Personal Loan vs Credit Card: What’s the Difference in 2026

When it comes to borrowing money, many people find themselves weighing options like a personal loan or credit card. With rising costs for everything from home repairs to unexpected emergencies, understanding the difference between personal loan and credit card can make a big difference in your money management. In 2026, interest rates remain a key factor—average credit card interest rates hover around 20-24%, while personal loan interest rates average about 12.2% for qualified borrowers. But which is better: personal loan or credit card? It depends on your needs, such as whether you're handling debt consolidation, making large purchases, or dealing with everyday expenses.

This comprehensive guide will break down everything you need to know about personal loan vs credit card. We'll cover the basics, key differences, pros and cons, interest rate comparisons, and real-world scenarios like personal loan vs credit card for debt or emergencies. By the end, you'll have finance tips to decide if a personal loan is better than a credit card for your situation, or vice versa. We'll also explore question like "Which is cheaper: personal loan or credit card?" and "Should I use a credit card or personal loan?"

Whether you're new to finance or looking to optimize your borrowing, this article aims to provide maximum value. We'll use simple tables, lists, and examples based on the latest 2026 data from top sources like Bankrate, NerdWallet, and Experian. If you're dealing with high-interest debt, for instance, knowing the personal loan vs credit card interest can save you hundreds or even thousands. Let's dive in and help you make smarter choices for better money management.

Table of Contents

- What is a Personal Loan?

- What is a Credit Card?

- Key Differences Between Personal Loans and Credit Cards

- Personal Loan vs Credit Card Pros and Cons

- Personal Loan vs Credit Card Interest Rates Comparison

- Personal Loan vs Credit Card Repayment: How It Works

- Personal Loan vs Credit Card for Large Purchases

- Personal Loan vs Credit Card for Debt

- Credit Card or Personal Loan for Emergency

- Is a Personal Loan Better Than a Credit Card? When to Choose Each

- Finance Tips: Personal Loan vs Credit Card Which One Saves Money

- FAQ

What is a Personal Loan?

