What Is Insurance and Why Do You Need It in 2026

In today's fast-paced world, unexpected events can happen at any moment—a sudden illness, a car accident, or even a natural disaster. These incidents not only disrupt your daily life but can also lead to massive financial burdens. That's where insurance comes in. Insurance is essentially a financial safety net that protects you, your family, and your assets from the high costs of unforeseen risks. By paying a regular premium, you transfer the potential financial loss to an insurance company, which steps in to cover expenses when things go wrong.

But what exactly is insurance, and why do you need it? In simple terms, insurance is a contract between you and an insurer. You agree to pay a fee (the premium), and in return, the company promises to pay for covered losses as outlined in your policy. This could include medical bills from an injury, repairs to your home after a storm, or even a payout to your loved ones if something happens to you. Without insurance, you'd have to pay these costs out of pocket, which could wipe out your savings or leave you in debt.

The importance of insurance has only grown in 2026, with rising healthcare costs, increasing natural disasters due to climate change, and economic uncertainties. For instance, medical expenses in the U.S. have been climbing steadily, with average hospital stays costing tens of thousands of dollars. Car repairs after an accident can easily exceed $5,000, and rebuilding a home damaged by fire might run into hundreds of thousands. Insurance provides financial protection and peace of mind, allowing you to focus on recovery rather than worrying about bills.

This guide will explain everything you need to know about insurance in straightforward language. We'll cover the basics, how it works, why it's essential for everyone, the main types you should consider, and the key benefits. Whether you're a young professional starting out, a family provider, or someone planning for retirement, understanding insurance can help you make smart decisions to safeguard your future. By the end, you'll see why having the right coverage isn't just a good idea—it's a necessity for financial security and risk management.

Table of Contents

- What Is Insurance?

- How Does Insurance Work?

- Why Is Insurance Important?

- Types of Insurance You Should Consider

- Benefits of Having Insurance

- Choosing the Right Insurance for Your Needs

- Real-Life Examples of Insurance in Action

- Frequently Asked Questions (FAQ)

What Is Insurance?

Insurance is a way to protect yourself from financial loss caused by unexpected events. At its core, it's an agreement where you pay a company a set amount of money—called a premium—and they agree to cover certain costs if something bad happens. This could be damage to your property, medical expenses, or even loss of income.

Think of insurance as a shared pool of money. Millions of people pay into it through their premiums. The insurance company manages this pool and uses it to pay out claims when policyholders face losses. If you never make a claim, your premiums help cover others, and vice versa. This system spreads the risk, making it affordable for everyone.

There are key terms to know:

- Policy: The contract that details what’s covered, limits, and exclusions.

- Premium: The cost you pay, often monthly or yearly.

- Deductible: The amount you pay out of pocket before the insurer covers the rest.

- Claim: A request for payment after a covered event.

Insurance isn't just about money—it's about security. In 2026, with inflation and higher living costs, having coverage means you're prepared for life's uncertainties without derailing your finances.

