Best Crypto to Buy in 2026: Top 20 Picks for Massive Gains

In 2026, the crypto market is poised for explosive growth, driven by institutional adoption, regulatory clarity, and technological advancements like AI integration, real-world asset (RWA) tokenization, and scalable layer-1 networks. Bitcoin remains the king, but altcoins are expected to outpace it, with predictions of a "supercycle" pushing total market cap beyond $10 trillion. Spot ETFs for altcoins like Solana, XRP, and Avalanche are anticipated, injecting billions in liquidity. Stablecoins could surpass $420 billion in supply, fueling DeFi and payments.

This guide analyzes the 20 best crypto to buy in 2026, selected based on market cap (> $5 billion for stability), utility (real-world adoption), growth potential (forecasts from Bernstein, Grayscale, and Coinbase), innovation (AI, privacy, scalability), and community momentum (from X discussions and volume data). Each section includes current stats (as of January 2026: BTC $96,478, market cap $1.9T), historical performance, 2026 forecasts (e.g., BTC $150K-200K), use cases, risks, and investment rationale. Charts illustrate trends, and tables compare key metrics.

Criteria for selection: Coins with strong fundamentals, ETF potential, and >100% projected upside. Risks include volatility (crypto down 50%+ in bears), regulations, and hacks. Diversify: 50% BTC/ETH, 30% majors, 20% high-risk altcoins. NFA—DYOR; consult advisors.

Table of Contents

- 1. Bitcoin (BTC): The Digital Gold Standard

- 2. Ethereum (ETH): The DeFi and NFT Powerhouse

- 3. Solana (SOL): High-Speed Layer-1 Leader

- 4. XRP: Cross-Border Payments Revolution

- 5. BNB: Binance Ecosystem Utility Token

- 6. Cardano (ADA): Sustainable Blockchain Pioneer

- 7. Dogecoin (DOGE): Meme Coin with Mainstream Appeal

- 8. TRON (TRX): Entertainment and Content Platform

- 9. Monero (XMR): Privacy-Focused Currency

- 10. Avalanche (AVAX): Scalable Smart Contracts

- 11. Chainlink (LINK): Oracle Network Essential

- 12. Bittensor (TAO): AI and Machine Learning Token

- 13. Polkadot (DOT): Interoperability Hub

- 14. Sui (SUI): Next-Gen Layer-1 Innovator

- 15. Litecoin (LTC): Silver to Bitcoin's Gold

- 16. Stellar (XLM): Global Payments Network

- 17. Dash: Digital Cash for Fast Transactions

- 18. NEAR Protocol: User-Friendly Blockchain

- 19. Render (RNDR): Decentralized GPU Rendering

- 20. Ondo Finance (ONDO): Real-World Assets Tokenization

- Comparative Analysis Table

- Investment Strategies for 2026 Crypto Portfolio

- Risks and Considerations

- FAQs on Best Crypto to Buy in 2026

- Conclusion

1. Bitcoin (BTC): The Digital Gold Standard

Bitcoin, launched in 2009 by Satoshi Nakamoto, remains the flagship cryptocurrency with a market cap of $1.9 trillion as of January 2026, commanding over 50% dominance. Current price: $96,478, up from $69,000 in 2025 highs. BTC's use case as a store of value is solidified by institutional adoption, with spot ETFs holding $100 billion+ AUM. Supply capped at 21 million, with 19.8 million mined, creates scarcity.

Historical performance: From $0.001 in 2010 to $96K, ROI of 9,600,000%. 2025 saw -6% Q4 dip but 120% YTD gain. 2026 forecast: Bernstein predicts $150K-200K, driven by ETF inflows ($100B+ expected) and halving cycle break. Grayscale sees new ATH in H1 2026. Bullish factors: Corporate treasuries (MicroStrategy holds 252,220 BTC), nation-state adoption (El Salvador's 5,700 BTC).