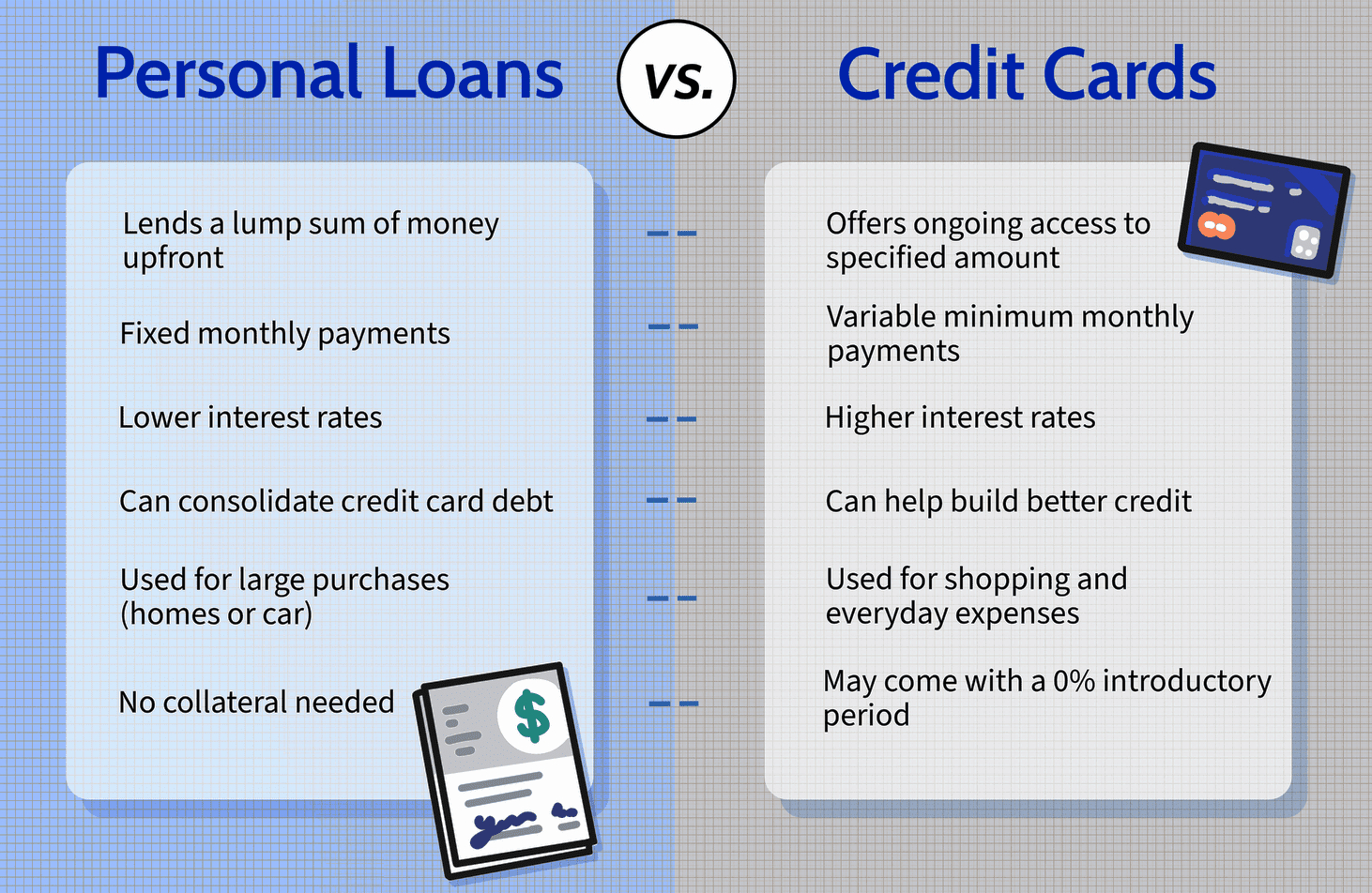

A personal loan is an unsecured loan that gives you a lump sum of money upfront, which you repay in fixed monthly payments over a set period, usually 1 to 7 years. It's ideal for borrowing money when you need a large amount at once, like for home improvements or consolidating debts. Lenders base approval on your credit score, income, and debt-to-income ratio. In 2026, personal loans often come with fixed interest rates, making payments predictable.

How Personal Loans Work

- You apply through a bank, credit union, or online lender.

- If approved, funds are deposited into your account quickly—often within days.

- Repayment includes principal and interest, with no option to borrow more without a new application.

For example, if you take a $10,000 personal loan at 12% interest over 3 years, your fixed monthly payment might be around $332. This structure helps with budgeting, as you know exactly when the debt ends.

Types of Personal Loans

- Unsecured: No collateral needed, based on credit.

- Secured: Backed by assets like a car, for lower rates but higher risk.

- Debt Consolidation Loans: Specifically for paying off multiple debts.

What is a Credit Card?

A credit card provides revolving credit, meaning you have a credit limit you can use repeatedly as you repay. It's great for everyday spending or smaller amounts, where you only pay interest on what you borrow. Credit cards are issued by banks or companies like Visa or Mastercard, and they often include perks like rewards.

How Credit Cards Work

- You charge purchases up to your limit.

- Each month, you get a statement with a minimum payment due (usually 2-4% of the balance).

- If you pay in full, you avoid interest thanks to a grace period (typically 21-25 days).

For instance, with a $5,000 limit, you could spend $2,000 on groceries and repay it over time, rebuilding your available credit. In 2026, many cards offer 0% introductory APR for 12-21 months on purchases or balance transfers.

Types of Credit Cards

- Rewards Cards: Earn cash back, points, or miles.

- Balance Transfer Cards: Low or 0% APR for transferring debt.

- Secured Cards: For building credit, requiring a deposit.

Key Differences Between Personal Loans and Credit Cards

The main difference between personal loan and credit card lies in structure: loans are installment-based with a fixed end, while cards are revolving with ongoing access. Here's a detailed comparison:

| Aspect |

Personal Loan |

Credit Card |

| Funding |

Lump sum upfront |

Revolving line up to limit |

| Interest Type |

Fixed rate |

Variable rate |

| Average Rate (2026) |

12.2% |

19.65-23.79% |

| Repayment |

Fixed monthly payments |

Minimum payments, flexible |

| Loan Amount |

Up to $100,000 |

Up to $40,000+ |

| Fees |

Origination (1-8%), late fees |

Annual, balance transfer (3-5%), late fees |

| Rewards |

None |

Cash back, points, perks |

| Credit Impact |

Builds installment history |

Affects utilization ratio |

These differences make personal loans better for structured borrowing, while credit cards offer flexibility. More details about Apply for loan online in USA.

Personal Loan vs Credit Card Pros and Cons

Understanding the pros and cons of credit card vs personal loan helps you choose wisely.

Pros and Cons of Personal Loans

✅ Pros:

- Lower personal loan interest rate compared to cards.

- Fixed monthly payment for easy budgeting.

