How to Choose Your First Credit Card in 2026: The Ultimate Complete Guide for Beginners

Getting your first credit card is a big step toward financial independence. Whether you're a young adult starting out, a college student with limited income, or someone with no credit history, choosing the right card can help you build credit responsibly while avoiding costly mistakes.

Many people feel overwhelmed when figuring out how to choose your first credit card. With so many options — from secured vs unsecured credit cards to student credit cards and rewards cards — it's easy to pick the wrong one. This comprehensive guide covers credit card basics for first-timers, what to consider when choosing your first credit card, top credit cards for beginners in 2026, common pitfalls, and step-by-step tips to get approved and use it wisely.

We'll dive deep into everything you need to know before getting your first credit card, including credit score needed for first credit card, how to compare offers, and how to responsibly use your first credit card. By the end, you'll have the knowledge to select the best first credit card for your needs.

Here are some exciting visuals of young people getting their first credit card — see how empowering it looks!

Table of Contents

- What is a Credit Card? Basics for First-Timers

- How Credit Cards Work for Beginners

- Credit Score & Eligibility: What Credit Score Do You Need for a First Credit Card?

- Secured vs Unsecured Credit Cards Explained

- Types of First Credit Cards: Best Options for Beginners

- What to Look for in Your First Credit Card

- Best First Credit Card Options in 2026

- How to Compare Credit Cards for First Timers

- First Credit Card Common Mistakes to Avoid

- How to Apply for Your First Credit Card & Get Approved

- How to Build Credit with Your First Card & How Long It Takes

- How to Responsibly Use Your First Credit Card

- How to Upgrade from a First Credit Card

- FAQ: People Also Ask About First Credit Cards

- Conclusion & Next Steps

What is a Credit Card? Credit Card Basics for First-Timers

A credit card is a payment tool issued by a bank or financial institution that lets you borrow money up to a set credit limit for purchases, then pay it back later. Unlike a debit card (which uses your own money), a credit card is a short-term loan.

Key credit card terms every beginner should know:

- APR (Annual Percentage Rate) — The interest rate on unpaid balances. Average purchase APR in 2026 is around 20-25% variable.

- Grace Period — Usually 21-25 days after the billing cycle ends where you pay in full to avoid interest on purchases.

- Credit Limit — Maximum amount you can borrow.

- Minimum Payment — Smallest amount due to avoid late fees (usually 1-3% of balance + interest/fees).

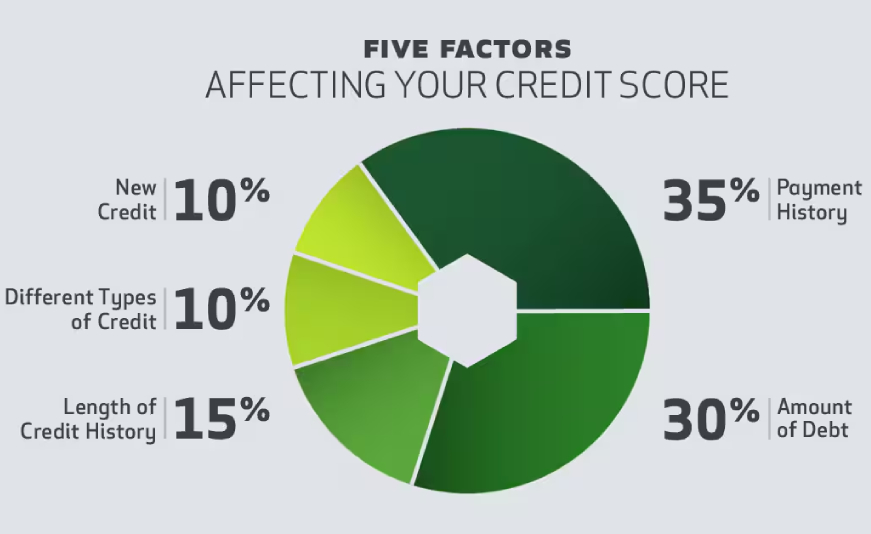

- Credit Utilization — Percentage of your limit you're using (aim for under 30% for good credit score impact).

How credit cards affect your credit score: Issuers report to major credit bureaus (Experian, Equifax, TransUnion). Positive: on-time payments (35% of score), low utilization (30%). Negative: late payments, high balances.

