Health Insurance Explained in Simple Terms: A Complete Guide for 2026

In today's fast-paced world, navigating health insurance can feel overwhelming, especially with rising costs and changing regulations. Whether you're a first-time buyer or just trying to understand your current plan, health insurance explained in simple terms is key to making informed decisions. Many people struggle with questions like what is health insurance in simple words or how does health insurance work step by step. Without clear knowledge, you might end up paying more than necessary or missing out on essential coverage.

This complete guide to health insurance breaks everything down into easy-to-digest pieces. We'll cover health insurance basics, from premiums and deductibles to types of plans and how to choose the right one. By the end, you'll have a solid understanding of health insurance, equipped with practical tips for 2026. With premiums expected to rise by an average of 11% nationally this year, as noted in recent market analyses, staying informed is more important than ever. We'll use simple explanation of health insurance concepts, including tables, lists, and examples, to make it health insurance made simple. If you're new to this, think of it as your beginner guide to health insurance— no jargon overload, just straightforward advice to protect your health and wallet.

Table of Contents

- What is Health Insurance?

- Health Insurance Basics

- How Health Insurance Works Step by Step

- Health Insurance Terms Explained: A Glossary

- Types of Health Insurance Plans

- What Does Health Insurance Cover?

- How Much Does Health Insurance Cost?

- Why Do You Need Health Insurance?

- How to Choose Health Insurance

- Health Insurance Explained for Beginners: Common Mistakes

- Real-Life Examples and Case Studies

- FAQ: Common Questions About Health Insurance

What is Health Insurance?