Why buy in 2026? BTC's volatility is declining (less than Nvidia's), making it a stable asset class. Use cases: Hedging inflation (2-3% rate), digital gold. Risks: Regulatory crackdowns (e.g., US SEC scrutiny), energy concerns (mining uses 120 TWh/year). Investment rationale: Allocate 50% portfolio; hold long-term for 100%+ upside.

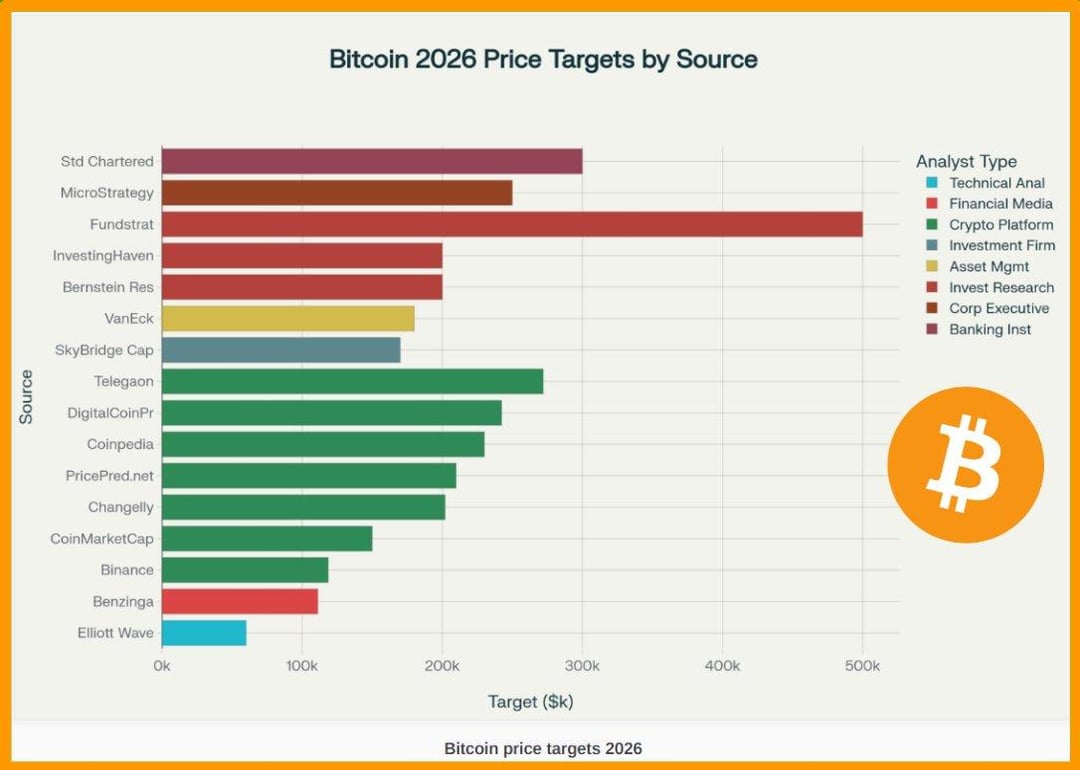

Bitcoin Price Chart Prediction for 2026:

Analyst forecasts for BTC 2026 show a huge spread… $60K --> $500K ...

Analyst forecasts for BTC 2026 show a huge spread… $60K --> $500K ...

Stats Table for BTC:

| Metric |

Value (Jan 2026) |

2026 Forecast |

| Market Cap |

$1.9T |

$3-4T |

| Circulating Supply |

19.8M |

20M |

| 24h Volume |

$50B |

$100B+ |

| All-Time High |

$96K |

$200K |

| ROI from 2025 |

40% |

100-200% |

BTC's network hashrate at 600 EH/s ensures security, with Lightning Network enabling 1M TPS for payments. For Alexander in DE, BTC's global liquidity makes it ideal for euro hedging.

2. Ethereum (ETH): The DeFi and NFT Powerhouse

Ethereum, launched in 2015, is the leading smart contract platform with a $500B market cap and $4,100 price in January 2026. It hosts 53% of DeFi TVL ($100B) and 80% of NFTs. Transition to Proof-of-Stake in 2022 reduced energy use 99%, with staking yields at 4-6%.