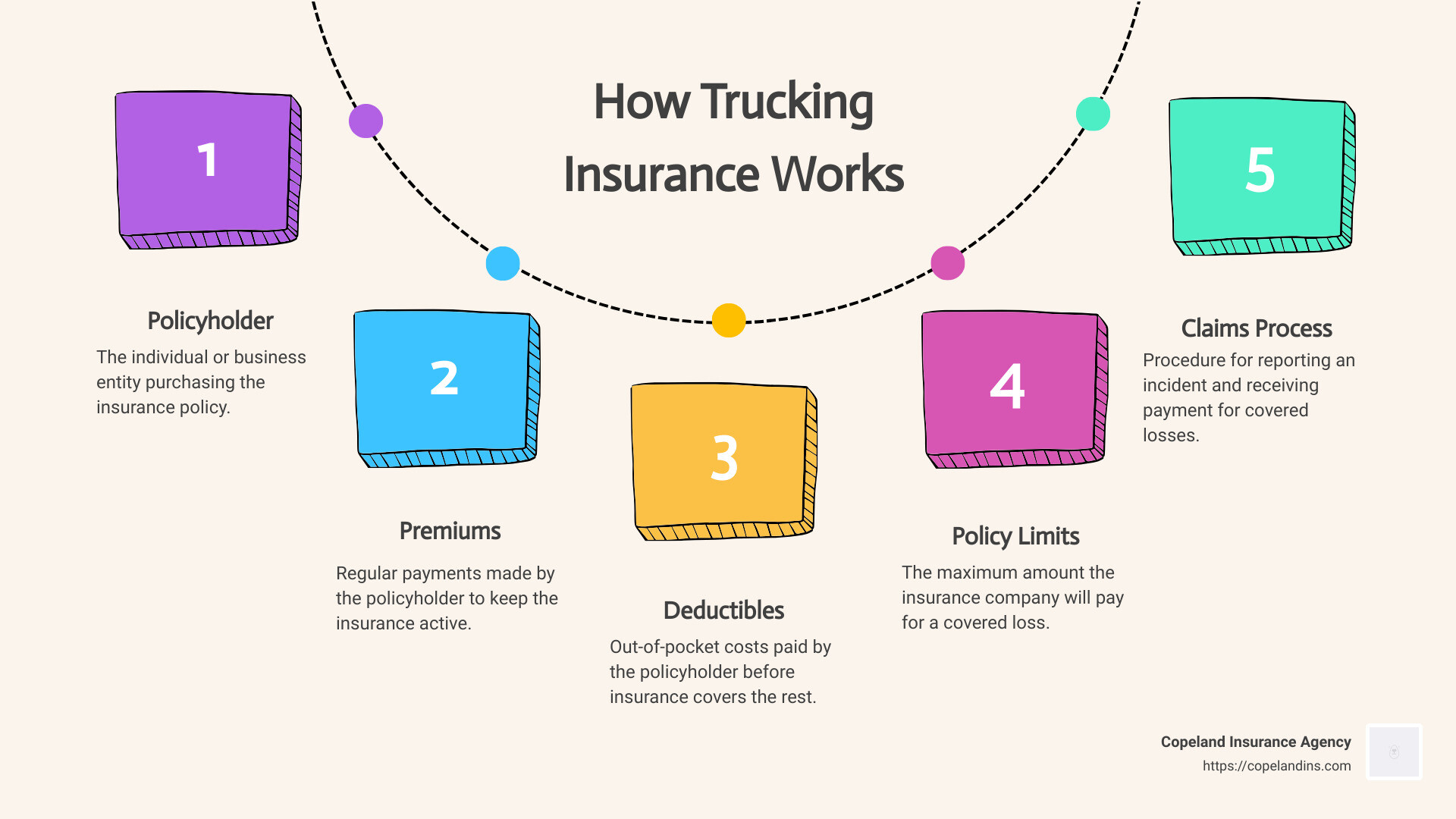

How Does Insurance Work?

Insurance operates on the principle of risk transfer. You identify potential risks, like getting sick or crashing your car, and buy a policy to shift those financial burdens to the insurer.

Here's a step-by-step breakdown:

- Assess Your Needs: Evaluate what you want to protect—your health, home, car, or family.

- Choose a Policy: Shop around for coverage that fits. Factors like your age, location, and history affect premiums.

- Pay Premiums: Make regular payments to keep the policy active.

- File a Claim: If an event happens, submit details to the insurer. They review and pay if it's covered.

- Receive Payout: The company covers costs minus your deductible, up to policy limits.

For example, if your health insurance has a $1,000 deductible and you have a $5,000 hospital bill, you pay the first $1,000, and the insurer covers $4,000 (depending on coinsurance).

Insurers use underwriting to set premiums—higher risks mean higher costs. They invest premiums to grow the fund for claims. Exclusions apply, like floods in standard home policies, so read the fine print.

Why Is Insurance Important?

Insurance is crucial because life is unpredictable. One accident or illness can lead to financial ruin without it. In 2026, with medical costs averaging over $13,000 per person annually in the U.S., going uninsured is risky.

Here are key reasons why insurance matters:

- Financial Protection: Covers large expenses, preventing debt or bankruptcy.

- Peace of Mind: Reduces stress knowing you're covered for emergencies.

- Legal Requirements: Auto and workers' comp are mandatory in many places to protect others.

- Risk Management: Helps businesses and families recover quickly from losses.

- Long-Term Security: Supports goals like retirement or education by safeguarding assets.