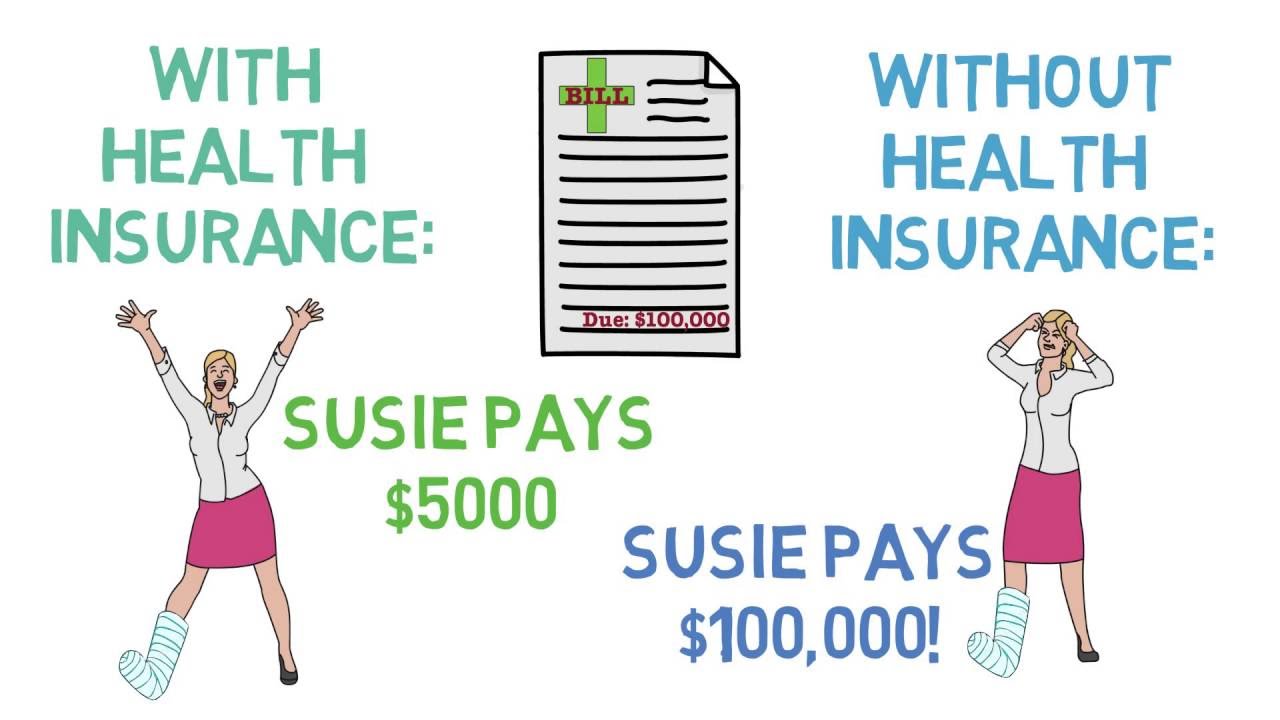

Health insurance is essentially a contract between you and an insurance company. In simple words, you pay a regular fee—called a premium—and in return, the company helps cover your medical expenses. This includes everything from routine doctor visits to major surgeries. Without it, you'd have to pay the full cost of healthcare, which can be extremely expensive. For instance, a single hospital stay could run into tens of thousands of dollars.

Understanding health insurance starts with recognizing its role as a safety net. It's not just for when you're sick; many plans cover preventive care like check-ups and vaccinations at no extra cost. This encourages early detection of issues, potentially saving lives and money. In the U.S., health insurance is provided through various channels: employers, government programs like Medicare and Medicaid, or directly from insurers via marketplaces.

Why does this matter in 2026? With ongoing changes from the Affordable Care Act (ACA), more people are eligible for subsidies, making coverage more accessible. However, not all plans are created equal. Some focus on low premiums but have high out-of-pocket costs, while others offer broader coverage at a higher monthly rate. The key is finding a balance that fits your needs.

Health insurance for beginners often boils down to this: It's a way to share the risk of medical costs. Instead of one person bearing the full burden, millions contribute through premiums, and the pool funds those who need care. This system has evolved, but the core idea remains—protection against financial ruin from health issues.

To illustrate, imagine health insurance as car insurance. You pay monthly to avoid massive bills if something goes wrong. Similarly, health coverage shields you from unexpected medical events. According to sources like Investopedia and Healthcare.gov, this contract typically lasts one year and renews annually, with options to change during open enrollment periods.

In summary, what is health insurance? It's your financial partner in healthcare, ensuring you can access services without breaking the bank. As we dive deeper, you'll see how these basics apply in real life.

Health Insurance Basics

Diving into health insurance basics, let's build on the foundation. At its core, health insurance is about managing risks and costs associated with medical care. For non-experts, think of it as a membership that gives you discounted access to healthcare services.

One fundamental aspect is the health insurance plan itself—a package outlining what's covered, how much the insurer pays, and your responsibilities. Plans vary in scope; some are comprehensive, covering hospital stays, prescriptions, and mental health, while others are limited, like short-term policies that might only last a few months.

A key basic is the distinction between private and public insurance. Private plans come from companies like UnitedHealthcare or Florida Blue, often through employers. Public options include Medicare for those 65+ or disabled, and Medicaid for low-income individuals. In 2026, with ACA enhancements, more plans qualify for Health Savings Accounts (HSAs), allowing tax-free savings for medical expenses.

Another basic: Networks of providers. In-network providers have agreements with your insurer for lower rates, while out-of-network ones cost more or aren't covered. This is crucial for beginners to grasp, as choosing the wrong doctor can lead to surprise bills.

Health insurance concepts explained simply: You pay premiums to keep the plan active. Then, when you need care, you might pay a deductible first—the amount out-of-pocket before insurance kicks in. After that, copays (flat fees) or coinsurance (percentages) apply until you hit the out-of-pocket maximum, capping your yearly spending.

Why learn these basics? They empower you to avoid common pitfalls, like assuming all services are free. Resources from CMS and university guides emphasize checking plan details upfront. For example, preventive services like annual wellness visits are often covered 100%, promoting better health outcomes.

In 2026, basics include understanding open enrollment—typically November to January for Marketplace plans. Missing it means waiting unless you have a qualifying event, like job loss. Also, with premium hikes in some regions up to 60%, per StretchDollar reports, budgeting is essential.

To make it clearer, here's a basic checklist for starters:

- Identify your needs: Frequent doctor visits? Chronic conditions?

- Compare sources: Employer, Marketplace, or government?

- Review costs: Not just premiums, but total potential outlay.

Mastering these health insurance basics sets you up for smarter choices ahead.

