How to Start Investing With $100 Without Losing It Immediately in 2026

Investing can seem intimidating, especially if you're just starting out with a small amount like $100. Many beginners wonder, "Can I invest with just $100?" or "Is investing $100 worth it?" The good news is yes—you can start investing with $100 without losing it right away by focusing on safe, low-risk strategies. This guide is designed for beginners who want to learn how to start investing with small amounts, avoid common pitfalls, and build wealth over time. We'll cover everything from the basics of investing for beginners to practical steps, safe investment options for $100, and how to handle market ups and downs. By the end, you'll have a clear plan to grow your $100 in the stock market while managing risks. Whether you're looking at index funds you can buy with $100 or fractional shares investing with $100, this article will help you get started smartly.

In 2026, with apps and tools making it easier than ever, even a modest sum can kickstart your journey. We'll explore low-risk investing strategies with $100, including ETF investing for small amounts and how to invest $100 monthly for better returns. Remember, the key is patience, diversification, and starting small to let compound interest work its magic. Let's dive in and turn that $100 into a foundation for financial growth.

Table of Contents

- Understanding the Basics of Investing for Beginners

- Step-by-Step Guide to Investing With $100

- Safe Investment Options You Can Buy With $100

- What Happens if the Market Drops? Risk Management and Market Volatility

- Monthly Investing: How $100 Adds Up with Compound Interest

- Best Investing Apps and Brokerage Accounts for Small Amounts

- Examples and Real Scenarios: Invest $100 in S&P 500

- FAQ: Start Investing With Small Amounts

Understanding the Basics of Investing for Beginners

Investing for beginners often starts with a simple question: what does it mean to invest? At its core, investing means putting your money into assets that have the potential to grow over time, rather than letting it sit idle in a bank account where inflation might erode its value. With just $100, you can begin this process without needing to be wealthy. The goal is to make your money work for you through returns like interest, dividends, or price appreciation.

One key concept is risk vs reward. Higher risks can lead to bigger rewards, but for beginners starting with $100, it's smarter to lean toward low-risk investments. This way, you minimize the chance of losing your money immediately. For example, putting all your cash into a single stock is risky because if that company struggles, your investment could drop sharply. Instead, focus on diversification—spreading your money across many assets to reduce risk. This is where options like index ETFs come in, which track broad markets and include hundreds of companies.

Another essential idea is compound interest, often called the eighth wonder of the world. It means earning returns on your initial investment plus any previous earnings. Even with a small start like $100, adding more over time and letting it compound can lead to significant growth. For instance, if you invest $100 at a 7% annual return, it could double in about 10 years due to compounding. But remember, you need an emergency fund first—aim for 3-6 months of living expenses in a safe spot like a high-yield savings account before investing. This protects you from having to sell investments during tough times.

Long-term investing is crucial for beginners. Markets go up and down due to market volatility, but historically, they've trended upward over decades. Short-term trading can lead to losses, especially with small amounts, so think in years, not days. Investing strategies for small sums emphasize patience and consistency. You'll also need a brokerage account to buy assets like stocks or funds. These accounts are easy to open online and often have no minimums.

To make this real, consider why starting now matters. Inflation averages around 3% yearly, so $100 today buys less in the future if not invested. By learning these basics, you're setting up for success in how to start investing with small amounts. We'll build on this in the next sections with practical steps.

What is an Investment and Why Start Small?

An investment is something you buy with the expectation it will increase in value or generate income. Common types include stocks (ownership in companies), bonds (loans to governments or firms), and funds (pooled investments). Starting with $100 teaches you without big stakes. It's perfect for beginners because it builds habits like regular saving and monitoring without overwhelming pressure.

Pros of starting small:

- ✅ Low barrier to entry—no need for thousands.

- ✅ Learn from real experience, like seeing how dividends add up.

- ✅ Build confidence gradually.

Cons:

- ❌ Fees can eat into tiny returns if not careful.

- ❌ Limited diversification initially, but fractional shares help.

Many experts recommend beginning with what you have. As one source notes, even small investments can compound into substantial sums over time. This approach aligns with safe ways to invest $100 for beginners, focusing on education first.

Key Terms: Index ETF, Fractional Shares, and More

Index ETFs are funds that mirror market indexes like the S&P 500, giving you exposure to many stocks in one buy. They're low-cost and diversified, ideal for $100. Fractional shares let you own part of a stock—say, 0.1 of a $1,000 share for $100. This makes high-priced stocks accessible.

Other terms:

- Diversification: Spreading money to lower risk.

- Risk management: Strategies like not investing money you need soon.