- Larger amounts for big needs.

- No temptation to overspend.

❌ Cons:

- No rewards or grace period.

- Fees like origination can add costs.

- Inflexible—can't borrow more easily.

Pros and Cons of Credit Cards

✅ Pros:

- Revolving credit for ongoing use.

- Avoid interest if paid in full.

- Rewards and 0% intro offers.

- Builds credit with responsible use.

❌ Cons:

- Higher credit card interest rate if carrying balance.

- Risk of debt cycle from minimum payments.

- Multiple fees can pile up.

- High utilization hurts credit score.

Overall, personal loan vs credit card pros and cons show loans win for cost savings on large debts, while cards excel in convenience.

Personal Loan vs Credit Card Interest Rates Comparison

Interest is a big factor in personal loan vs credit card interest. Personal loans typically have lower, fixed rates, making them cheaper over time for balances you can't pay off quickly. Credit cards have higher variable rates but allow interest avoidance.

In January 2026:

- Average personal loan interest rate: 12.2% (for good credit, as low as 6%).

- Average credit card interest rate: 19.65% to 23.79%.

Example: Borrowing $5,000 at 12% on a loan vs 20% on a card. If repaid over 3 years, the loan costs about $1,600 in interest; the card could cost over $3,000 if minimum payments only. So, personal loan vs credit card which one saves money? Loans often do for long-term borrowing.

Personal Loan vs Credit Card Repayment: How It Works

Repayment is another key area. Personal loans use fixed monthly payments, including principal and interest, until paid off. Credit cards require minimum payments but encourage full payoff to avoid interest.

- Loan Example: $10,000 at 12%, 36 months = $332/month fixed.

- Card Example: $10,000 at 20%, minimum 3% = starts at $300/month, but decreases as balance drops—could take years if only minimum.

This makes loans better for discipline, cards for flexibility.

Personal Loan vs Credit Card for Large Purchases

For large purchases, like a $15,000 home renovation, personal loans shine. They offer higher limits and lower rates, with fixed payments. Credit cards might work if you qualify for 0% intro APR and repay quickly, but limits are often lower, and rates spike after promo. Are personal loans better for large expenses? Yes, for most cases.

Personal Loan vs Credit Card for Debt

In personal loan vs credit card for debt, loans are often the best option for paying off debt. Use a personal loan to consolidate high-interest card balances into one lower-rate payment. For example, consolidating $20,000 at 20% card rate to a 12% loan saves big on interest. Balance transfer cards can work for smaller debts during 0% periods.

Credit Card or Personal Loan for Emergency

For emergencies, like a $3,000 medical bill, consider credit card or personal loan for emergency based on size. Cards are faster and convenient if you can pay off soon. But for larger emergencies, loans provide structure without high ongoing rates. Is it safe to rely on a credit card for emergencies? It can be, but only if you avoid carrying balances.