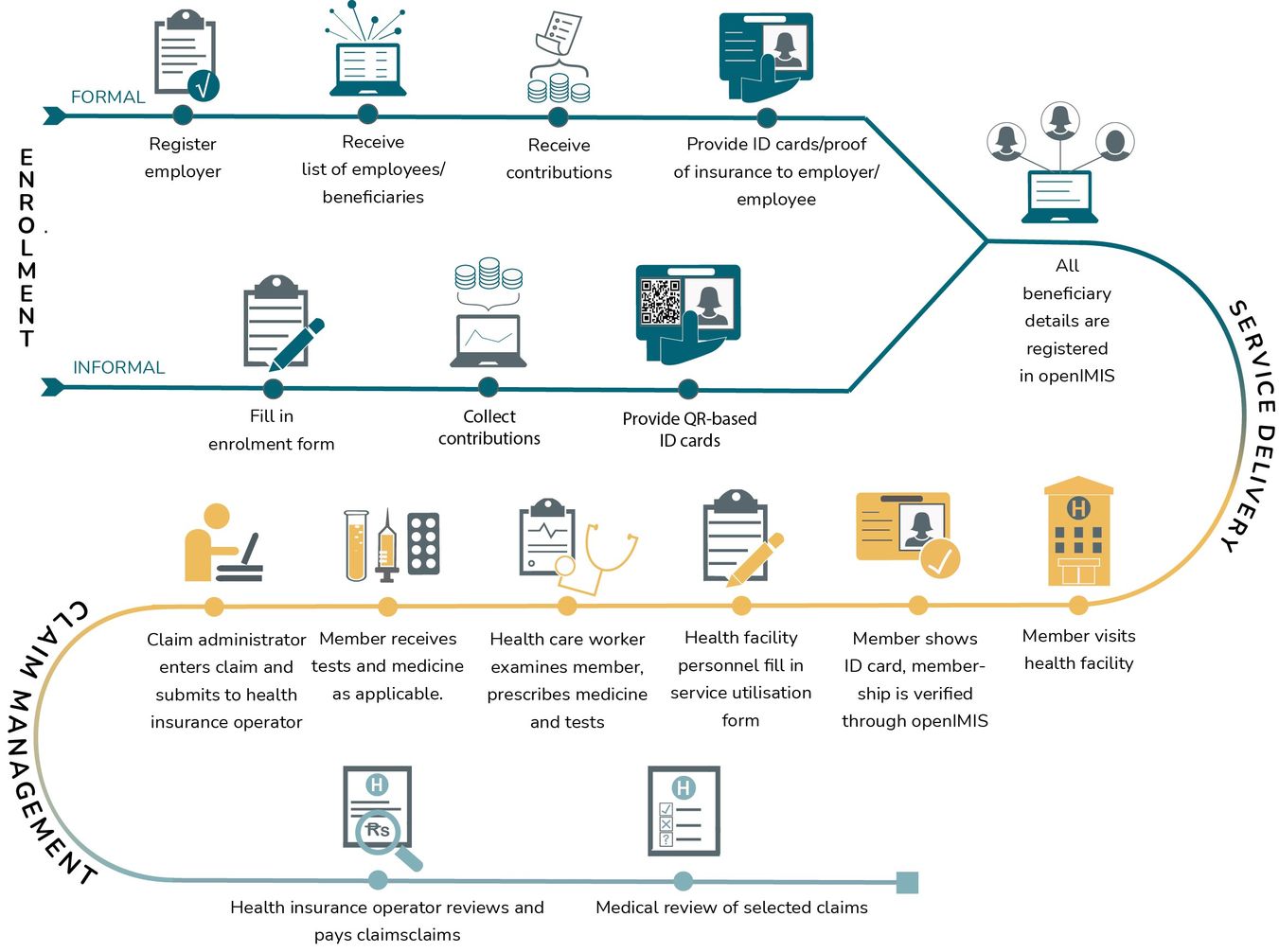

How Health Insurance Works Step by Step

Health insurance explained for dummies often starts with a step-by-step breakdown. Let's walk through how health insurance works, making it easy for non-experts.

Step 1: Choosing and Enrolling in a Plan. You select a health insurance plan based on your needs—through your job, the ACA Marketplace, or directly from an insurer. In 2026, open enrollment for Marketplace plans runs from November 1, 2025, to January 15, 2026. Pay your first premium to activate coverage.