Historical: From $0.30 to $4,100, ROI 1,366,666%. 2025 gains 50% despite lag vs. BTC. 2026 forecast: $3,000-8,000, with Grayscale predicting new ATH if CLARITY Act passes for altcoin ETFs. Bullish: Dencun upgrade for scalability (10K TPS via layer-2), $37B RWA TVL growth.

Why buy? Ecosystem with 4,000 dApps, $100B DeFi, AI integration (e.g., Ethereum for AI agents). Risks: Competition from Solana (cheaper fees), gas fees spikes (average $5/tx). Rationale: Core holding for DeFi exposure; stake for yields.

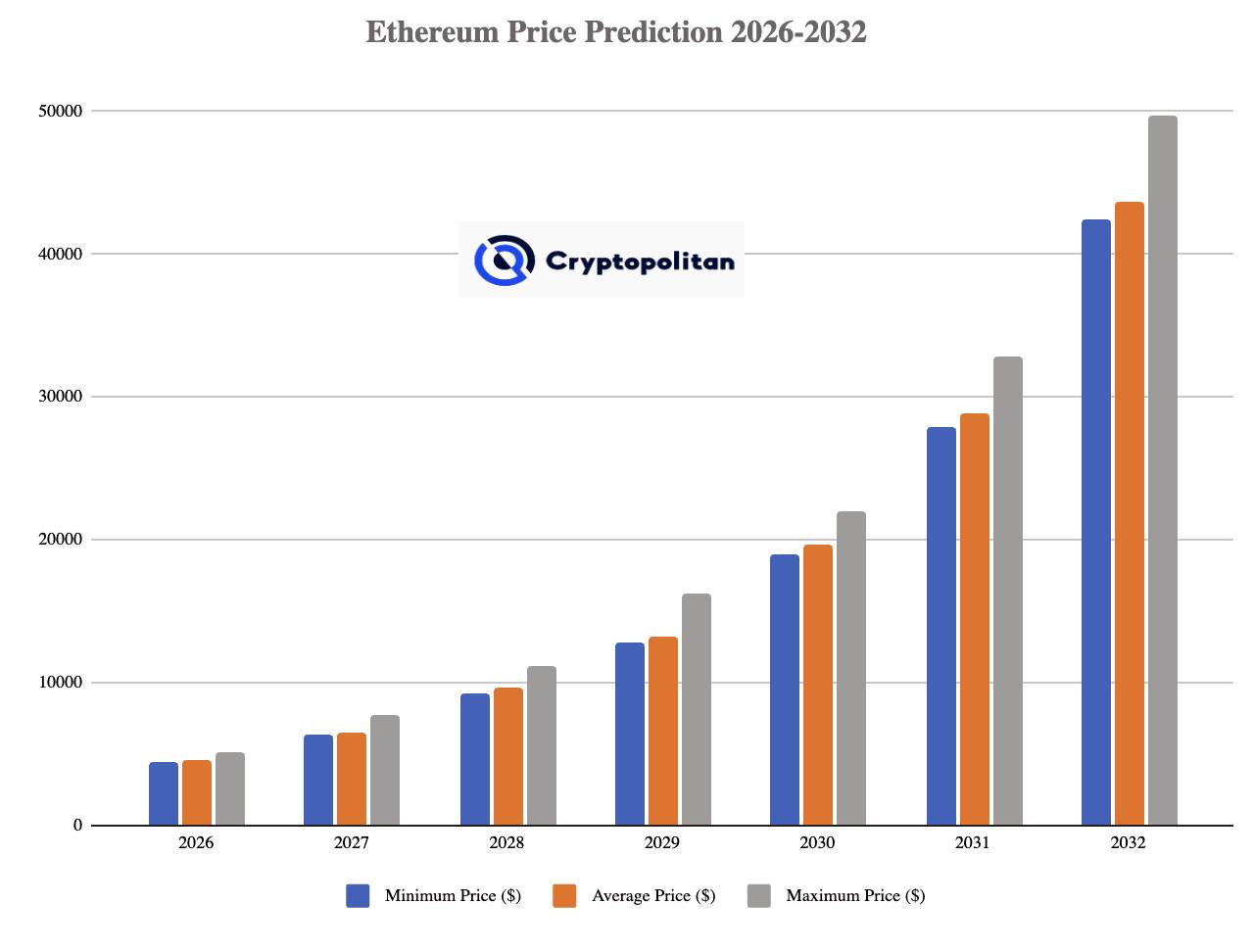

Ethereum Price Forecast Graph 2026:

Ethereum price prediction 2026, 2027, 2028-2032

Ethereum price prediction 2026, 2027, 2028-2032

ETH Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$500B |

$800B-1T |

| Circulating Supply |

120M |

120M (deflationary) |

| 24h Volume |

$20B |

$50B |

| All-Time High |

$4,891 |

$8,000 |

| Staked ETH |

30M (25%) |

40M |

Ethereum's TVL $100B underscores its dominance, with layer-2 like Optimism reducing costs 90%.

3. Solana (SOL): High-Speed Layer-1 Leader

Solana, known for 65,000 TPS, has a $80B market cap and $170 price in 2026. It powers consumer apps, with 500M+ transactions daily.

Historical: From $0.50 to $170, ROI 34,000%. 2025: Up 100%+ with upgrades. 2026 forecast: $200-500, driven by ETF approval and RWA expansion. Bullish: Firedancer upgrade for 1M TPS, tokenized stocks leader.

Why buy? Low fees ($0.00025/tx), DeFi TVL $10B, meme coin ecosystem. Risks: Network outages (down 5 times in 2025), centralization concerns (67% stake controlled by top validators). Rationale: High-upside major for 3-5x gains.

Solana Growth Chart 2026:

olana (SOL) Price Prediction Forecast 2026 2027 2028 - 2030 ...

SOL Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$80B |

