What Is a Credit Card and How Does It Work in 2026: A Complete Guide

In today's fast-paced world, credit cards are one of the most common ways people manage everyday spending, from groceries to travel bookings. But many people find them confusing at first. What exactly is a credit card? How does the money flow when you swipe or tap it? And why do interest rates seem so high right now?

This comprehensive guide breaks down everything you need to know about credit cards in 2026. We'll explain the basics, how transactions work behind the scenes, the different types available, and practical tips for using them wisely. Whether you're new to credit or looking to optimize your cards, you'll find clear answers here to make informed decisions.

Table of Contents

- What Is a Credit Card?

- How Do Credit Cards Work?

- Types of Credit Cards

- How Credit Card Interest and Fees Work

- How to Apply for a Credit Card

- Benefits and Risks of Using Credit Cards

- Real-Life Examples

- Frequently Asked Questions (FAQ)

What Is a Credit Card?

A credit card is a payment tool issued by banks or financial companies that lets you borrow money to make purchases, up to a pre-approved limit. Unlike a debit card, which pulls funds directly from your bank account, a credit card uses a revolving line of credit. You can pay back what you borrow over time, and if managed well, it helps build your credit history.

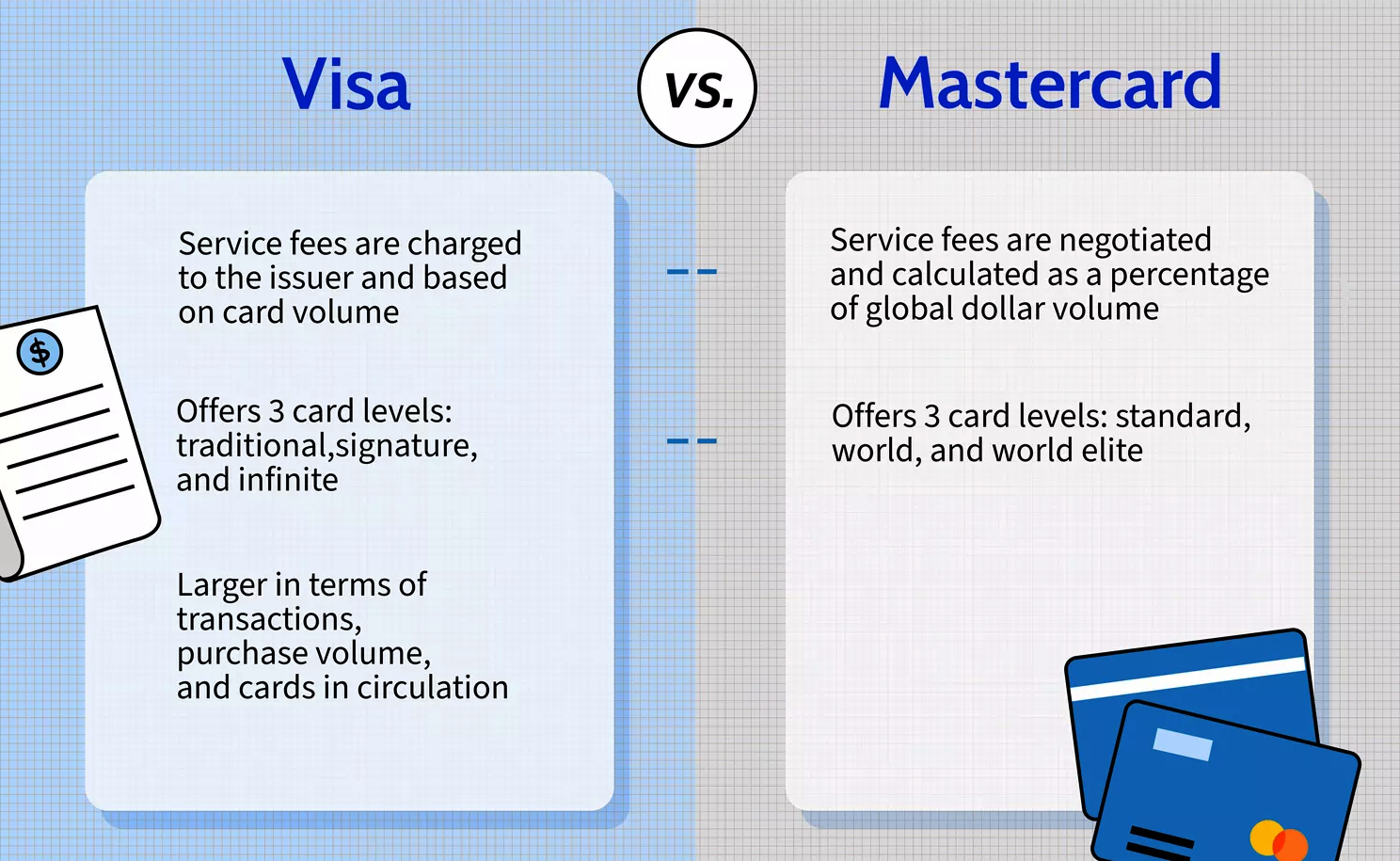

In simple terms, it's like a short-term loan for everyday expenses. Major networks like Visa, Mastercard, American Express, and Discover process transactions globally. As of 2026, average credit limits vary based on your credit score, but responsible use can lead to higher limits and better offers.

Credit cards differ from charge cards (which require full payment monthly) and prepaid cards (which use loaded funds). They're powerful for convenience but require discipline to avoid debt.

How Do Credit Cards Work?

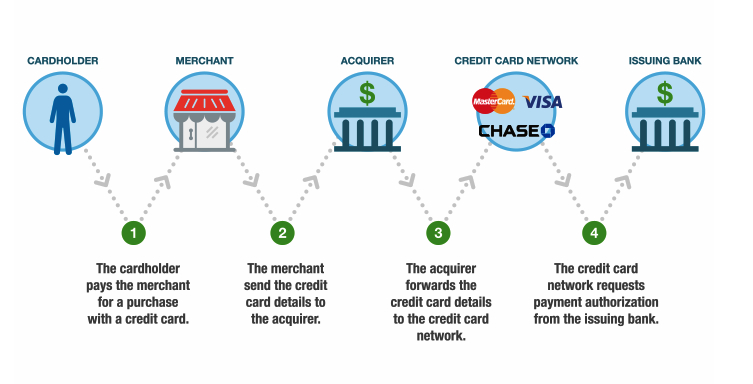

When you use a credit card, here's what happens step by step:

- You make a purchase: Swipe, tap, or enter details online.