Things to know before getting your first credit card: It's not free money. Responsible use builds credit for future loans (car, mortgage) at better rates. Irresponsible use leads to debt and damaged credit.

How Credit Cards Work for Beginners

When you make a purchase, the issuer pays the merchant, adding to your balance. You get a monthly statement. Pay in full during the grace period → no interest. Carry a balance → interest accrues daily.

Credit card jargon explained:

- Schumer Box — The box on the application/disclosure with key terms like APR, fees, grace period (required by law).

- Foreign Transaction Fee — 0-3% on international purchases (avoid for travel).

- Balance Transfer — Moving debt from one card to another (often with intro 0% APR).

Pros for beginners: Build credit, earn rewards (cash back, points), convenience, fraud protection. Cons: High interest if carrying balance, temptation to overspend, fees.

Credit Score & Eligibility: Credit Score Needed for First Credit Card

For credit cards for no credit history, you don't need a high score — many approve with no score or low one. Good score (670+) opens better options.

Credit score ranges (FICO):

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800+

For first time credit card, start with secured/student cards if no history. Income matters (proof required for under 21).

Here is a chart showing credit score ranges and impacts:

Secured vs Unsecured Credit Cards Explained

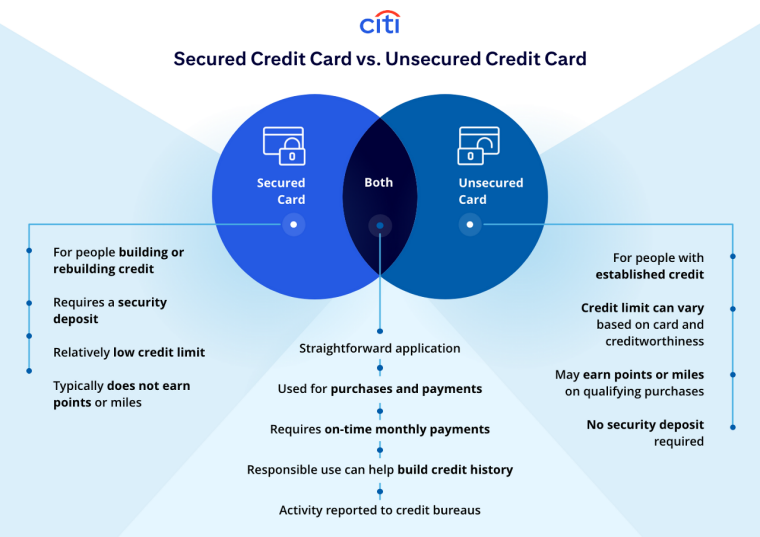

What is a secured credit card? Requires refundable deposit (e.g., $200) that becomes your limit. Great for building credit.

What is an unsecured credit card? No deposit, based on credit/income.

Here are clear infographics comparing secured vs unsecured:

Secured Credit Cards vs Unsecured Credit Cards | Citi.com

Secured is often better for first credit with no history — lower risk for issuer, easier approval.

Types of First Credit Cards: Best Types for Beginners

- Secured Cards — Best for no credit.

- Student Credit Cards — For college students, often no credit check.

- Starter/Unsecured for Fair Credit — If some history.

- Authorized User — Added to parent's card.

Best first credit card for young adults or students with limited income: Student or secured with rewards.

What to Look for in Your First Credit Card

What to consider when choosing your first credit card:

- No annual fee

- Low APR (or intro 0%)

- Reports to all bureaus

- Rewards if paid in full

- Path to upgrade

- Credit card eligibility tips: Check pre-approval tools

Best credit cards for beginners 2026: Focus on no fee, building features.

Best First Credit Card Options in 2026

Here are top picks based on current data:

Secured:

- Discover it® Secured — Rewards (2% gas/restaurants), cashback match first year, auto review.

- Capital One Platinum Secured — Low deposit ($49+), no fee, potential increase in 6 months.

Student/Beginner:

- Discover it® Student Cash Back — 5% rotating, cashback match.

- Capital One Quicksilver Student — 1.5% unlimited cash back.

- Chase Freedom Rise® — 1.5% cash back, easy for Chase customers.

Best beginner credit cards with rewards — These offer cash back while building credit.

