison short vs long term investing reveals short-term's wild swings versus long-term's stability. Volatility measures price fluctuations; higher means riskier.

Short-term: Daily changes can be 5-10%, amplified by news. A stock might drop 20% in a week.

Long-term: Annual volatility averages 15-20% for stocks, but over decades, it evens to positive returns. Historical S&P 500 shows 1-year volatility at 16%, dropping to 5% over 20 years.

Short term investment annual volatility often exceeds 20-30% for active trades. Long-term reduces impact via diversification.

Chart example (hypothetical):

| Period |

Volatility (%) |

| 1 Year |

25 |

| 5 Years |

15 |

| 10 Years |

10 |

Long-term wins for beginners seeking steady growth.

Short Term vs Long Term Investment Returns

Short term vs long term investment returns differ in consistency and magnitude. Short-term can spike (e.g., 50% in months) but averages lower after fees.

Long-term: Historical 7-10% annual for stocks. $1,000 at 8% grows to $4,660 in 20 years.

Short-term: Variable, often negative for amateurs. 2022 saw short-term crypto trades lose 70% amid crashes.

Long term vs short term ROI favors long: Compounding boosts.

How Long-Term Returns Compare Historically

How long-term returns compare historically shows superiority over short-term. S&P 500 averaged 10% annually since 1926, despite depressions. 10 year investing return historical: 1928-2024 averaged 9.5%.

Short-term: One-year returns varied from -43% (1931) to +54% (1933).

Long-term investing average returns historically over 10+ years: Rarely negative, thanks to recovery.

Example: Investing in 2008 crash; by 2018, returns exceeded 100%.

Which is Better: Long Term or Short Term Investing

Which is better long term or short term investing depends on goals, but for most beginners, long-term prevails. It offers stability, compounding, and lower risk.

Short-term suits experienced traders with time; long-term fits busy individuals.

Trader vs investor: Traders seek quick wins; investors build wealth.

Long-term's edge: Historical outperformance, tax benefits.

Risks of Short-Term Investing for Beginners

Risks of short-term investing for beginners include high volatility, emotional stress, and financial losses. Market timing often fails, with 80% of day traders losing money.

Inflation erodes low returns; reinvestment risk if rates drop.

Leverage amplifies losses; beginners might borrow, leading to debt.

Avoid by starting with demos, limiting capital.

Long Term Investing Benefits for Beginners

Long term investing benefits for beginners: Simplicity, compounding, and risk reduction. Start small; time heals mistakes.

Benefits:

- Compound returns: $100/month at 7% becomes $200,000 in 40 years.

- Tax advantages.

- Emotional ease: No daily checks.

- Diversification options.

Ideal for financial strategy building.

How to Choose Investment Horizon as Beginner

How to choose investment horizon as beginner: Assess goals, age, risk.

Steps:

- List objectives (e.g., house in 5 years).

- Evaluate tolerance: Conservative for short?

- Match assets: Stocks for long, bonds for short.

Review annually; adjust for life changes.

Short Term Investing Example with Real Numbers

Short term investing example with real numbers shows high volatility and risk for beginners. In 2022, Apple stock rose from $130 to $180 in Q1 (38% gain), but dropped to $140 by Q2 (22% loss). A $5,000 investment could gain $1,900 then lose $1,100, netting $800 minus fees/taxes.

This highlights unpredictability; beginners often sell low.

Best Long-Term Investment Ideas

Best long-term investment ideas: Index funds, real estate ETFs, dividend stocks.

Ideas:

- S&P 500 ETF: Historical 10% returns.

- Bonds for stability.

- Roth IRA for tax-free growth.

Low risk long term investments: Treasury bonds, CDs.

Low Risk Long Term Investments

Low risk long term investments include government bonds, annuities, blue-chip stocks. They offer 3-5% returns with minimal volatility.

Examples: U.S. Treasuries (safe from default), index funds for diversification.

Suit beginners preserving capital while growing modestly.

Short Term Trading vs Long Term Investing

Short term trading vs long term investing: Trading is active, speculative; investing passive, growth-focused.

Trading: High turnover, fees. Investing: Buy and hold, compounding.

Beginners favor investing for sustainability.

How to Build a Long Term Investment Portfolio

How to build a long term investment portfolio: Diversify across assets.

Steps:

- Set goals.

- Allocate: 60% stocks, 40% bonds.

- Use ETFs.

- Rebalance yearly.

Tools: Robo-advisors automate.

Tools for Beginner Investors

Tools for beginner investors: Apps like Robinhood for trading, Vanguard for funds.

Others: Mint for budgeting, Yahoo Finance for research.

Free education: Khan Academy courses.

FAQ

What is Short-Term Investing?

Short-term investing involves assets held briefly for quick profits, often risky for beginners.

What is Long-Term Investing?

Long-term investing holds for years, focusing on growth and compounding.

Is Short Term Investing Riskier Than Long Term?

Yes, due to volatility and timing challenges.

Should Beginners Avoid Short-Term Investing?

Generally yes; start with long-term to build habits.

How Do Long-Term Returns Compare Historically?

Averaging 7-10% annually, outperforming short-term.

What Time Horizon Should a Beginner Investor Choose?

Based on goals; longer for growth.

Additional Q&A:

- Why beginners usually choose short-term investing: Excitement over quick wins.

- Volatility comparison short vs long term investing: Short higher, long smoother.

Conclusion

In summary, long-term vs short-term investing highlights why beginners usually choose wrong by opting for short-term thrills over sustainable growth. Embrace long-term for compound returns, lower risks, and financial security. Now, start building your portfolio—check our guide on How to Improve Risk Tolerance or subscribe for updates. Your future self will thank you.

This article is for educational purposes only. See our Financial Disclaimer.

About author person.