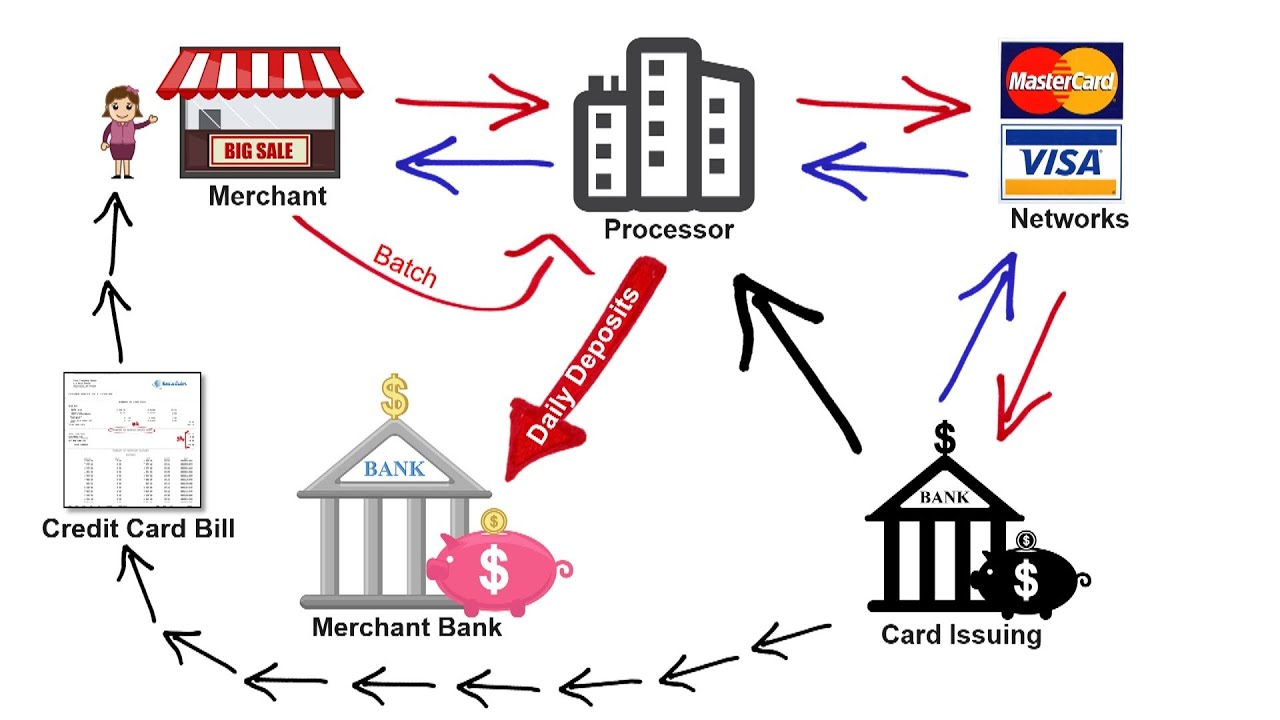

- Authorization: The merchant sends details to their bank (acquiring bank).

- Network routing: It goes through the card network (e.g., Visa) to your issuer (e.g., Chase).

- Approval: The issuer checks your available credit and approves/declines.

- Settlement: Funds transfer from issuer to merchant (minus fees).

- Billing: At month-end, you get a statement with purchases, minimum due, and total balance.

You have a grace period (usually 21-25 days) to pay without interest on new purchases. Pay in full to avoid charges; otherwise, interest accrues on the remaining balance.

Your payments report to credit bureaus (Experian, Equifax, TransUnion), impacting your score. On-time payments build credit; late ones hurt it.

Types of Credit Cards

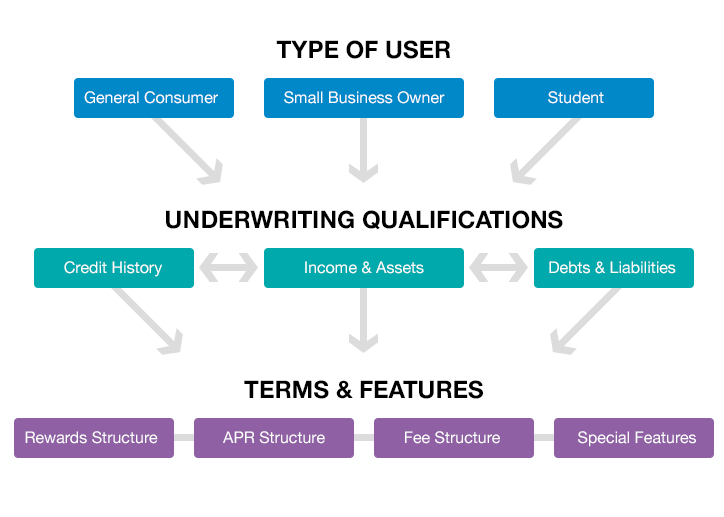

Credit cards come in various forms to match different needs. Here's a comparison:

| Type |

Best For |

Key Features |

Examples in 2026 |

Pros |

Cons |

| Rewards/Cash Back |

Everyday spending |

Earn % back or points on purchases |

Chase Freedom Unlimited (1.5-5% cash back), Citi Double Cash (2%) |

Easy rewards, no/low annual fee |

Rewards may have caps or categories |

| Travel Rewards |

Frequent travelers |

Miles/points for flights, hotels |

Chase Sapphire Preferred, Capital One Venture X |

High-value redemptions, perks like lounges |

Annual fees, blackout dates |

| Balance Transfer |

Paying off debt |

0% intro APR on transfers |

Wells Fargo Reflect (long intro periods) |

Saves on interest |

Transfer fees (3-5%) |

| Secured |

Building/rebuilding credit |

Requires deposit as limit |

Discover it Secured |

Easier approval, reports to bureaus |

Deposit tied up |

| Student |

College students |

Low limits, no history required |

Capital One Student cards |

Builds credit early |

Lower limits |

| Business |

Small business owners |

Expense tracking, higher limits |

Ink Business Cash (5% on office supplies) |

Separate business/personal |

Personal liability often |

| Low Interest/0% Intro |

Large purchases or debt payoff |

Low ongoing or intro APR |

Citi Simplicity |

Avoids high interest |

Fewer rewards |

Choose based on your spending—rewards for high spenders, secured for beginners.

How Credit Card Interest and Fees Work

Interest (APR) is the cost of borrowing. In 2026, average rates hover around 19-22%, down slightly from 2025 peaks but still high due to economic factors.

- Grace period: No interest if paid in full.

- Compound interest: Daily on unpaid balances.

- Minimum payment: Usually 1-3% of balance—pay more to reduce debt faster.