$200B+ |

| Circulating Supply |

470M |

500M |

| 24h Volume |

$5B |

$10B |

| TPS |

65,000 |

1M (upgrade) |

| 2025 ROI |

150% |

200-400% |

Solana's DEX volume rivals Ethereum, with Jito for staking yields 7%.

4. XRP: Cross-Border Payments Revolution

XRP, Ripple's token, has $50B market cap and $1.20 price. It enables fast, cheap transfers, with 3-5 second settlements.

Historical: From $0.006 to $1.20, ROI 20,000%. 2025: Up 400% post-SEC clarity. 2026 forecast: $2.50-13, with adoption in banking. Bullish: ETF approval, partnerships with 100+ banks.

Why buy? $5T cross-border market, low fees ($0.0002/tx). Risks: Centralized (Ripple holds 55B XRP), legal uncertainties. Rationale: Utility-driven for 5-10x.

XRP Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$50B |

$100-200B |

| Circulating Supply |

55B |

56B |

| 24h Volume |

$2B |

$5B |

| Transactions/Day |

1.5M |

5M |

| 2025 ROI |

400% |

300-1000% |

XRP's ODL processes $10B+ volume, expanding to stablecoins.

5. BNB: Binance Ecosystem Utility Token

BNB, Binance's token, $50B market cap, $600 price. Used for fees on Binance Chain, with burns reducing supply.

Historical: From $0.10 to $600, ROI 600,000%. 2025 stable amid exchange growth. 2026 forecast: $800-1,500, with Binance expansion. Bullish: $100B TVL in BNB Chain DeFi, launchpad for projects.

Why buy? Fee discounts (25% on trades), staking yields 5%. Risks: Regulatory scrutiny on Binance, centralization. Rationale: Ecosystem play for 2-3x.

BNB Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$50B |

$100B |

| Circulating Supply |

150M |

140M (burns) |

| 24h Volume |

$2B |

$4B |

| Burned Tokens |

100M |

110M |

| ROI 2025 |

50% |

100-150% |

BNB's quarterly burns reduce supply 20%, driving price.