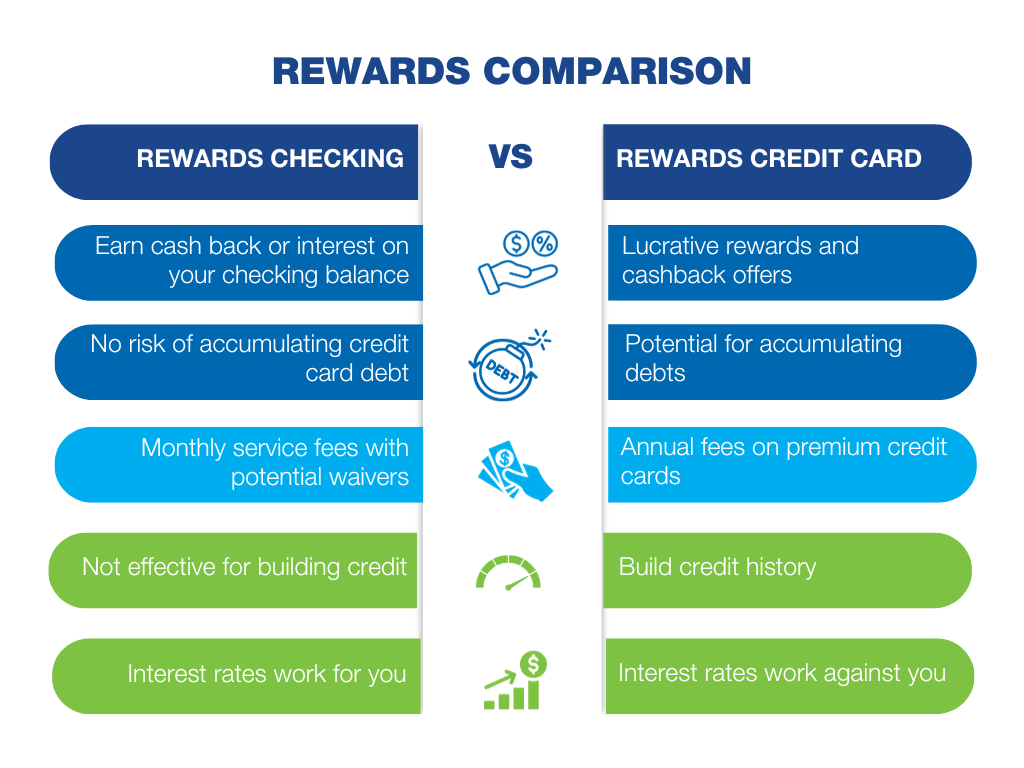

Here are visuals of rewards in action:

Rewards Checking Account vs. Rewards Credit Card | GNCU

How to Compare Cards for First Timers

Use comparison tables. Key columns: Annual Fee, APR, Rewards, Deposit, Upgrade Path.

Example Table (2026 data):

| Card |

Annual Fee |

Rewards |

Deposit |

Best For |

| Discover it Secured |

$0 |

2% gas/restaurants |

$200+ |

Rewards + Building |

| Capital One Platinum Secured |

$0 |

None |

$49+ |

Low Deposit |

| Discover it Student Cash Back |

$0 |

5% rotating |

None |

Students |

| Chase Freedom Rise |

$0 |

1.5% cash back |

None |

Easy Approval |

Compare using pre-qualification tools to avoid hard inquiries.