Common fees:

- Annual: $0-$550 (offset by perks).

- Late: Up to $40.

- Cash advance: Higher APR + fees.

- Foreign transaction: 3% (avoid with no-foreign-fee cards).

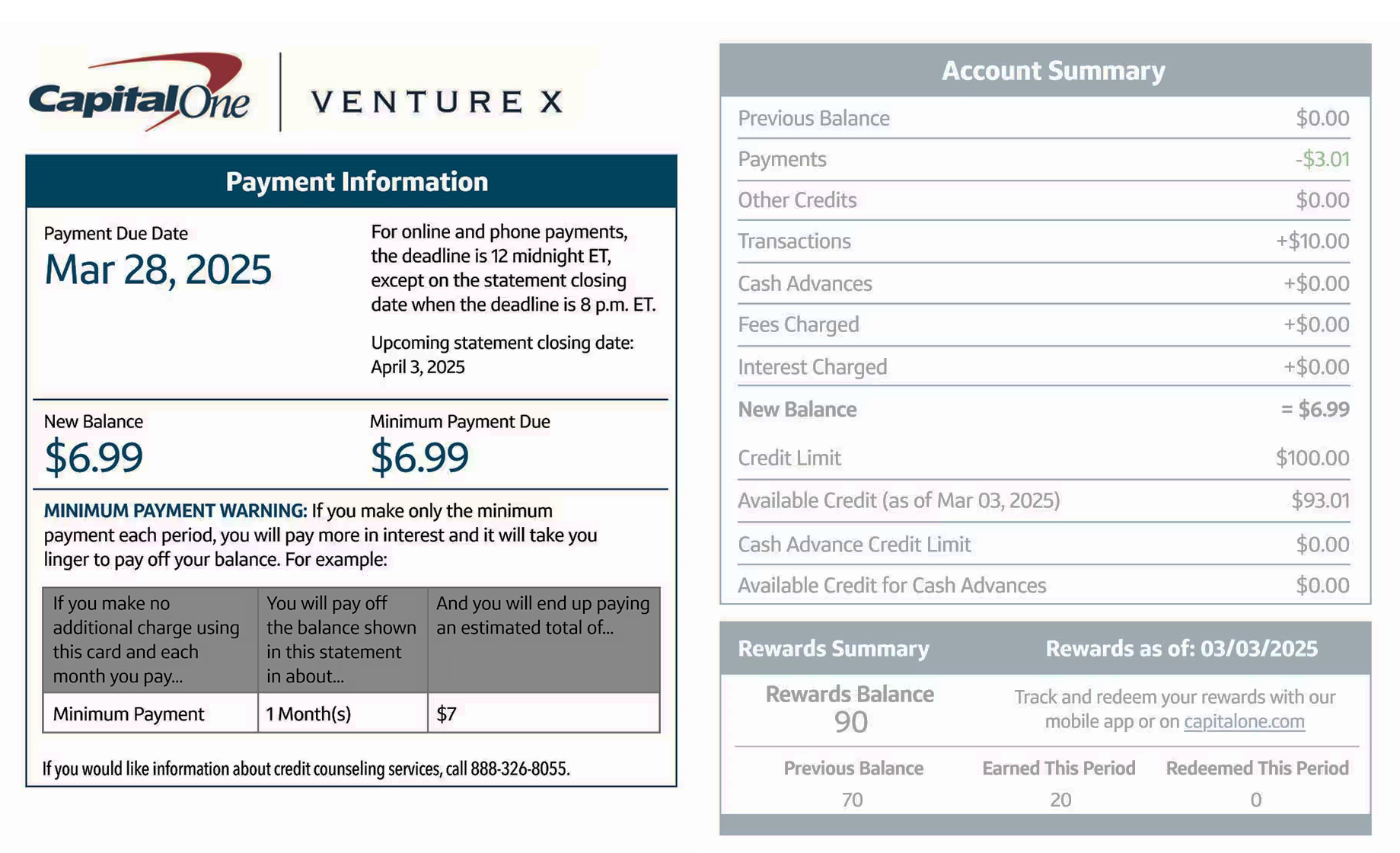

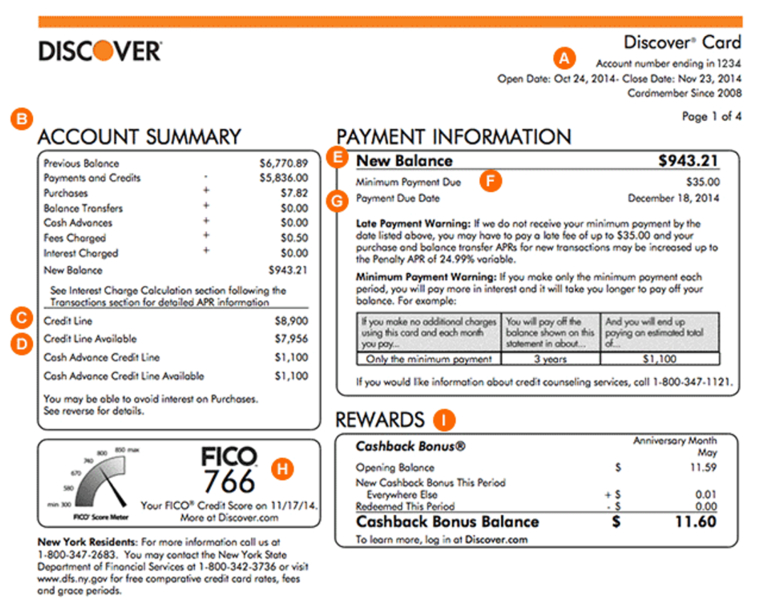

Here's a sample statement breakdown:

Always review statements for errors or fraud.

How to Apply for a Credit Card

Follow these steps:

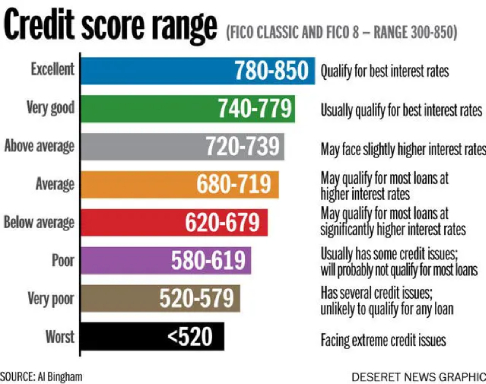

- Check your credit score (free via annualcreditreport.com).

- Compare cards (rewards, fees, APR).

- Pre-qualify online (soft inquiry, no score hit).

- Apply (provides personal/financial info).

- Await approval (instant or 7-10 days).

Tips: Good credit (670+) gets best offers. Start with secured if needed.

Benefits and Risks of Using Credit Cards

Benefits:

- Convenience and security (fraud protection up to $50 liability).

- Build credit history.

- Rewards and perks (cash back, travel insurance).

- Emergency funds.

Risks:

- High-interest debt if not paid off.

- Overspending temptation.

- Fees adding up.

- Credit score damage from missed payments.

Use responsibly: Pay in full monthly, keep utilization under 30%.

Real-Life Examples

- Building Credit: A student gets a secured card with $500 deposit. Pays on time for a year—score rises from none to 700+.

- Rewards Maximized: Someone spends $2,000/month on groceries/dining with a 6% cash back card—earns $1,440/year.

- Debt Trap Avoided: Transfers $10,000 balance to 0% intro card, pays off in 18 months—saves thousands in interest.