Step 2: Paying the Premium. This is your monthly fee to the insurance company. It's like a subscription; even if you don't use services, you pay to keep the plan active. Employers often cover part of it, and subsidies may apply for lower incomes.

Step 3: Accessing Care. When you need medical help, visit an in-network provider to minimize costs. Some plans require a primary care physician (PCP) referral for specialists.

Step 4: Meeting the Deductible. Before the insurer pays, you cover this initial amount out-of-pocket (except for preventive care). For example, if your deductible is $1,500, you pay the first $1,500 of covered services.

Step 5: Sharing Costs with Copays and Coinsurance. After the deductible, you pay a copay (e.g., $25 for a doctor visit) or coinsurance (e.g., 20% of the bill). The insurer covers the rest.

Step 6: Reaching the Out-of-Pocket Maximum. This caps your yearly spending. Once hit, the plan pays 100% for covered services.

Step 7: Filing Claims. Providers usually submit claims to your insurer. You'll get an Explanation of Benefits (EOB) detailing what was covered—not a bill, but a summary.

Step 8: Renewing or Changing. Plans renew annually, but review during open enrollment for adjustments.

This health insurance explained step by step shows it's a process of shared responsibility. From Illinois DOI and UHC sources, remember: Out-of-network care can disrupt this, leading to higher costs or denials. For 2026, with more HDHPs eligible for HSAs, saving pre-tax for steps 4-6 is smarter.

Practical tip: Use online tools from Healthcare.gov to simulate costs. This easy explanation of health insurance helps beginners avoid surprises.

Health Insurance Terms Explained: A Glossary

Health insurance vocabulary can be confusing, but this health insurance glossary breaks down basic health insurance terms in simple language. We'll use a table for quick reference, followed by detailed explanations.

| Term |

Definition |

Example |

| Insurance Premium |

Monthly payment to keep your plan active. |

$300 per month for family coverage. |

| Deductible |

Amount you pay out-of-pocket before insurance starts covering costs. |

$2,000— you pay the first $2,000 yearly. |

| Copay |

Fixed fee for a service. |

$20 for a primary doctor visit. |

| Coinsurance |

Percentage of costs you pay after deductible. |

20%— you pay $20 of a $100 bill, insurer pays $80. |

| Out-of-Pocket Maximum |

Yearly cap on your spending for covered services. |

$8,000— after this, plan pays 100%. |

| Health Insurance Plan |

The contract detailing coverage and costs. |

A PPO plan with network providers. |

| Medical Insurance |

Another term for health insurance, focusing on medical care. |

Covers hospital and doctor bills. |

| Coverage |

What the plan pays for. |

Includes preventive care at 100%. |

| Monthly Premium |

See Insurance Premium. |

Paid via payroll or directly. |

| In-Network Providers |

Doctors/hospitals with insurer agreements for lower costs. |

Your local clinic contracted with the plan. |

| Out-of-Network Providers |

Providers without agreements; higher costs. |

A specialist not in your network. |

Now, let's expand. Insurance premium is the base cost—think rent for your coverage. Deductible acts as a threshold; high-deductible plans have lower premiums but require more upfront payment. Copay is straightforward, like a toll fee for visits. Coinsurance shares the load post-deductible, encouraging cost-conscious choices.

Out-of-pocket maximum protects against catastrophe; in 2026, limits are around $9,200 for individuals per KFF data. Health insurance plan types vary, but all include essential benefits under ACA.

These health insurance terms explained help demystify bills. From Investopedia and CMS, remember: Not all costs count toward deductibles, like premiums. For beginners, review your plan's summary to match these terms.

Types of Health Insurance Plans

Exploring types of health insurance plans is vital for understanding health insurance. Here's a breakdown with comparisons.

First, Managed Care Plans: These emphasize networks.

- HMO (Health Maintenance Organization): Low cost, but must use in-network and get PCP referrals. No out-of-network coverage except emergencies. Ideal for those who want simplicity.

- PPO (Preferred Provider Organization): Flexible; no referrals needed, out-of-network allowed but pricier. Good for frequent specialist needs.

- EPO (Exclusive Provider Organization): Like HMO but no referrals; strictly in-network.

- POS (Point of Service): Hybrid; lower in-network costs, some out-of-network with referrals.

