Stocks vs Bonds: What’s the Difference in 2026?

Investing can feel overwhelming, especially when deciding between stocks and bonds. Many people wonder about the stocks vs bonds difference, particularly if they're new to the game or planning for long-term goals like retirement. In 2026, with market volatility, inflation concerns, and economic shifts, understanding these two core investment types is more important than ever. Stocks represent ownership in companies and can offer high growth potential, while bonds are like loans to issuers and provide steadier income. But what's the real difference between stocks and bonds? This guide breaks it all down simply and clearly.

Whether you're exploring stocks vs bonds for beginners or comparing stocks and bonds for more advanced strategies, we'll cover everything you need to know. We'll dive into how stocks work, how bonds work, their risks and returns, and even scenarios like stocks vs bonds during inflation or recession. By the end, you'll have a solid grasp of equity vs fixed income investments, including pros and cons, to help build a balanced investment portfolio. We'll use real data from historical performance of stocks and bonds to show why diversification benefits matter, based on insights from top sources like Investopedia, NerdWallet, and Vanguard. No fluff—just practical advice to match your risk tolerance and investment horizon.

If you're asking, "Should I invest in stocks or bonds?" the answer depends on your goals. Stocks might suit long-term growth, while bonds could fit passive income needs. This article answers all your questions, from basic comparisons to advanced topics like asset allocation in a 60/40 portfolio stocks bonds. Let's get started and make investing less confusing.

Table of Contents

- What Are Stocks?

- What Are Bonds?

- Key Differences Between Stocks and Bonds

- Stocks vs Bonds Risk

- Stocks vs Bonds Returns

- Stocks vs Bonds Pros and Cons

- Stocks vs Bonds for Beginners

- Stocks vs Bonds Investing Strategies

- Stocks vs Bonds During Inflation

- Stocks vs Bonds During Recession

- Stocks vs Bonds for Long-Term Investing

- Stocks vs Bonds for Retirement

- Stocks vs Bonds for Passive Income

- Historical Performance of Stocks and Bonds

- FAQ

- Conclusion

What Are Stocks?

Stocks, also known as shares or equity, give you ownership in a company. When you buy a stock, you're purchasing a small piece of that business. This stock ownership means you can benefit from the company's success through capital appreciation—when the stock price rises—or dividend income, where companies share profits with shareholders.

How stocks work is straightforward: They're traded on the stock market, like the NYSE or Nasdaq. Prices fluctuate based on supply, demand, company performance, and economic factors, leading to market volatility. For example, if a tech company innovates, its stock might soar; but bad news can cause drops.

Stocks are ideal for growth but come with risks. Over time, they've historically outperformed other assets, but short-term losses are possible. If you're building an investment portfolio, stocks add potential for high returns.

For more on starting with equities, check our guide on Best Stocks for Beginners.

Infographic: Stocks vs Bonds Comparison | Easy Peasy Finance for ...

What Are Bonds?

Bonds are fixed-income investments where you lend money to a bond issuer, like a government, corporation, or municipality. In return, they pay you bond interest rate payments, called coupons, and return the principal at the maturity date.

How bonds work differs from stocks: They're more like IOUs. You earn yield from interest, not ownership. Types include government bonds (low risk) and corporate bonds (higher yield but more credit risk, if the issuer defaults).

Bonds provide stability in volatile markets. Interest is often fixed, making them predictable. However, rising interest rates can lower bond prices.

Bonds suit conservative investors. Learn more in Best Bonds to Invest In.

Key Differences Between Stocks and Bonds

The main stocks and bonds comparison boils down to ownership vs. debt. Stocks make you a shareholder; bonds make you a creditor.

Here's a table summarizing the difference between stocks and bonds:

| Aspect |

Stocks |

Bonds |

| Nature |

Equity (ownership) |

Debt (loan) |

| Returns |

Dividends + capital gains |

Interest payments |

| Risk |

High (market volatility) |

Lower (credit risk) |

| Market |

Stock market |

Bond market |

| Potential |

Unlimited growth |

Fixed returns |

| Taxation |

Capital gains tax |

Income tax on interest |

This shares vs bonds overview shows stocks offer higher potential but more ups and downs.