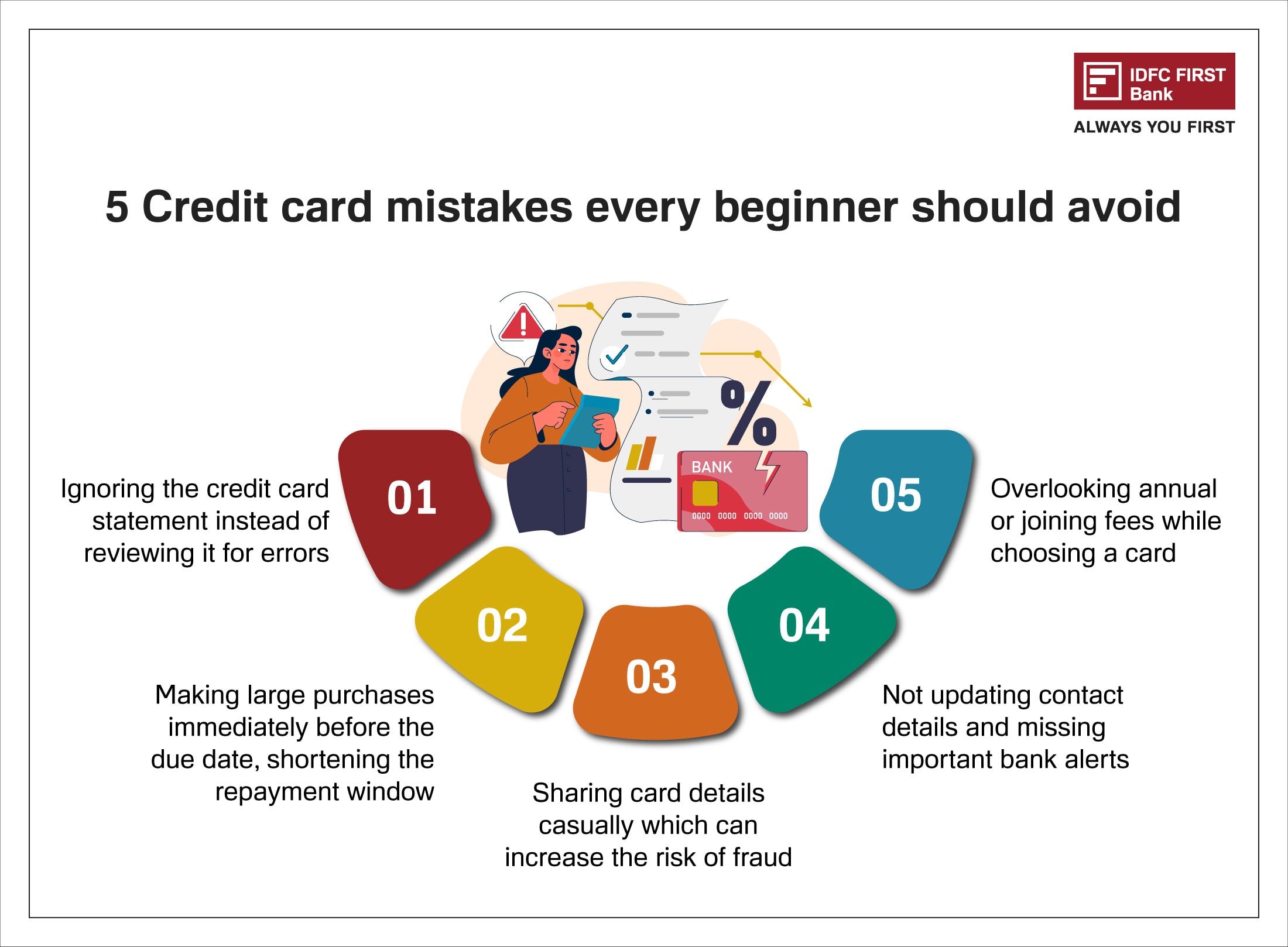

First Credit Card Common Mistakes to Avoid

- Carrying balance → high interest

- Maxing out limit → high utilization

- Missing payments

- Applying too many → inquiries hurt score

- Ignoring fees

First credit card mistakes — Pay in full, keep utilization low.