Without insurance, you'd bear full costs—imagine paying $100,000 for a home repair after a storm. It's a safety net that keeps your life on track.

Types of Insurance You Should Consider

There are many types of insurance, but focus on essentials based on your life stage. Here's a table comparing common ones:

| Type |

What It Covers |

Why You Need It |

Average Annual Premium (2026 Estimate) |

| Health Insurance |

Medical bills, hospital stays, preventive care |

Protects against high healthcare costs; often employer-provided |

$7,000–$10,000 per person |

| Life Insurance |

Payout to beneficiaries upon death |

Supports family financially if you pass away |

$300–$1,000 (term policy) |

| Auto Insurance |

Vehicle damage, liability for accidents |

Required by law; covers repairs and injuries |

$1,500–$2,500 |

| Home/Renters Insurance |

Property damage, theft, liability |

Safeguards your home or belongings |

$1,200–$2,000 |

| Disability Insurance |

Income replacement if unable to work |

Maintains lifestyle during illness/injury |

$1,000–$3,000 |

- Health Insurance: Includes plans like HMOs or PPOs; essential for routine and emergency care.

- Life Insurance: Term for temporary needs, whole for lifelong coverage with cash value.

- Car Insurance: Liability is minimum; add comprehensive for theft or disasters.

- Home Insurance: Covers structures and contents; renters version for apartments.

- Other Types: Travel for trips, pet for vet bills, or business for operations.

Choose based on assets and dependents. Explore more on life insurance options.

Benefits of Having Insurance

Insurance offers more than just payouts—it's a tool for stability. Key benefits include:

- Financial Security: Avoids out-of-pocket costs for big events.

- Risk Mitigation: Transfers uncertainty to the insurer.

- Tax Advantages: Some premiums (like health) are deductible.

- Additional Perks: Roadside assistance in auto policies or wellness programs in health.

- Family Protection: Ensures loved ones aren't burdened.

For businesses, it enables continuity after disruptions. Overall, it builds a "safety net" against unexpected events.

Choosing the Right Insurance for Your Needs

Selecting insurance isn't one-size-fits-all. Follow these steps:

- Evaluate Risks: Consider your health, assets, and lifestyle.

- Compare Quotes: Use online tools or agents for options.

- Understand Coverage: Check limits, deductibles, and exclusions.

- Budget Wisely: Balance premiums with protection—higher deductibles lower costs.

- Review Annually: Update for life changes like marriage or moving.

Tips:

- Work with independent agents for multiple quotes.

- Bundle policies (e.g., home and auto) for discounts.

- Check insurer ratings for reliability.

Learn how to improve your insurance score.

Real-Life Examples of Insurance in Action

Case 1: Sarah, a 35-year-old mother, had a car accident. Her auto insurance covered $10,000 in repairs and medical bills, saving her savings.

Case 2: John's home was damaged by a flood. Without separate flood coverage, he paid out-of-pocket, but his neighbor with added riders recovered fully.

Case 3: After Tom's unexpected death, his life insurance paid $500,000 to his family, covering mortgage and education costs.

These show how insurance turns potential disasters into manageable situations.

Frequently Asked Questions (FAQ)

How Does Insurance Work?

As explained earlier, you pay premiums, and the insurer covers losses per the policy.

What Are the Benefits of Insurance?

Financial protection, peace of mind, and risk transfer—see the benefits section for more.

Why Is Insurance Important?

It prevents financial hardship from unexpected events and is often legally required.

Do I Really Need Insurance?

Yes, unless you can afford massive losses. Even minimal coverage beats none.

What Types of Insurance Should I Have?

Start with health, auto, home, and life. Add others as needed. More on essential types.

Conclusion

Insurance is your shield against life's uncertainties, providing financial protection, peace of mind, and a path to recovery. In 2026, with evolving risks like climate events and healthcare inflation, having the right coverage is more vital than ever. We've covered what insurance is, how it works, its importance, types, benefits, and tips for choosing wisely.

Don't wait for a crisis—review your needs today. Contact a trusted agent or use online tools to get quotes. For personalized advice, check out our related guides like How to Choose Life Insurance or subscribe to our newsletter for updates on insurance trends. Protect what matters most—your future starts with smart coverage.

This article is for educational purposes only. See our Financial Disclaimer.

About author person.