What is a Personal Loan and How Does It Work? – Complete Guide & Tips for 2026

A personal loan is a popular way to borrow money when you need cash for almost any purpose — from consolidating high-interest debt to covering unexpected expenses or funding home improvements. Unlike credit cards, which offer revolving credit, a personal loan gives you a fixed lump sum upfront that you repay in predictable monthly installments over a set period. Apply for a personal loan online.

In 2026, with average interest rates around 12.20% (and lower for excellent credit), personal loans remain more affordable than credit cards (average ~19-20%). But they require careful planning to avoid overpaying.

This comprehensive guide explains the personal loan meaning, how personal loans work, eligibility, pros and cons, application steps, and practical tips to help you decide if it's right for you and get the best deal.

Table of Contents

- What is a Personal Loan?

- How Do Personal Loans Work?

- Types of Personal Loans

- Pros and Cons of Personal Loans

- Personal Loan Interest Rates in 2026

- Personal Loan Eligibility Criteria

- How to Get a Personal Loan: Step-by-Step Guide

- Using a Personal Loan Calculator

- Personal Loan Repayment and Tips

- Personal Loan Benefits and When to Use One

- FAQs About Personal Loans

- Final Thoughts

Find out how to get instant approval personal loan.

What is a Personal Loan?

A personal loan definition is simple: It's an installment loan where a lender (bank, credit union, or online provider) gives you a lump sum of cash, which you repay with fixed monthly payments including principal and interest.

Most are unsecured personal loans — no collateral like your home or car is required. Approval depends on your creditworthiness, income, and debt levels.

Typical amounts range from $1,000 to $50,000 (up to $100,000 in some cases), with terms from 1 to 7 years.

How Do Personal Loans Work?

- You apply and get approved for a specific amount.

- The lender disburses the full sum (often within days, sometimes same-day).

- You repay in equal monthly installments.

- The rate is usually fixed, so payments stay the same.

- Interest accrues on the remaining balance, and on-time payments can build your credit.

Example: Borrow $10,000 at 12% APR over 3 years. Your monthly payment might be around $332, with total interest of about $1,000+ (use a calculator for exacts).

Types of Personal Loans

- Unsecured Personal Loan — Most common; no collateral, higher rates but no asset risk.

- Secured Personal Loan — Backed by savings, vehicle, or other assets for lower rates.

- Debt Consolidation Loan — Specifically for combining high-interest debts.

- Fixed-Rate — Predictable payments (standard).

- Variable-Rate — Rare, can change with market (riskier).

Pros and Cons of Personal Loans

Personal loans offer structure and flexibility, but they're not always the best choice.

Pros:

- Lower rates than credit cards (average 12.20% vs. 19%+).

- Fixed payments for easy budgeting.

- Fast funding (often 1-3 days).

- Builds credit with on-time payments.

- Versatile use — debt consolidation, emergencies, home repairs.

Cons:

- Origination fees (1-8%) increase costs.

- Higher rates for fair/bad credit.

- Fixed commitment — missed payments hurt credit.

- Longer terms mean more total interest.

Personal Loan Interest Rates in 2026

As of January 2026, the average personal loan interest rate is around 12.20% for a 700 FICO score borrower on a $5,000, 3-year loan.

Here's a breakdown by credit tier (approximate averages):

- Excellent (720+): 11-12% or lower (as low as 6-7% for top borrowers).

- Good (690-719): ~14-15%.

- Fair (630-689): ~18%.

- Bad (<630): 20-36%.

Shorter terms often have lower rates. Shop around — prequalify with multiple lenders!

Personal Loan Eligibility Criteria

Lenders look at:

- Credit score (higher = better rates; minimum often 600+).

- Income (stable job, DTI under 36-40%).

- Debt-to-income ratio.

- Employment history.

- Sometimes a co-signer for weaker credit.