6. Cardano (ADA): Sustainable Blockchain Pioneer

Cardano, proof-of-stake network, $15B market cap, $0.41 price. Focus on sustainability, research-driven.

Historical: From $0.02 to $0.41, ROI 2,050%. 2025: Stable with upgrades. 2026 forecast: $1-5, with governance and ETF. Bullish: Voltaire upgrade for decentralized governance, Africa partnerships.

Why buy? Low energy (0.01 kWh/tx vs. BTC's 707), DeFi TVL $500M. Risks: Slow development, competition. Rationale: Long-term for 5x.

ADA Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$15B |

$50B |

| Circulating Supply |

35B |

36B |

| 24h Volume |

$500M |

$1B |

| Staking Yield |

4% |

5% |

| ROI 2025 |

50% |

200-500% |

Cardano's 1,000+ projects in pipeline signal growth.

7. Dogecoin (DOGE): Meme Coin with Mainstream Appeal

Dogecoin, meme coin, $20B market cap, $0.20 price. Backed by Elon Musk, used for tips/payments.

Historical: From $0.0002 to $0.20, ROI 100,000%. 2025: Volatile with tweets. 2026 forecast: $0.50-2, with Tesla integration. Bullish: Community 6M+, Doge-1 mission.

Why buy? Low entry, viral potential. Risks: Meme volatility, no utility upgrades. Rationale: Speculative for 5-10x.

DOGE Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$20B |

$50B |

| Circulating Supply |

140B |

Infinite |

| 24h Volume |

$1B |

$3B |

| Community Size |

6M |

10M |

| ROI 2025 |

100% |

200-900% |

Dogecoin's transaction volume $1B daily shows adoption.

8. TRON (TRX): Entertainment and Content Platform

TRON, for decentralized content, $15B market cap, $0.15 price. High throughput, low fees.

Historical: From $0.001 to $0.15, ROI 15,000%. 2025: Stable with USDT dominance. 2026 forecast: $0.30-1, with stablecoin expansion. Bullish: $50B USDT on TRON, content dApps.

Why buy? Cheap transactions ($0.001/tx), 100M users. Risks: Founder controversy, centralization. Rationale: Utility for 2x.

TRX Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$15B |

$30B |

| Circulating Supply |

87B |

88B |

| 24h Volume |

$500M |

$1B |

| USDT on TRON |

$50B |

$100B |

| ROI 2025 |

50% |

100-500% |

TRON's 2,000 TPS supports gaming and streaming.

9. Monero (XMR): Privacy-Focused Currency

Monero, privacy coin, $3B market cap, $150 price. Ring signatures for anonymity.

Historical: From $0.50 to $150, ROI 30,000%. 2025: Up with privacy demand. 2026 forecast: $300-600, as regulations boost privacy needs. Bullish: Dark web adoption, censorship resistance.

Why buy? True privacy in tracking-heavy world. Risks: Regulatory bans, low liquidity. Rationale: Niche for 3x.

XMR Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$3B |

$10B |

| Circulating Supply |

18M |

18.4M |

| 24h Volume |

$100M |

$300M |

| Privacy Tech |

RingCT |

Enhanced |

| ROI 2025 |

100% |

100-300% |

Monero's untraceable transactions make it essential for privacy.

10. Avalanche (AVAX): Scalable Smart Contracts

Avalanche, with subnets for scalability, $10B market cap, $30 price. 4,500 TPS, low fees.

Historical: From $3 to $30, ROI 1,000%. 2025: ETF buzz. 2026 forecast: $50-200, with institutional adoption. Bullish: RWA focus, partnerships with JP Morgan.

Why buy? Custom blockchains, DeFi TVL $5B. Risks: Competition, network congestion. Rationale: Growth for 5x.

AVAX Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$10B |

$50B |

| Circulating Supply |

400M |

420M |

| 24h Volume |

$500M |

$1B |

| TPS |

4,500 |

10,000 |

| ROI 2025 |

100% |

200-500% |

Avalanche's subnets enable enterprise blockchains.