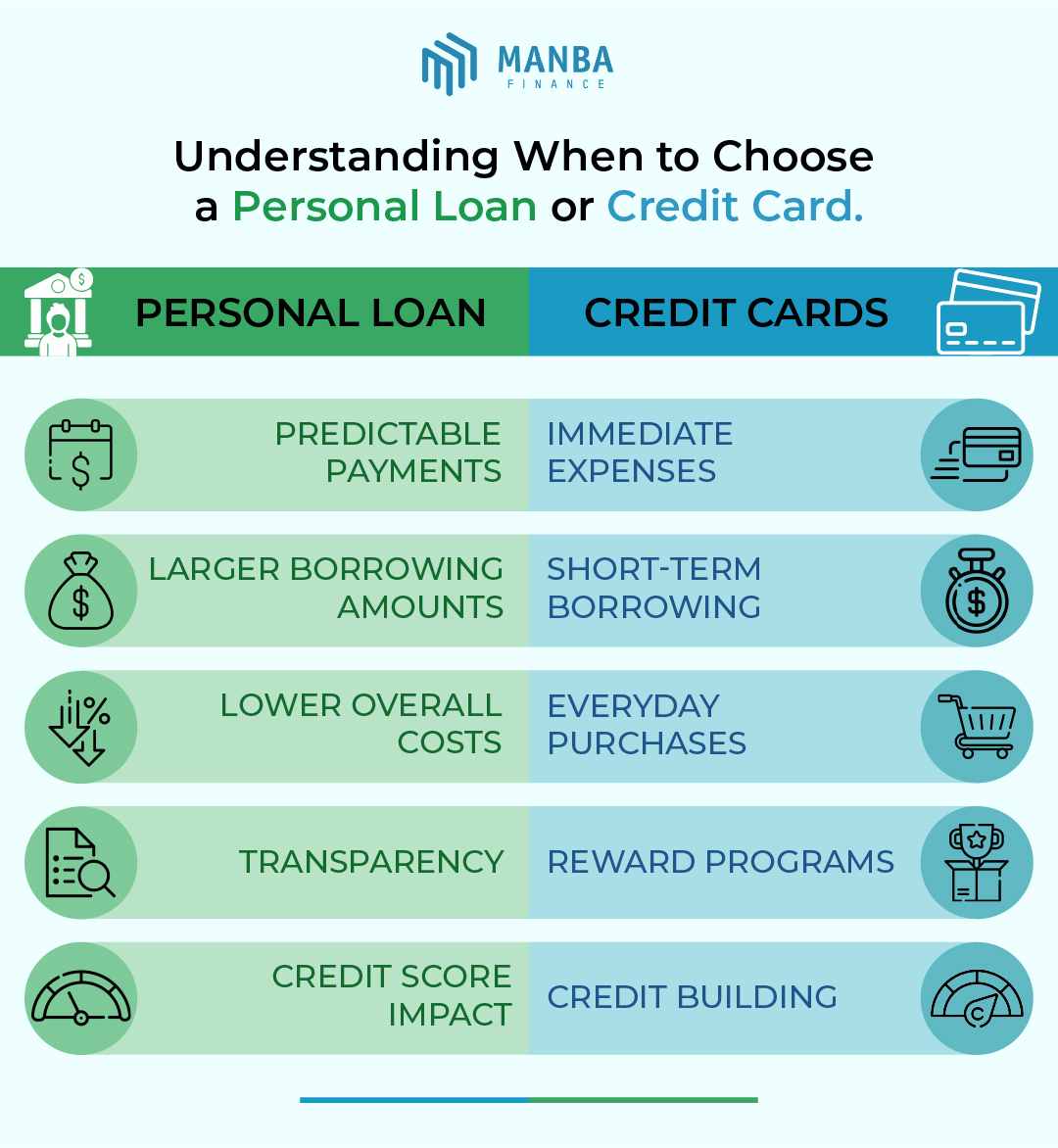

Is a Personal Loan Better Than a Credit Card? When to Choose Each

Is a personal loan better than a credit card? It depends.

Choose a personal loan when:

- You need a lump sum for debt consolidation or large expenses.

- You want lower rates and fixed payments.

Choose a credit card when:

- You need flexibility for smaller, ongoing spends.

- You can earn rewards or use 0% intro offers.

When should I choose a personal loan over a credit card? For anything you can't repay in 1-2 months. Can I use a credit card instead of a personal loan? Yes, for short-term needs. Best Loan Offers to Apply For.

Finance Tips: Personal Loan vs Credit Card Which One Saves Money

Here are finance tips for money management:

- Check your credit score first—higher scores get better rates.

- Use calculators to compare costs.

- For debt, prioritize high-interest first.

- Avoid minimum payments on cards to prevent cycles.

- Consider unsecured loans for no-collateral needs.

Personal loan vs credit card which one saves money? Loans usually for long-term, cards for short-term payoff.

For more on building credit, see our guide on How to Improve Your Credit Score.

FAQ

Which is cheaper: personal loan or credit card?

Personal loans are usually cheaper due to lower rates, especially if you carry a balance.

When should I choose a personal loan over a credit card?

For large, one-time needs or debt consolidation where fixed payments help.

Can I use a credit card instead of a personal loan?

Yes, for smaller amounts or if you pay off quickly to avoid interest.

Are personal loans better for large expenses?

Absolutely, with higher limits and lower rates.

Is it safe to rely on a credit card for emergencies?

It's okay for quick repayment, but loans are safer for bigger emergencies to avoid high interest.

Should I use a credit card or personal loan for paying off debt?

Best option: personal loan or credit card for paying off debt? Loans for consolidation, cards for transfers if promo applies.

For related reading, check Debt Consolidation Strategies.

Conclusion

In summary, the credit card vs personal loan debate boils down to your needs: loans for structure and savings on big borrowings, cards for flexibility and rewards. In 2026, with personal loan rates at 12.2% vs card rates over 20%, choosing wisely can boost your finance tips and money management. Now that you know the differences, compare options from lenders like LightStream or cards from American Express. Ready to apply? Check our Top Personal Loans for 2026 or subscribe for more tips.

This article is for educational purposes only. See our Financial Disclaimer.

About author person.