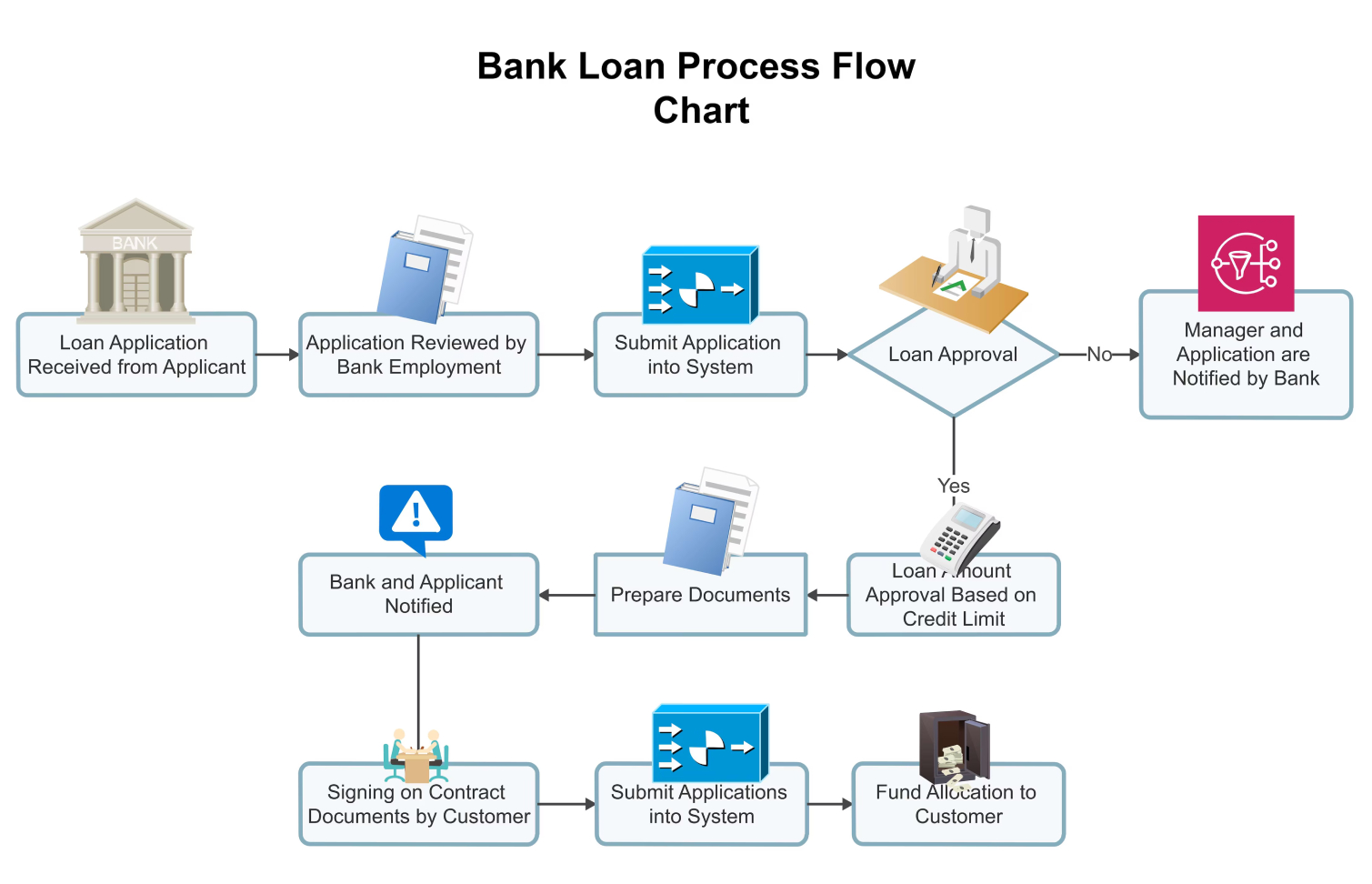

How to Get a Personal Loan: Step-by-Step Guide

- Check your credit — Get free reports and fix errors.

- Calculate needs — Decide amount and term.

- Prequalify — Compare offers (soft credit check, no score impact).

- Apply — Submit docs (ID, income proof); hard check occurs.

- Review & accept — Choose best terms.

- Get funded — Direct deposit, often fast.

Apply for a personal loan online — It's quick and convenient with many lenders. See more about best Place to Apply for a Loan.