High-Deductible Health Plans (HDHPs): Lower premiums, high deductibles ($1,650+ individual in 2026). Pair with HSAs for tax savings. More common in 2026 per Healthcare.gov.

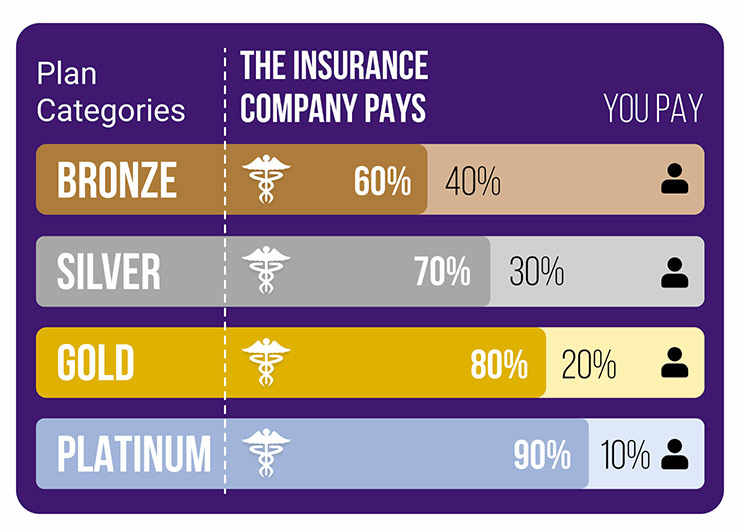

Marketplace Plans: Bronze (60% coverage, low premium), Silver (70%), Gold (80%), Platinum (90%). Catastrophic for under-30s or hardships.

Government Plans: Medicare for 65+, Medicaid for low-income.

Table comparing types:

| Plan Type |

Network Restriction |

Referrals Needed |

Premium Level |

Best For |

| HMO |

Strict in-network |

Yes |

Low |

Budget-conscious |

| PPO |

Flexible |

No |

Higher |

Specialist access |

| EPO |

In-network only |

No |

Medium |

No-referral preference |

| POS |

In-network preferred |

For out-of-network |

Medium |

Balance |

| HDHP |

Varies |

Varies |

Low |

Savers with HSA |

From California Insurance and Florida Blue, choose based on lifestyle. In 2026, with ACA tweaks, more bronze plans work with HSAs.

What Does Health Insurance Cover?

What does health insurance cover? Under ACA, plans must include 10 essential benefits: ambulatory services, emergency care, hospitalization, maternity/newborn care, mental health/substance use, prescription drugs, rehabilitative services, lab services, preventive/wellness, pediatric services.

Coverage includes preventive (free screenings), doctor visits, surgeries, and more. Not covered: Cosmetics, experimental treatments, off-label drugs.

In 2026, mental health parity ensures equal coverage. From UOregon and Eisai, check SBC for details.

Examples: Vaccines 100% covered; chronic condition management included.

To fully answer, consider variations. Employer plans might add dental/vision. Marketplace plans standardize essentials but vary extras like telehealth. Out-of-network might limit coverage to emergencies.

Why matters: Knowing avoids denials. Tips: Review exclusions; appeal if needed.

How Much Does Health Insurance Cost?

How much does health insurance cost? It varies by plan, age, location, family size.

Average 2026 individual premium: $500-600/month, up 11% nationally. Family: $1,500+.

Breakdown:

- Premiums: Monthly base.

- Deductibles: $1,000-7,000+.

- Copays: $20-50/visit.

- Coinsurance: 10-30%.

- Out-of-pocket max: $9,200 individual.

Subsidies reduce for eligible. HDHPs lower premiums but higher deductibles.

Table: Cost by Metal Level (2026 estimates)

| Level |

Avg Premium |

Deductible |

Coverage % |

| Bronze |

Low |

High ($7,500) |

60% |

| Silver |

Medium |

Medium |

70% |

| Gold |

Higher |

Low |

80% |

| Platinum |

Highest |

Lowest |

90% |

From Anthem and GoodRx, factor total costs, not just premiums.

Add: Employer contributions cut costs 50-70%. Self-employed deduct premiums.

Why Do You Need Health Insurance?

Why do you need health insurance? Medical costs average $13,000/year per person; without, bankruptcy risk.