In 2026, top picks include Chase Sapphire for travel and Wells Fargo Active Cash for flat-rate rewards.

Frequently Asked Questions (FAQ)

What is the difference between a credit card and a debit card?

Credit cards borrow money (revolving credit); debit cards use your own funds. Credit builds score; debit doesn't.

How does credit card interest work?

It's charged on unpaid balances after grace period. Average APR ~20% in 2026—pay full to avoid.

Can I get a credit card with bad credit?

Yes, via secured cards or credit-builder options.

What happens if I only pay the minimum?

You pay more interest over time; debt lingers longer.

Is it safe to use credit cards online?

Yes, with fraud monitoring and zero liability on most cards.

How many credit cards should I have?

2-5 for most; more for rewards optimization, but manage responsibly.

Do credit cards have expiration dates?

Yes, usually 3-5 years; new one sent automatically.

What is a good credit utilization ratio?

Under 30% (e.g., $3,000 used on $10,000 limit).

Conclusion

Credit cards are powerful tools for convenience, rewards, and credit building when used smartly. In 2026, with rates stabilizing around 19-20%, focus on paying balances in full and choosing cards that match your lifestyle.

Ready to get started? Check your credit score today and explore options that fit your needs. Responsible use can open doors to better financial opportunities ahead.

This article is for educational purposes only. See our Financial Disclaimer.

About author person.