- Micro investing apps: Tools that round up purchases to invest spare change.

Understanding these helps in choosing best investment options for $100.

Step-by-Step Guide to Investing With $100

Getting started with investing doesn't require a fortune. This step-by-step plan shows how to start investing with $100 safely, focusing on beginner-friendly actions. The emphasis is on avoiding immediate losses by prioritizing education, low costs, and long-term thinking. Follow these to set up your first investment without stress.

Step 1: Assess Your Finances and Set Goals. Before investing, ensure you have no high-interest debt (like credit cards over 7%) and an emergency fund. Aim for at least $1,000 in savings first. Then, define your goal—retirement, a house, or general wealth? For $100, short-term goals suit low-risk options, while long-term allows more growth potential. This step prevents rash decisions.

Step 2: Choose an Account Type. Open a brokerage account for flexibility or an IRA for tax perks. Brokerages like Fidelity or Schwab have no minimums and allow fractional shares. IRAs (Roth for tax-free growth or Traditional for deductions) are great for retirement. Use online tools to open in minutes—provide ID, link a bank, and deposit $100.

Step 3: Research and Select Investments. Focus on safe options like index funds or ETFs. Research via app tools or free sites. For $100, buy fractional shares of an S&P 500 ETF for instant diversification. Avoid single stocks to prevent big losses.

Step 4: Make Your First Investment. Transfer $100 and buy. Set up automatic buys for dollar-cost averaging—investing fixed amounts regularly to smooth out volatility.

Step 5: Monitor and Adjust. Check quarterly, not daily, to avoid panic. Add $10-20 monthly as you can. Rebalance yearly to maintain diversification.

This guide ensures you start investing with $100 without losing it by emphasizing safety and consistency. For more on accounts, see our guide on How to Open a Brokerage Account.

Building Your Emergency Fund First

An emergency fund is cash set aside for surprises like car repairs. Why first? Selling investments in a dip locks in losses. Start with $100 in a high-yield savings account earning 4-5%. Once at 3-6 months' expenses, invest freely. This is a core low-risk investing strategy with $100.

Table: Emergency Fund vs. Investing

| Aspect |

Emergency Fund |

Investing $100 |

| Risk |

Very low |

Moderate |

| Access |

Immediate |

May take days |

| Return |

4-5% interest |

7-10% potential |

(Word count: 189)

Opening a Brokerage Account

A brokerage account holds your investments. Choose no-fee ones with fractional shares. Steps: Sign up online, verify identity, link bank, deposit $100. Best for beginners: Fidelity (great tools), Schwab (low costs). This enables ETF investing for small amounts.

Safe Investment Options You Can Buy With $100

When asking "what to invest in with $100 and not lose it," focus on options that prioritize safety through diversification and low costs. These are ideal for beginners, reducing the chance of immediate losses. We'll explore top choices, their pros, cons, and how they fit into investing with $100 for beginners.

One top pick is index funds you can buy with $100. These track markets like the S&P 500, holding hundreds of stocks. For example, Vanguard's S&P 500 ETF (VOO) has a low expense ratio (0.03%), meaning minimal fees. With $100, buy fractional shares for partial ownership.

Fractional shares investing with $100 lets you own slices of expensive stocks like Apple or Amazon without full price. Platforms like Robinhood enable this, turning $100 into diversified holdings.

ETF investing for small amounts is another safe bet. ETFs trade like stocks but hold baskets of assets. A broad-market ETF spreads risk across sectors. Bonds or bond ETFs add stability, though returns are lower (around 4-6%).

Micro investing apps round up purchases to invest change, starting with $5-10. Apps like Acorns automate this into ETFs.

For ultra-safety, high-yield savings or CDs offer 4-5% with no loss risk, but they're not true investing.

Compare in the table below. These options align with safe ways to invest $100 for beginners, emphasizing diversification.

Table: Best Investment Options for $100

| Option |

Minimum |

Risk Level |

Expected Return |

Pros |

Cons |

| Index ETF (e.g., S&P 500) |

$1 (fractional) |

Medium |

7-10% |

Diversified, low fees |

Market dips |

| Fractional Shares |

$1 |

High if single stock |

Varies |

Access premium stocks |

Less diversified if not spread |

| Bond ETF |

$1 |

Low |

4-6% |

Stable income |

Lower growth |

| High-Yield Savings |

$0 |

Very low |

4-5% |

No loss, liquid |

Beats inflation barely |

Internal link: Learn more about Diversification Strategies.