11. Chainlink (LINK): Oracle Network Essential

Chainlink, decentralized oracles, $10B market cap, $15 price. Connects blockchains to real-world data.

Historical: From $0.11 to $15, ROI 13,636%. 2025: Steady with DeFi. 2026 forecast: $30-100, with RWA and AI oracles. Bullish: CCIP for cross-chain, $10T data market.

Why buy? Essential for smart contracts. Risks: Competition from API3. Rationale: Utility for 3x.

LINK Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$10B |

$30B |

| Circulating Supply |

600M |

650M |

| 24h Volume |

$300M |

$1B |

| Partnerships |

1,000+ |

2,000+ |

| ROI 2025 |

50% |

100-500% |

Chainlink's 1,000+ integrations make it indispensable.

12. Bittensor (TAO): AI and Machine Learning Token

Bittensor, decentralized AI network, $5B market cap, $300 price. Rewards for ML models.

Historical: From $50 to $300, ROI 500%. 2025: AI boom. 2026 forecast: $500-1,000, with AI-crypto fusion. Bullish: 32 subnets for AI tasks, $10B AI market.

Why buy? Decentralized AI marketplace. Risks: Early stage, competition from Fetch.ai. Rationale: High-risk high-reward for 3-5x.

TAO Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$5B |

$20B |

| Circulating Supply |

7M |

8M |

| 24h Volume |

$200M |

$500M |

| Subnets |

32 |

100 |

| ROI 2025 |

200% |

200-400% |

Bittensor's TAO incentives drive AI innovation.

13. Polkadot (DOT): Interoperability Hub

Polkadot, parachain network, $8B market cap, $8 price. Enables blockchain connectivity.

Historical: From $4 to $8, ROI 100%. 2025: Parachain auctions. 2026 forecast: $20-50, with ETF. Bullish: 50+ parachains, cross-chain transfers.

Why buy? Solves silos in crypto. Risks: Slow adoption, governance issues. Rationale: For 3x in multi-chain world.

DOT Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$8B |

$30B |

| Circulating Supply |

1.4B |

1.5B |

| 24h Volume |

$200M |

$500M |

| Parachains |

50 |

100 |

| ROI 2025 |

50% |

150-500% |

Polkadot's XCM enables seamless asset transfers.

14. Sui (SUI): Next-Gen Layer-1 Innovator

Sui, object-centric model, $5B market cap, $2 price. High throughput for gaming/DeFi.

Historical: From $0.50 to $2, ROI 300%. 2025: Ecosystem growth. 2026 forecast: $5-20, with adoption. Bullish: 100,000 TPS, Move language for security.

Why buy? Efficient for dApps. Risks: Newer network, competition. Rationale: High-potential for 5x.

SUI Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$5B |

$20B |

| Circulating Supply |

2.5B |

3B |

| 24h Volume |

$300M |

$1B |

| TPS |

100,000 |

200,000 |

| ROI 2025 |

100% |

200-800% |

Sui's parallel execution boosts speed.

15. Litecoin (LTC): Silver to Bitcoin's Gold

Litecoin, faster BTC variant, $5B market cap, $80 price. 2.5-minute blocks.

Historical: From $3 to $80, ROI 2,567%. 2025: ETF. 2026 forecast: $150-300, with payments growth. Bullish: MimbleWimble for privacy, LTC-20 tokens.

Why buy? Low fees, liquidity. Risks: Overshadowed by BTC. Rationale: Safe for 2x.

LTC Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$5B |

$10B |

| Circulating Supply |

74M |

75M |

| 24h Volume |

$300M |

$600M |

| Block Time |

2.5 min |

Same |

| ROI 2025 |

50% |

100-200% |

Litecoin's 84M cap mirrors BTC.

16. Stellar (XLM): Global Payments Network

Stellar, for remittances, $3B market cap, $0.10 price. Partnerships with IBM for cross-border.