Stocks vs Bonds Risk

Are stocks riskier than bonds? Yes, generally. Stocks face market volatility, where prices can swing wildly due to economic news or company issues. Bonds have credit risk—if the issuer defaults—but they're safer overall.

For instance, during market crashes, stocks can lose 30-50%, while bonds might hold steady or even rise. Consider your risk tolerance: High for stocks, low for bonds.

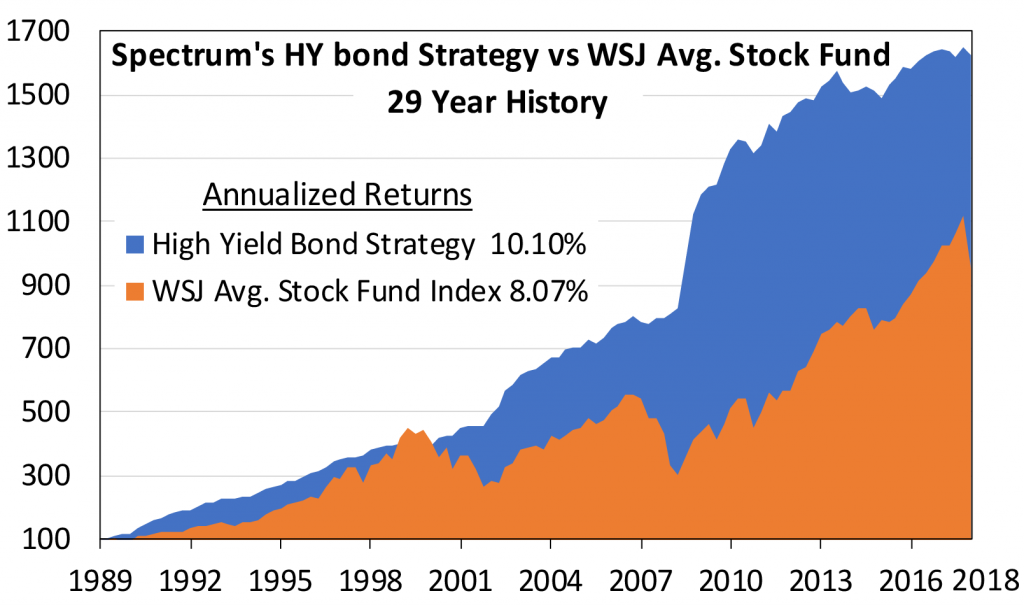

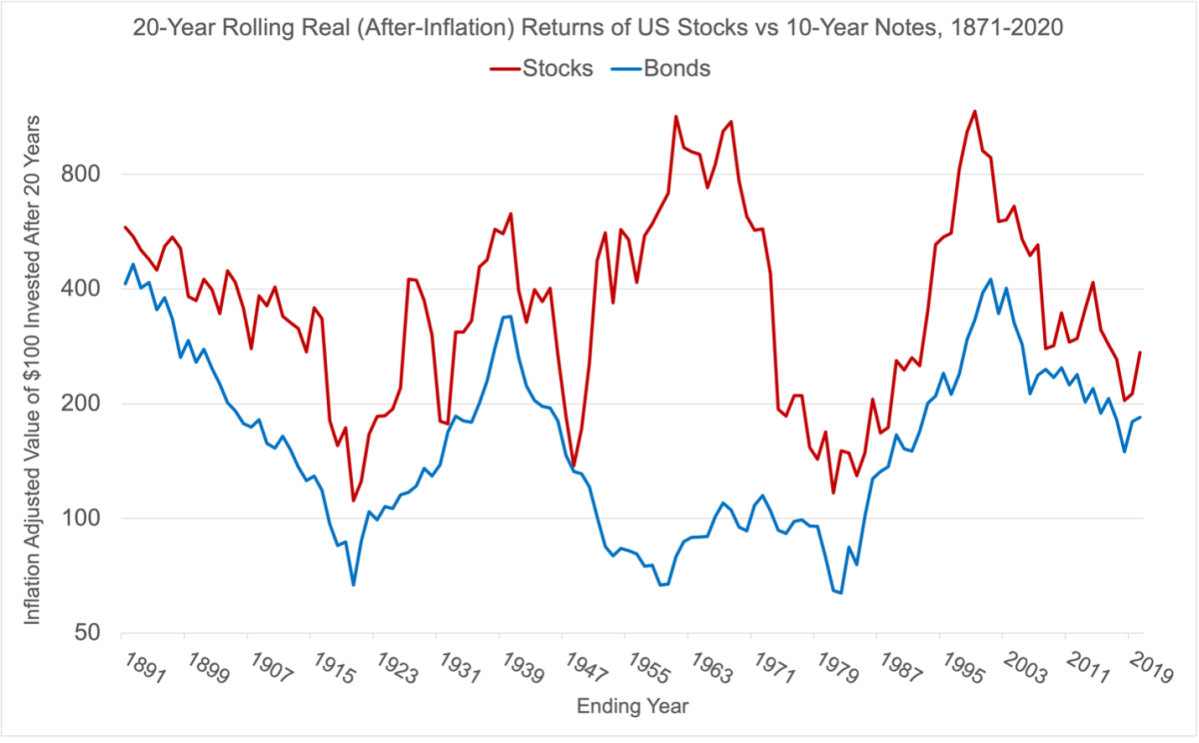

Stocks vs Bonds Returns

Stocks vs bonds returns favor stocks long-term. Historical data shows stocks averaging 9-11% annually, bonds 4-5%.

But real returns after inflation matter. Stocks often beat inflation; bonds may not. Yield vs dividend: Bonds provide steady yield, stocks variable dividends.

Stocks vs Bonds Pros and Cons

Pros of stocks:

- High growth potential

- Dividend income

- Beats inflation long-term

Cons:

- High volatility

- Possible losses

- No guarantees

Pros of bonds:

- Steady income

- Lower risk

- Principal protection

Cons:

- Lower returns

- Interest rate sensitivity

- Inflation erosion

Stocks vs Bonds for Beginners

For stocks vs bonds for beginners, start with basics. Stocks suit growth seekers; bonds for stability. Build a simple portfolio: 70% stocks, 30% bonds if young.

Avoid common mistakes like chasing hot stocks. Use index funds for diversification.

Stocks vs Bonds Investing Strategies

Effective stocks vs bonds investing involves asset allocation. The 60/40 portfolio stocks bonds—60% stocks for growth, 40% bonds for stability—has been popular, delivering about 4.7% real returns historically.

Consider your investment horizon: Long-term? More stocks. Short-term? More bonds. Diversification benefits reduce risk.

Stock and bond portfolio example:

- Aggressive: 80/20

- Balanced: 60/40

- Conservative: 40/60

Match to risk tolerance. For strategies, see Investment Strategy Stocks vs Bonds.