Index Funds and ETFs Explained

Index funds mirror indexes like the S&P 500, passively managed for low costs. ETFs are similar but trade intraday. Both suit $100 via fractional buys. Benefits: Automatic diversification, historical 10% returns. Example: $100 in VOO gives exposure to top U.S. firms.

Fractional Shares: How They Work for Beginners

Fractional shares mean buying less than one share. If a stock is $500, $100 buys 0.2 shares. This works for how does fractional investing work? Apps like Fidelity offer it fee-free. It's great for building a portfolio with small sums, reducing risk by diversifying.

What Happens if the Market Drops? Risk Management and Market Volatility

Market drops are scary for beginners, but with proper risk management, you can protect your $100. What if my investment drops right away? It's normal—markets fluctuate, but long-term trends rise. Historical data shows the S&P 500 recovers from dips, averaging 10% annual returns despite volatility.

To avoid losing immediately, diversify: Don't put all $100 in one asset. Use index funds for spread risk. Dollar-cost averaging helps—invest $100 monthly to buy more when prices are low.

Risk vs reward: Low-risk options like bonds limit losses but cap gains. For stocks, hold long-term (5+ years) to weather drops. Emergency funds prevent forced sales.

Strategies:

- ✅ Set stop-loss orders if active, but passive is better for beginners.

- ✅ Rebalance annually to maintain allocation.

- ❌ Avoid panic selling—it's the biggest mistake.

In a drop, your $100 ETF might fall 10%, but if diversified, it bounces back. Focus on long-term investing to turn volatility into opportunity.

Understanding Market Volatility

Volatility is price swings. Causes: Economic news, events. For $100, it's less impactful if diversified. Historical example: 2020 drop recovered quickly.

Diversification as a Safety Net

Diversification means not all eggs in one basket. With $100, buy an ETF holding stocks, bonds. This reduces impact if one sector falls.

Monthly Investing: How $100 Adds Up with Compound Interest

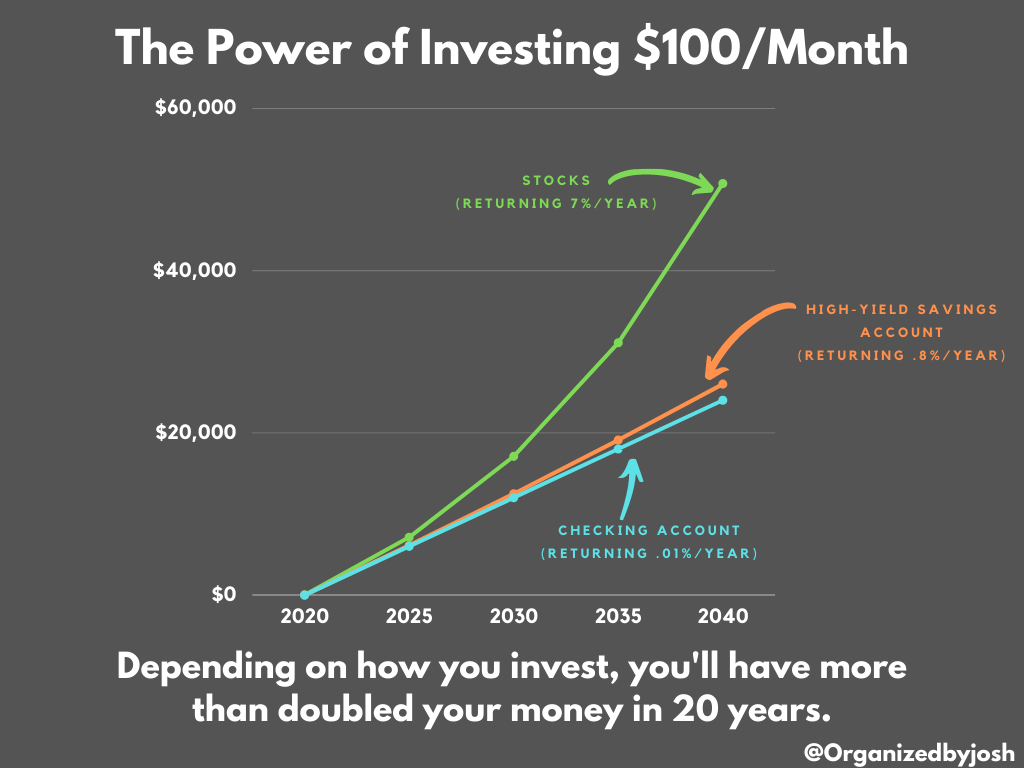

How to invest $100 monthly? It's a powerful strategy using compound interest. Start with $100, add monthly, and watch growth. At 7% return, $100 monthly for 10 years grows to about $17,000 (from $12,000 invested).