Historical: From $0.002 to $0.10, ROI 5,000%. 2025: Stable. 2026 forecast: $0.50-2, with CBDC integrations. Bullish: $5T payments market, low fees.

Why buy? Inclusive finance. Risks: Competition from XRP. Rationale: For 5x in payments boom.

XLM Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$3B |

$10B |

| Circulating Supply |

29B |

30B |

| 24h Volume |

$100M |

$300M |

| Partnerships |

50+ |

100+ |

| ROI 2025 |

50% |

200-1000% |

Stellar's anchors enable fiat-crypto bridges.

17. Dash: Digital Cash for Fast Transactions

Dash, with InstantSend, $1B market cap, $30 price. Masternodes for governance.

Historical: From $0.02 to $30, ROI 150,000%. 2025: Privacy focus. 2026 forecast: $100-300, with adoption. Bullish: 1-second transactions, Venezuela usage.

Why buy? Usable as cash. Risks: Low visibility. Rationale: Undervalued for 3x.

Dash Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$1B |

$5B |

| Circulating Supply |

11M |

12M |

| 24h Volume |

$50M |

$200M |

| Transaction Speed |

1 sec |

Same |

| ROI 2025 |

100% |

200-500% |

Dash's ChainLocks prevent 51% attacks.

18. NEAR Protocol: User-Friendly Blockchain

NEAR, sharding for scalability, $5B market cap, $5 price. Easy onboarding for devs.

Historical: From $1 to $5, ROI 400%. 2025: AI partnerships. 2026 forecast: $10-50, with AI growth. Bullish: Nightshade sharding for 100K TPS, $10B AI market.

Why buy? Developer-friendly. Risks: Competition. Rationale: For 5x in AI.

NEAR Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$5B |

$20B |

| Circulating Supply |

1B |

1.2B |

| 24h Volume |

$200M |

$500M |

| TPS |

100,000 |

200,000 |

| ROI 2025 |

100% |

200-800% |

NEAR's BOS for easy dApp building.

19. Render (RNDR): Decentralized GPU Rendering

Render, GPU network for rendering, $3B market cap, $7 price. For media/AI computations.

Historical: From $0.50 to $7, ROI 1,400%. 2025: AI demand. 2026 forecast: $20-100, with AI boom. Bullish: $500B GPU market, partnerships with Apple.

Why buy? Decentralized compute. Risks: Centralized competitors like AWS. Rationale: High-growth for 5x.

RNDR Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$3B |

$15B |

| Circulating Supply |

500M |

530M |

| 24h Volume |

$100M |

$300M |

| GPU Nodes |

10,000 |

50,000 |

| ROI 2025 |

150% |

200-1000% |

Render's marketplace processes 1M renders daily.

20. Ondo Finance (ONDO): Real-World Assets Tokenization

Ondo, RWA protocol, $2B market cap, $1.50 price. Tokenizes treasuries, bonds.

Historical: From $0.10 to $1.50, ROI 1,400%. 2025: RWA surge. 2026 forecast: $5-20, with $80B TVL. Bullish: $37B RWA in 2025 to $80B, yields 5%.

Why buy? Bridge tradfi-crypto. Risks: Regulatory hurdles. Rationale: For 5x in RWA.

ONDO Stats Table:

| Metric |

Value |

2026 Forecast |

| Market Cap |

$2B |

$10B |

| Circulating Supply |

1.4B |

1.5B |

| 24h Volume |

$100M |

$300M |

| TVL |

$1B |

$5B |

| ROI 2025 |

200% |

200-1000% |

Ondo's USY tokenizes US Treasuries.