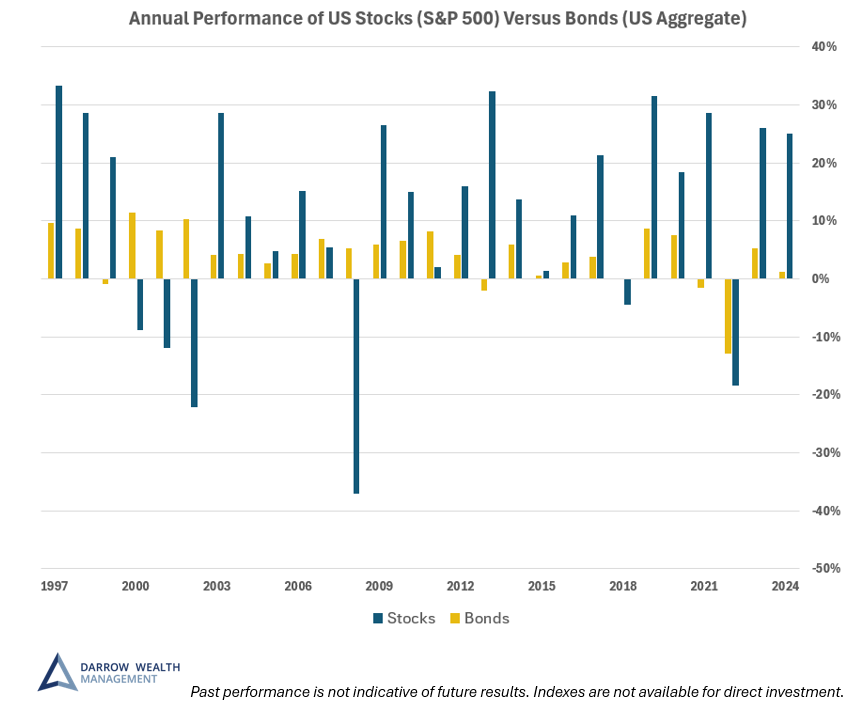

Stocks vs Bonds During Inflation

Stocks vs bonds during inflation: Stocks often perform better as companies raise prices, boosting profits. Bonds suffer as inflation erodes fixed payments.

High inflation can make bond yields unattractive. Tip: Inflation-protected bonds or growth stocks.

Stocks vs Bonds During Recession

Stocks vs bonds during recession: Bonds shine, providing stability while stocks drop. In 2008, bonds returned 20% as stocks fell 37%.

Are bonds safer than stocks? Yes, in downturns. But stocks recover stronger post-recession.

Stocks vs Bonds for Long-Term Investing

For stocks vs bonds for long-term investing, stocks win due to compounding. Over 97 years, stocks returned 9.8% geometrically vs. bonds' 4%.

Long-term vs short-term investing: Hold stocks 10+ years to weather volatility.

Stocks vs Bonds for Retirement

Stocks vs bonds for retirement: Shift to more bonds as you near retirement for income and less risk. A 50/50 mix might suit.

Dividend stocks provide growth; bonds steady payouts. Aim for 4% withdrawal rate.

Stocks vs Bonds for Passive Income

Stocks vs bonds for passive income: Bonds offer reliable interest, often monthly. Stocks via dividends, but variable.

Do bonds pay monthly income? Some do, like certain corporates. Stocks for growing income.

Historical Performance of Stocks and Bonds

Historical performance of stocks and bonds shows stocks outperforming. From 1928-2024, S&P 500 averaged 11.45% arithmetically, bonds 4.56%.

Here's a table of average returns:

| Period |

Stocks (S&P 500) |

Bonds (10-yr T.Bond) |

| 1928-2024 |

11.45% |

4.56% |

| Geometric |

9.80% |

4.00% |

Volatility: Stocks 18.80% SD, bonds 5.92%.

Stocks vs. Bonds: Historical Returns, Risk, and the Case for Both

How do stocks and bonds perform over time? Stocks grow more, but with dips.

FAQ

What is the main difference between stocks and bonds?

Stocks are ownership; bonds are loans. Stocks offer growth, bonds income.

Are stocks better than bonds?

Depends: Stocks for growth, bonds for safety. Neither is universally better.

Which is safer: stocks or bonds?

Bonds are safer due to lower volatility.

Can you lose money in bonds?

Yes, if interest rates rise or issuer defaults, but less likely than stocks.

Do bonds pay monthly income?

Some do; others semi-annually.

How do stocks and bonds perform over time?

Stocks higher returns, bonds more stable.

Conclusion

In summary, the stocks vs bonds debate hinges on your goals. Stocks drive growth with risk; bonds offer stability. A mix, like 60/40, provides diversification benefits for most.

Now you know the difference—start building your portfolio. Check our Stock and Bond Portfolio Example for more. Subscribe for updates on investing in 2026.

This article is for educational purposes only. See our Financial Disclaimer.

About author person.