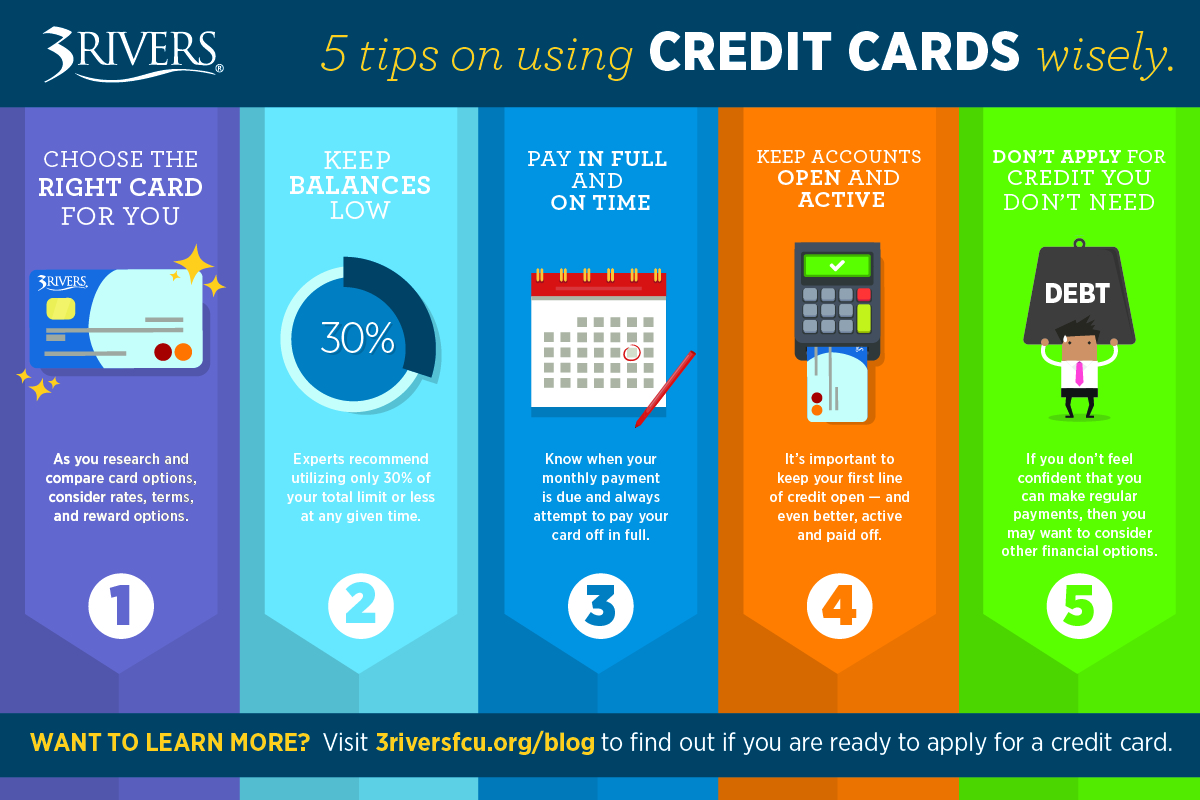

Here are tips for responsible use:

5 Ways to Use Credit Cards Wisely

Follow these infographics for smart habits!

How to Apply for Your First Credit Card & Get Approved

How to get approved for your first credit card:

- Check credit report (free at AnnualCreditReport.com)

- Use pre-qualification

- Gather info: SSN, income, address

- Apply online

- Credit card application tips — Be honest, start small

Apply for first credit card today with pre-approval.

How to Build Credit with Your First Card

Use 10-30% of limit, pay on time/in full. How long does it take to build credit with first credit card — 3-6 months for noticeable improvement, 6-12 months for good score.

How to Responsibly Use Your First Credit Card

- Treat as debit — pay in full

- Track spending

- Set autopay

- Avoid cash advances

How to responsibly use your first credit card — Build good habits early.

How to Upgrade from a First Credit Card

After 6-12 months responsible use, request increase or apply for unsecured/rewards card. Many secured upgrade automatically.

FAQ: What is the Best Way to Choose Your First Credit Card?

What is the best way to choose your first credit card? Start with your goals (build credit, rewards), compare no-fee options, use pre-qual.

How do I know which credit card is right for me? Match to your spending, credit history, income.

Are secured credit cards better for first credit card? Yes, for no credit — easier approval, builds history.

Can I get a credit card with no income? No, need proof of income (or student status).

What benefits should I look for in a first credit card? No fee, low APR, rewards, reports to bureaus.

How can I build credit with my first credit card? On-time payments, low utilization.

How long before my first credit card helps my credit score? Positive changes in 1-3 months, significant in 6+.

What credit cards should beginners avoid? High-fee, high-APR subprime.

Can I have more than one first credit card? Yes, but start with one.

Conclusion & Next Steps

Now you know how to pick a credit card as a beginner in 2026. Start with a secured or student card, use responsibly, and watch your credit grow. For a deeper understanding of all the intricacies of this issue, please read the second part of this article Ultimate Complete Guide How to Choose First Credit Card.

Ready to apply for first credit card? Check pre-approval tools from issuers like Discover or Capital One for best first credit card deals today!

This guide is your one-stop first credit card guide — bookmark it and refer back. Good luck building your credit! 🚀

This article is for educational purposes only. See our Financial Disclaimer.

About author person.