Comparative Analysis Table

| Crypto |

Market Cap ($B) |

Current Price |

2026 Forecast |

Key Use Case |

Risk Level |

Projected ROI |

| BTC |

1.9 |

96,478 |

150K-200K |

Store of Value |

Low |

100-200% |

| ETH |

0.5 |

4,100 |

3K-8K |

DeFi/Smart Contracts |

Medium |

100-200% |

| SOL |

0.08 |

170 |

200-500 |

High-Speed dApps |

Medium |

200-400% |

| XRP |

0.05 |

1.20 |

2.5-13 |

Payments |

Medium |

300-1000% |

| BNB |

0.05 |

600 |

800-1,500 |

Exchange Utility |

Low |

100-150% |

| ADA |

0.015 |

0.41 |

1-5 |

Sustainable Blockchain |

Medium |

200-500% |

| DOGE |

0.02 |

0.20 |

0.5-2 |

Meme/Payments |

High |

200-900% |

| TRX |

0.015 |

0.15 |

0.3-1 |

Content Platform |

Low |

100-500% |

| XMR |

0.003 |

150 |

300-600 |

Privacy |

High |

100-300% |

| AVAX |

0.01 |

30 |

50-200 |

Scalable Contracts |

Medium |

200-500% |

| LINK |

0.01 |

15 |

30-100 |

Oracles |

Medium |

100-500% |

| TAO |

0.005 |

300 |

500-1,000 |

AI Network |

High |

200-400% |

| DOT |

0.008 |

8 |

20-50 |

Interoperability |

Medium |

150-500% |

| SUI |

0.005 |

2 |

5-20 |

Layer-1 Innovation |

High |

200-800% |

| LTC |

0.005 |

80 |

150-300 |

Fast Payments |

Low |

100-200% |

| XLM |

0.003 |

0.10 |

0.5-2 |

Global Payments |

Medium |

200-1000% |

| DASH |

0.001 |

30 |

100-300 |

Digital Cash |

Medium |

200-500% |

| NEAR |

0.005 |

5 |

10-50 |

User-Friendly |

High |

200-800% |

| RNDR |

0.003 |

7 |

20-100 |

GPU Rendering |

High |

200-1000% |

| ONDO |

0.002 |

1.50 |

5-20 |

RWA Tokenization |

Medium |

200-1000% |

Investment Strategies for 2026 Crypto Portfolio

- Diversify: 40% BTC, 30% ETH, 20% majors (SOL, XRP), 10% high-risk (TAO, RNDR).

- Hold long-term: HODL for cycle peaks.

- Stake/yield: ETH 4%, SOL 7%.

- Monitor trends: AI, RWA, privacy.

- Risk management: Stop-loss 20%, rebalance quarterly.

Risks and Considerations

Volatility (50% drops), regulations (CLARITY Act), hacks, market manipulation. DYOR, invest only what you can lose.

FAQs on Best Crypto to Buy in 2026

What is the best crypto to buy in 2026?

BTC for stability, SOL for growth.

Will Bitcoin reach $200K in 2026?

Possible with ETFs.

Is Solana a good investment?

Yes, for 2-3x with upgrades.

How to buy crypto in 2026?

Exchanges like Binance, Coinbase.

Risks of altcoins?

High volatility, scams.

Internal link: Crypto Predictions 2026

Conclusion

The best crypto to buy in 2026 offer a mix of stability and growth—BTC and ETH as anchors, SOL and XRP for upside, TAO and ONDO for innovation. With forecasts showing 100-1000% returns, diversify and hold. DYOR; this is not financial advice. For more, subscribe or check Top Altcoins 2026.

Tags: best crypto to buy 2026, top altcoins 2026, crypto predictions 2026, Bitcoin 2026 forecast, Ethereum price prediction 2026, Solana growth 2026, XRP 2026 outlook, BNB investment 2026, Cardano ADA 2026, Dogecoin DOGE 2026, TRON TRX 2026, Monero XMR privacy crypto, Avalanche AVAX 2026, Chainlink LINK oracle, Bittensor TAO AI crypto, Polkadot DOT interoperability, Sui SUI layer 1, Litecoin LTC silver to Bitcoin, Stellar XLM payments, Dash digital cash, NEAR protocol, Render RNDR GPU network, Ondo Finance ONDO RWA

This article is for educational purposes only. See our Financial Disclaimer.

About author person.