Benefits: Financial protection, preventive care access, peace of mind.

Is health insurance worth it? Yes, even for healthy—unexpected events happen.

In 2026, with rising costs, coverage essential. From Michigan Medicine, act during enrollment.

Pros: Cost sharing, no pre-existing denials.

Cons: Premiums if unused.

Overall, worth it for security.

How to Choose Health Insurance

How to choose health insurance? Step-by-step guide.

- Assess needs: Health status, budget.

- Compare types: HMO vs. PPO.

- Check networks: Doctors included?

- Evaluate costs: Total, not just premium.

- Review coverage: Essentials + extras.

- Consider subsidies: Via Marketplace.

- Enroll timely.

Internal link: For more on scores, see How to Improve Credit Score for Better Rates.

From BCBS and OPM, use tools like cahealthcarecompare.org.

Example: Family with kids? Prioritize pediatric.

Health Insurance Explained for Beginners: Common Mistakes

Health insurance explained for beginners includes avoiding pitfalls.

Mistake 1: Ignoring networks—leads to high bills.

Mistake 2: Focusing only on premiums—high deductibles surprise.

Mistake 3: Missing enrollment—wait a year.

Mistake 4: Not using preventive care—miss free services.

Mistake 5: Forgetting life events for special enrollment.

Tips: Read EOBs, appeal denials.

Case: Forgot network, paid extra $500.

Real-Life Examples and Case Studies

Real examples make health insurance explained clearly.

- Case: John, 35, HDHP. Premium $300/month, deductible $3,000. Broke arm—paid $3,000, then coinsurance. Saved with HSA.

- Case: Sarah, family PPO. Premium $1,200, low deductible. Kid's surgery covered mostly, hit max early.

- Case: Elderly on Medicare. Supplements filled gaps.

From sources, these show planning importance.

FAQ: Common Questions About Health Insurance

What is Health Insurance?

A contract with an insurer for financial protection against medical expenses, covering doctor visits, hospital stays, and prescriptions.

Why Do You Need Health Insurance?

- Financial Security: Protects savings from large bills for accidents or serious illnesses.

- Access to Care: Ensures you can get necessary treatments, check-ups, and emergencies without prohibitive costs.

- Peace of Mind: Allows focus on recovery, not bills.

How Does Health Insurance Work? (Step-by-Step)

- Pay Premiums: You pay a regular fee (monthly) to the insurer.

- Meet Deductible: Pay out-of-pocket for care until you reach a set amount (deductible).

- Share Costs (Coinsurance/Copay): After the deductible, you and the insurer share costs (e.g., you pay 20%, insurer pays 80%) or pay a flat fee (copay) for visits.

- Insurer Pays: The plan covers remaining costs (up to policy limits).

- Stay In-Network: Using providers in the plan's network gives lower rates.

What Does Health Insurance Cover? (Essentials)

- Preventive Care: Annual check-ups, flu shots, wellness screenings (often 100% covered).

- Doctor Visits & Hospitalizations: Consultations, surgeries, emergency care, ambulance.

- Prescription Drugs: Medications.

- Day-Care Procedures: Certain treatments done in a day.

- Pre/Post-Hospitalization: Care before and after a hospital stay.

How Much Does Health Insurance Cost? (Averages)

Costs vary greatly based on age, health, location, and plan (premiums, deductibles, copays).

Higher coverage plans usually mean higher premiums but lower out-of-pocket costs when care is needed.

Is Health Insurance Worth It?

Yes: For most, it's essential to avoid financial ruin from major medical events and ensures access to timely, quality care, making it a crucial financial and health tool.

How to Choose Health Insurance

- Assess Needs: Consider family size, health conditions, and expected care.

- Compare Plans: Look at premiums, deductibles, out-of-pocket maximums, and coinsurance.

- Check Networks: Ensure your preferred doctors/hospitals are in-network.

- Review Coverage: See what's included (dental, vision, maternity, etc.).

- Consider Riders: Add-ons for specific needs (critical illness, maternity).

Conclusion

We've covered health insurance explained in simple terms, from basics to choosing. Now equipped, explore options. For personalized advice, check Marketplace or consult agents. Subscribe for updates on 2026 changes.

This article is for educational purposes only. See our Financial Disclaimer.

About author person.