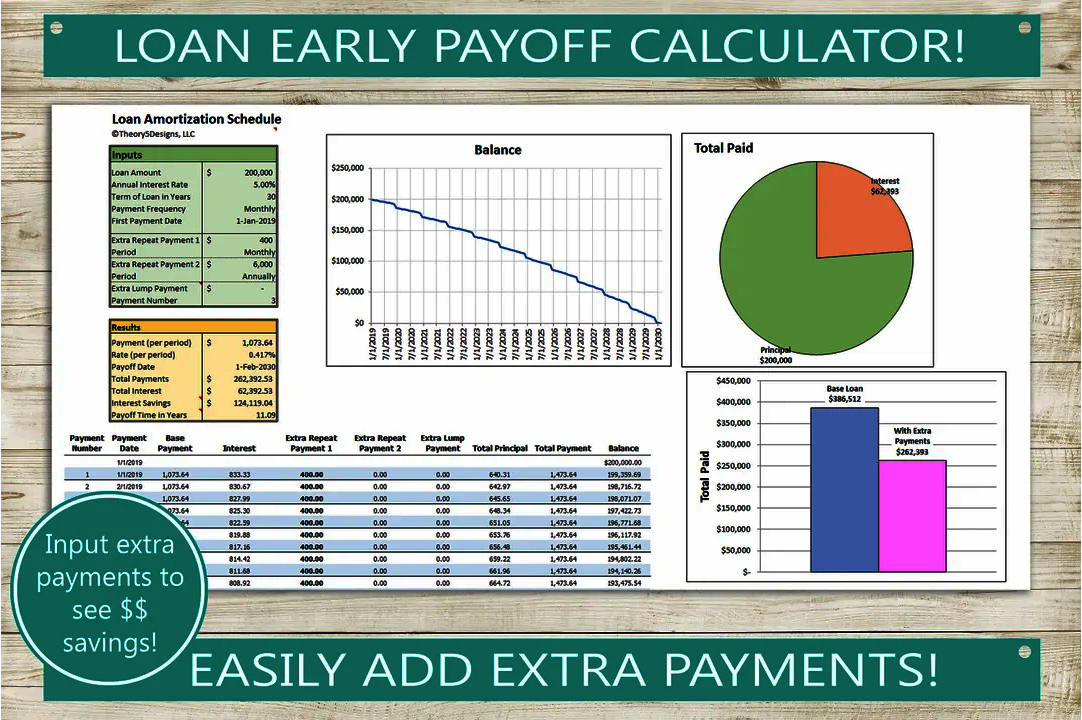

Using a Personal Loan Calculator

A personal loan calculator helps estimate payments.

Enter:

- Loan amount

- Interest rate

- Term (years/months)

It shows monthly payment, total interest, and payoff schedule.

Example Scenario (hypothetical for illustration):

- $15,000 loan

- 12% APR

- 5-year term

Monthly payment: ~$333 Total interest: ~$5,000 Total repaid: ~$20,000

Try different terms to balance payments and interest!

Personal Loan Repayment and Tips

- Set up autopay for discounts.

- Pay extra to reduce interest.

- Avoid new debt after consolidation.

- Personal loan tips: Shop multiple lenders, watch fees, borrow only what you need.

Personal Loan Benefits and When to Use One

Benefits include lower costs than cards for consolidation, predictable payments, and credit building.

Best for:

- Debt consolidation (if rate < current debts).

- Large one-time expenses.

- Emergencies (if no savings).

Avoid for everyday spending — save instead!

FAQs About Personal Loans

What is the personal loan meaning? A lump-sum installment loan repaid in fixed payments, often unsecured.

How do personal loans work exactly? Funds disbursed upfront; repay monthly with fixed interest.

What credit score do I need? Good to excellent (670+) for best rates; options exist for lower scores.

Are there fees? Often origination (1-8%); check for prepayment penalties (rare).

Can I pay off early? Yes — most have no penalties, saving interest.

Is it better than a credit card? Usually yes for fixed borrowing due to lower rates and structure.

How fast can I get funds? Same-day to a few days with online lenders.

What affects my rate? Credit, income, term, lender.

Final Thoughts

A personal loan can be a smart tool in 2026 for managing finances wisely — especially for debt consolidation or planned expenses. With rates stabilizing around 12%, shopping around and maintaining strong credit pays off.

Before applying, use a calculator, compare offers, and ensure payments fit your budget. If you're ready, start by prequalifying with reputable lenders.

For more on improving credit or comparing options, check our guides on credit score tips or debt management.

Need personalized advice? Consult a financial advisor. Borrow responsibly!

This article is for educational purposes only. See our Financial Disclaimer.

About author person.