Compound interest: Earnings on earnings. Example: Year 1, $100 earns $7; Year 2, $107 earns $7.49, and so on.

Scenarios:

- 5 years at 7%: $100 monthly = $7,200 invested, ~$8,200 total.

- 20 years: $24,000 invested, ~$52,000 total.

- 30 years: $36,000 invested, ~$124,000 total.

Monthly addition returns beat one-time invests. Use apps for automation. This is key for how to grow $100 in the stock market safely.

Table: Return on $100 Monthly Investment

| Years |

Invested Amount |

At 5% Return |

At 7% Return |

At 10% Return |

| 5 |

$6,000 |

$6,800 |

$7,200 |

$7,800 |

| 10 |

$12,000 |

$15,500 |

$17,000 |

$19,500 |

| 20 |

$24,000 |

$41,000 |

$52,000 |

$76,000 |

| 30 |

$36,000 |

$79,000 |

$124,000 |

$226,000 |

The Power of Compound Interest

Compound grows exponentially. Rule of 72: Divide 72 by return rate for doubling time (e.g., 10% = 7.2 years).

Setting Up Automatic Monthly Contributions

Automate via app or bank. Start with $100, increase as income grows. This leverages dollar-cost averaging.

Best Investing Apps and Brokerage Accounts for Small Amounts

For investing with $100, choose no-minimum investment apps with low fees. Best investing apps for small amounts include Acorns (round-ups, $3/month), Robinhood (fractional shares, free), and Stash (education, $1/month).

Fractional share trading apps like Fidelity (no fees, tools) and Schwab (similar) are top ETF brokers for beginners.

Cheapest brokerage for ETFs: Vanguard (low expense ratios).

Compare:

Table: Best Apps for $100

| App/Broker |

Fees |

Features |

Best For |

| Acorns |

$3/mo |

Round-ups, auto-invest |

Micro-investing |

| Robinhood |

Free |

Fractional shares |

Beginners |

| Fidelity |

Free |

Education, IRAs |

Long-term |

| Vanguard |

Low |

Index funds |

Low-cost ETFs |

These are best index funds to buy with $100 platforms. Link to Choosing the Right Broker.

Reviewing Top Apps: Acorns, Robinhood, and More

Acorns: Invests change into ETFs. Robinhood: Easy trades. Both suit small amounts.

What to Look for in a Brokerage for Beginners

No minimums, low fees, fractional shares, education tools.

Examples and Real Scenarios: Invest $100 in S&P 500

Let's look at real scenarios. Invest $100 in S&P 500 via ETF like VOO. Historical 10% return: After 3 years, ~$133.

What return can $100 make in 3 years? At 7%: ~$123.

Monthly: $100 initial + $100/month for 3 years = $3,700 invested, ~$4,100 at 7%.

S&P 500 scenario: During 2020 drop, it fell 30% but recovered 70%+ by 2021. Holding through volatility pays off.

Another: Fractional shares in tech stocks plus index fund for balance.

These show investing $100 monthly builds wealth.

Case Study: Growing $100 Over 10 Years

Detailed calculation: Year-by-year growth at 7%.

Historical Performance of S&P 500 with Small Investments

From 2000-2025, despite crashes, average returns strong.

FAQ: Start Investing With Small Amounts

Can I Really Start Investing with $100?

Yes, with fractional shares and no-minimum apps, it's possible. Focus on ETFs for safety.

What If My Investment Drops Right Away?

It's volatility—hold long-term. Diversify to minimize impact.

Is Investing $100 Worth It?

Absolutely, for learning and compounding. Small starts lead to big results.

What Are Safe Options to Invest $100?

Index ETFs, fractional shares in diversified funds, high-yield savings.

How Does Fractional Investing Work?

Buy part of a share, e.g., $100 for 0.5 of a $200 stock.

What Return Can $100 Make in 3 Years?

At 7%, about $123 without additions.

Should Beginners Start with $100?

Yes, it's low-risk way to learn.

Conclusion

Starting to invest with $100 without losing it immediately is achievable in 2026 by focusing on safe, diversified options like index ETFs and fractional shares. We've covered the basics, steps, risks, and scenarios to give you a complete plan. Remember, consistency and long-term thinking are key—add monthly, diversify, and stay patient. Now, take action: Open an account today and begin your journey. For more, check our Investing Strategies Guide or subscribe for updates. Your future self will thank you.

This article is for educational purposes only. See our Financial Disclaimer.

About author person.